Bullish Outlook Growing for Crude

Weaker US Helping Oil

Crude prices are looking a little more muted today on the back of a fresh push higher yesterday. Crude futures were seen rising to their highest levels since May 1st on Monday as a weaker US Dollar, rising summer demand and heightened geopolitical tensions stocked support for oil. The Dollar was seen softening from recent highs yesterday amidst speculation of forthcoming BOJ intervention and dovish comments from Fed’s Daly who warned of a coming inflection point in the US labour market. Looking ahead this week, focus will e on incoming US data with core PCE due on Friday.

Summer Demand Soaring

Away from USD, signs of rising demand in the US linked to the summer holiday season are also helping lift crude. A fresh drawdown in US API and EIA inventories data last week suggests that domestic demand is picking up there. Similarly, traders are expecting an uptick in jet fuel demand as the euro holiday season begins. The Paris Olympics is expected to be a big draw too alongside the Taylor Swift European tour which is attracting tourists from around the globe in a boost to the typical tourism numbers seen at this time of year.

Rising Geopolitical Tensions

Finally, oil is also rising on concerns over an escalation in violence between Ukraine and Russia following further Ukrainian attacks on Russian energy infrastructure. Simultaneously, traders are watching tentatively as the Israeli government mulls a new ‘all-out war’ on Hezbollah, following the signing off of plans for an offensive in Lebanon. Such a move raises huge fall-out risk amidst the prospect of a broader war in the Middle East which threatens supply from the region.

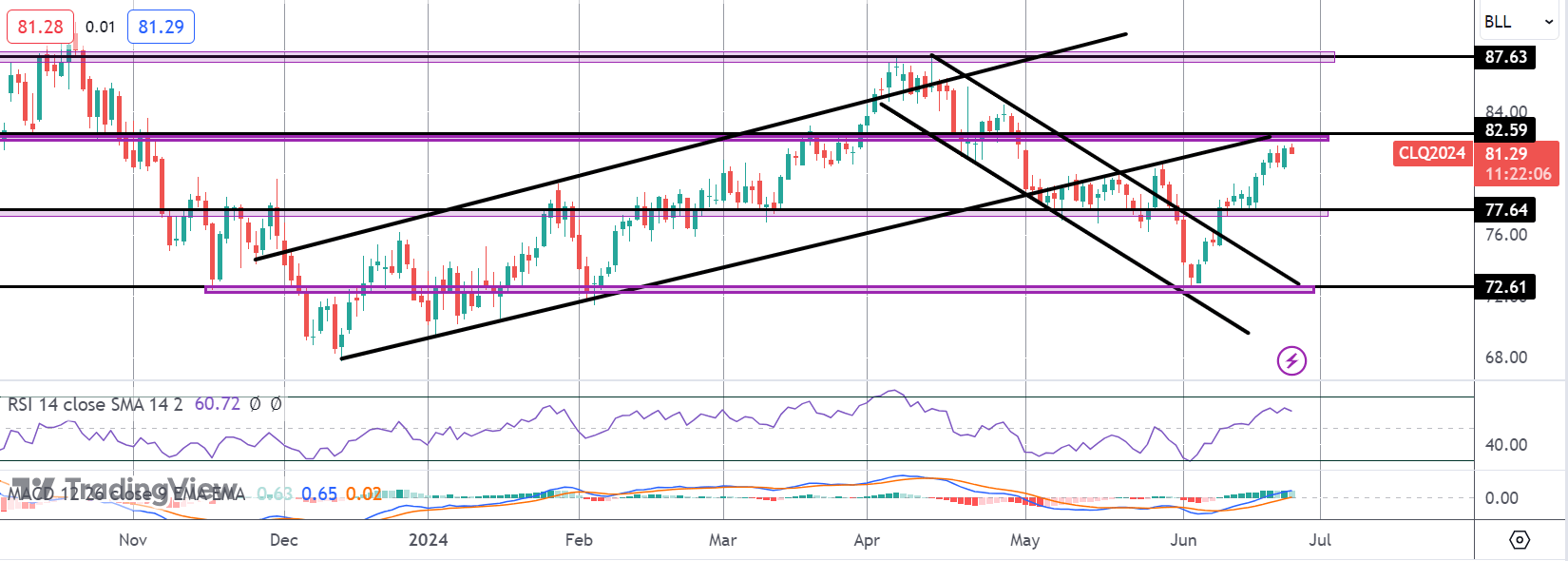

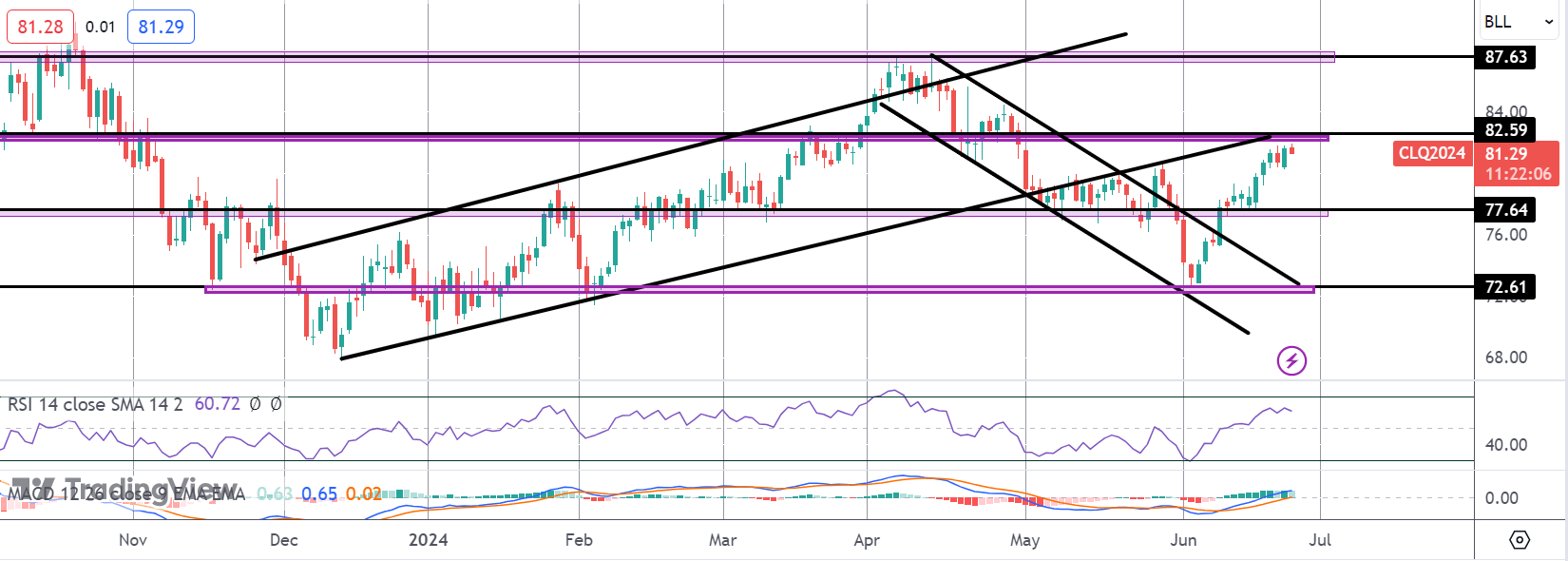

Technical Views

Crude

The rally in crude has seen the market breaking back above the 77.64 level. Price is now testing the 82.59 level, with the underside of the broken bull channel just above. This is a key pivot for the market and a break here will be firmly bullish, opening the way for a move higher to 87.63 next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.