BOJ Bond Purchases Causing USDJPY Volatility

USDJPY Driven by BOJ Operations

USDJPY is on watch today after the BOJ announced its second unplanned set of JGB purchases this week. The BOJ offered to purchase 300 billion JPY worth of 5-10yr bonds after yields rose to 9-year highs yesterday. This comes on the back of an initial 300 billion JPY worth of purchases made on Monday as the BOJ sought to calm rising yields.

BOJ Policy Shift Coming?

On the back of the BOJ further widening the scope of its YCC target band from 0.5% to 1%, traders have been pushing yields higher, essentially playing a game of chicken with the BOJ. Many saw the tweak as laying the groundwork for a forthcoming shift in BOJ policy. However, the bank has so far ruled out any imminent shift in monetary policy and is fighting to keep the move higher in yields gradual. While yields continue to spike, the BOJ will be forced to continue with unplanned purchases, keeping volatility risks alive near-term.

USD Well Bid

The US Dollar remains strong this week as a decline in risk appetite fuels safe-haven demand for the greenback. While this remains the backdrop, the focus remains bullish for USDJPY with the pair likely to find fresh demand on dips.

Technical Views

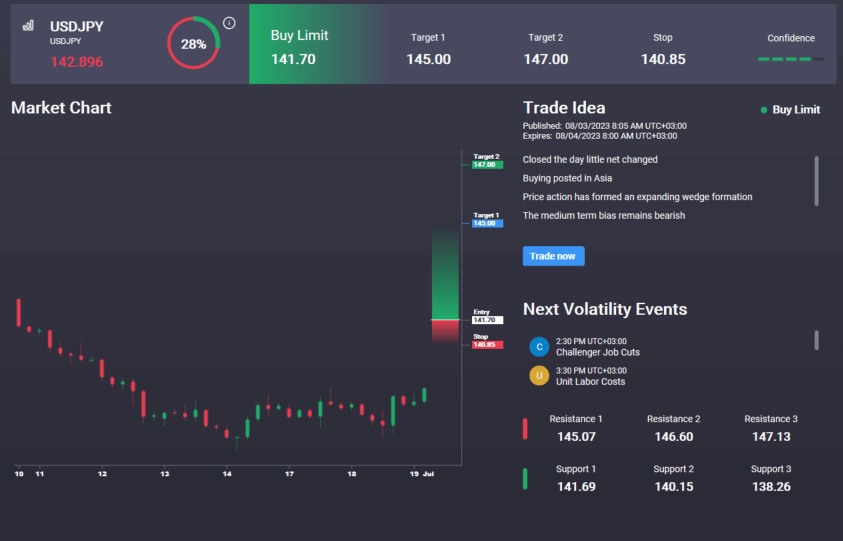

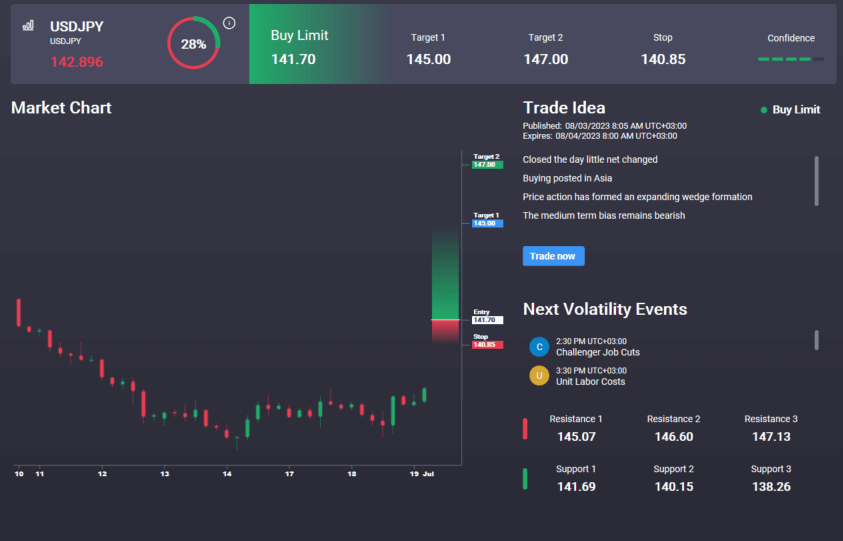

USDJPY

The rally off the 138.03 level has seen the market breaking back above the 142.21 level. Price is currently stalled here though, with momentum studies bullish, the focus remains on further upside near-term and a break above the 145 level and a continuation of the bull trend higher. Notably, the Signal Centre has an active buy signal in USDJPY today set above market at 141.790 targeting a run up to 145.

.png)

Signal Centre is a proprietary trading-signal suite offered to all Tickmill traders. Signal Centre combines human and AI driven analysis to offer traders actionable entry and exit points that they can use for their trading strategies. Signals are offered across a range of asset classes including Forex, Stocks, Commodities and Crypto.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.