Bitcoin Breakout Still In Sight

BTC Rebounding Near Highs

Bitcoin prices are recovering today following a more than 5% plunge from yesterday evening as markets reacted to news of Israel attacking Iran. BTC futures plunged amidst the broad drop off in risk assets as news of the attacks broke. However, the slide lower found strong support into the $103k lows with BTC now trading back up into the mid $105k region. The recovery today is an encouraging sign for bulls, reflecting the strong residual demand in the market amidst the growing view that BTC is on the verge of a breakout in the near-term.

Institutional Demand

Institutional demand has been rising steadily in Bitcoin over the last month with ETF inflows recently hitting record levels. With more funds applying to launch BTC ETFs and the UK set to approve BTC ETFs, institutional demand looks poised to continue to grow, taking BTC prices higher. Indeed, BTC ETFs have recently become more popular than gold with investors continuing to turn to the leading crypto asset. A finite supply and news of increasing levels of corporate and state purchases mean that the near-term outlook for BTC remains firmly bullish with some players calling for BTC to end the year well above the $200k mark.

Technical Views

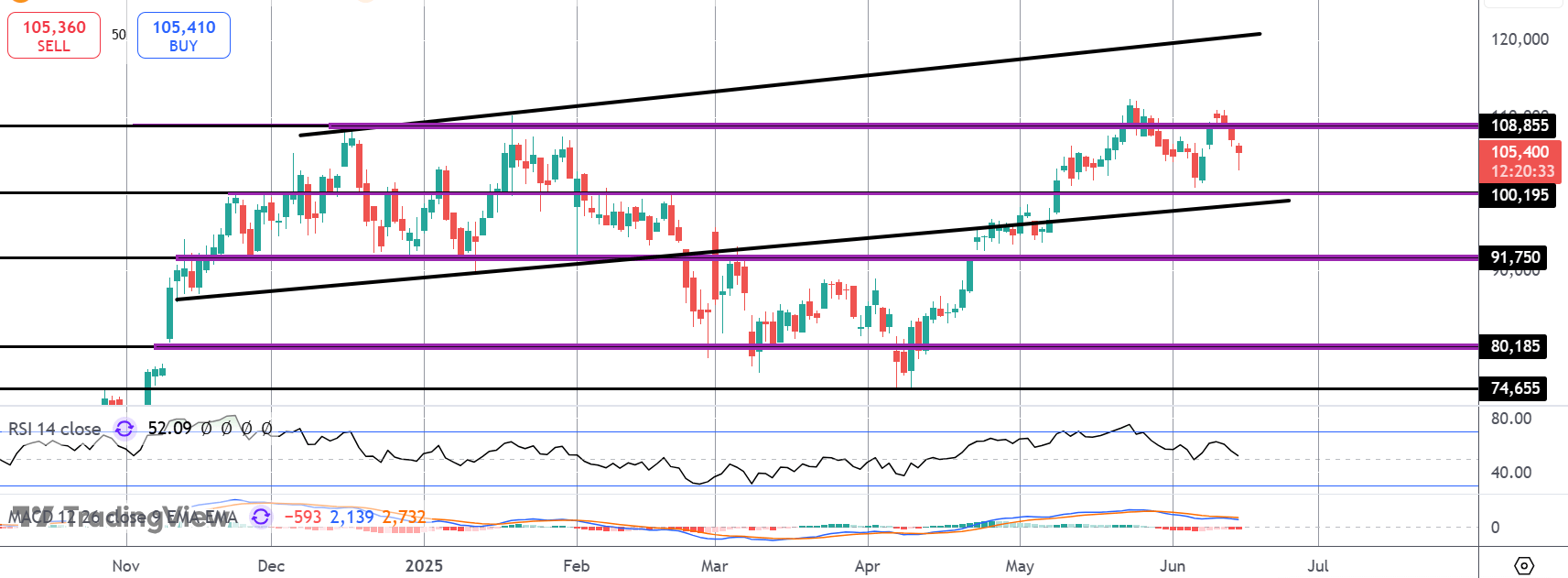

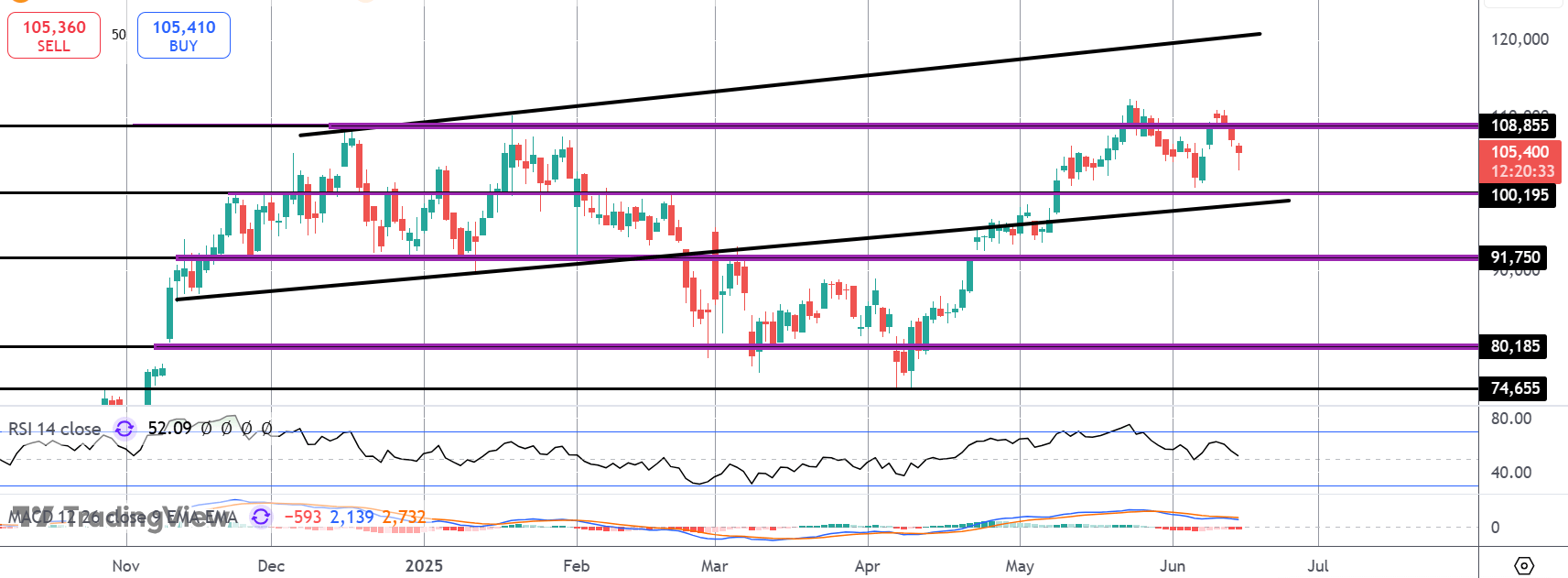

BTC

The sell off in BTC has found support well ahead of the $100k mark, keeping focus on a fresh push higher for now. If bulls can get back above the $108,855 level, focus will be on a move through current ATH and a test of the bull channel top and $120k mark next. Only a break below the $100k mark will negate this near-term bull view.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.