New ECB Chief To Speak on Thursday

Lagarde Assembles ECB Members For Informal Talks

Much attention is being placed on Christina Lagarde, the new head of the ECB, who is due to speak on Thursday. As yet, Lagarde has not given any insight into her views on ECB monetary policy and investors are eager to learn of her assessment and guidance.

One of the first acts which Lagarde undertook shortly after taking the helm of the ECB was to gather all 24 policymakers of the ECB at an off-site location in Germany. The purpose of the “informal and open” talks was to discuss how best to address the issues facing the Eurozone economy and try and restore some unity among policymakers.

Over recent months, division within the ECB has grown further, with members split on whether the bank should be easing further. Specifically, policymakers have been opposed over the use of further QE. At the Bank’s September meeting, rates were lowered further with bond purchases resumed at 20 billion EUR per month.

Data continues to highlight the severity of the downturn in the Eurozone both as a whole and among individual member economies. In Germany, following a negative growth print for Q2, growth was seen rising at just 0.1% in Q3. While the reading keeps Germany out of a technical recession, there is a risk of a downward revision to the number and certainly a risk of a move into negative territory over Q4. Later this week we will get October German PMI readings, if no rebound is seen (particularly in manufacturing, forecast to come in below 50 again) this could be very bearish for the Euro.

Lagarde Expected To Continue Draghi's Mission

So how will Lagarde likely approach ECB monetary policy? A Reuters poll conducted this week shows that the majority of analysts feel the new ECB chief will continue the program of easing led by Draghi over the last decade. Furthermore, in light of recent downward revisions to Eurozone growth forecasts, many feel that Lagarde will soon need to take fresh measures to counteract the slowdown. It is precisely the question of these measures which is creating division within the ECB. Given the opposition to further QE it seems the most likely step that we will see over the coming months is a further ECB rate cut.

Inflation in the Eurozone remains anaemic, printing less than half-way to the bank’s 2% target as of the last reading. The issue of stubbornly low inflation has been a persistent headache for the ECB and looks set to continue. The ECB recently revised lower its inflation forecasts in line with the views shared by many analysts. The Reuters poll showed that inflation is expected to average just 1.2% next year, and just 1.4% for 2021.

Technical & Trade Views

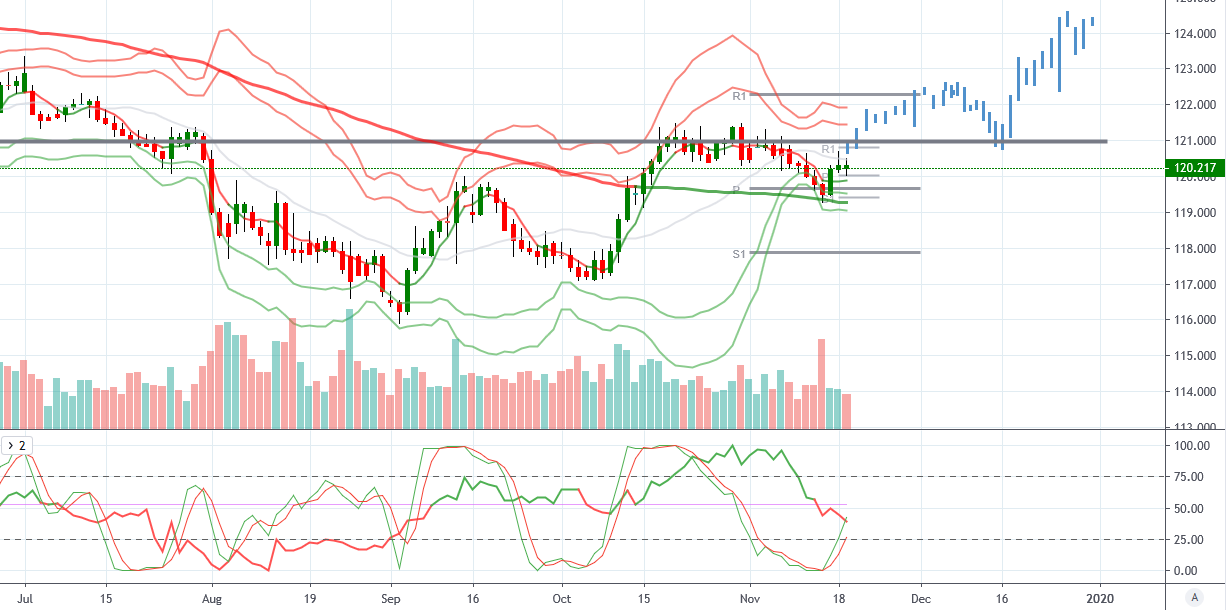

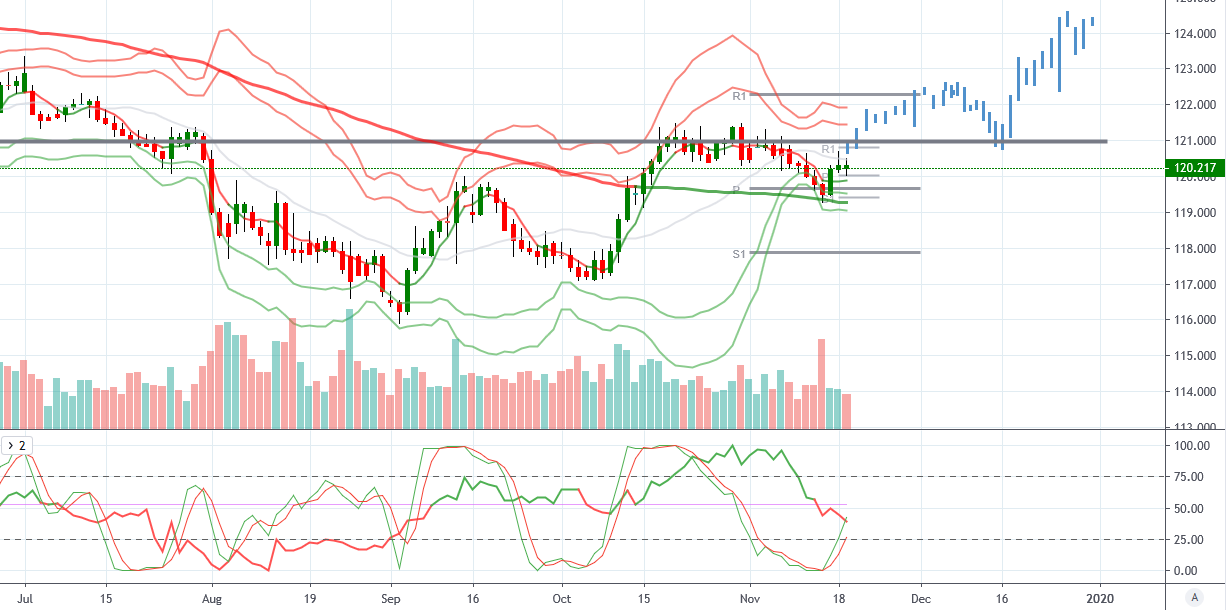

EURJPY

EURJPY From a technical and trading perspective. The yearly S1 at 121.00 is holding as resistance so far. With longer-term VWAP positive here, the currently bullish trend has room to continue, supported by volume studies. I will be watching for a break back above 121, which should then provide a platform for further upside. If price breaks back below the monthly pivot at 119.63 however, I will reassess.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!