Copper Plunges As Risk Aversion Sweeps Markets

Copper Lower on Friday

Copper futures continue to push lower through the end of the week. The market is now down around 4% from the week’s highs, lower today midst the broad weakening in risk appetite we’ve seen on the back of the Israeli strike on Iran overnight. Israel took out key nuclear facilities, leading military figures, and top nuclear scientists in the air strikes last night. The move has sparked fears of a fresh, all-out war in the Middle East as Israel braces for Iranian counteraction.

Rising Geopolitical Uncertainty

The strikes come at a time of heightened global uncertainty amidst the ongoing US trade war as well as the Russian/Ukraine war and the ongoing Israeli assault on Gaza. Trump has this week once again threatened to raise unilateral tariffs against trading partners if they don’t agree to his terms. These headlines have added to a feeling instability in markets this week with commodities drifting lower as traders scale back risk until there is a better view on these trade negotiations.

Weak US & China Data

On the data front, weaker US and China data this week has also fed into bearish sentiment for copper. Indicators suggest that demand in China is weakening, a sign of the growing negative impact of the trade war. While copper prices could easily rally in response to any sign of concrete progress in US/China trade talks, the market looks vulnerable to a continued slide lower for now with the risk of amplified selling if talks stall again or Trump takes fresh tariff action.

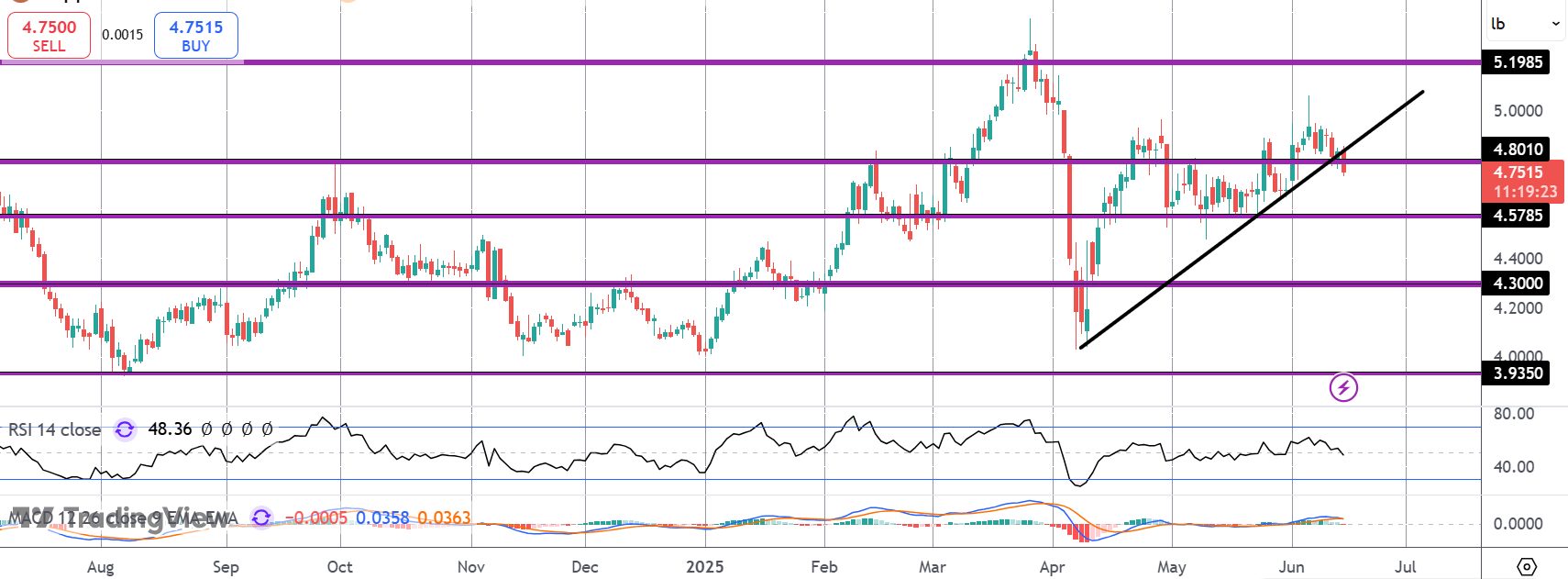

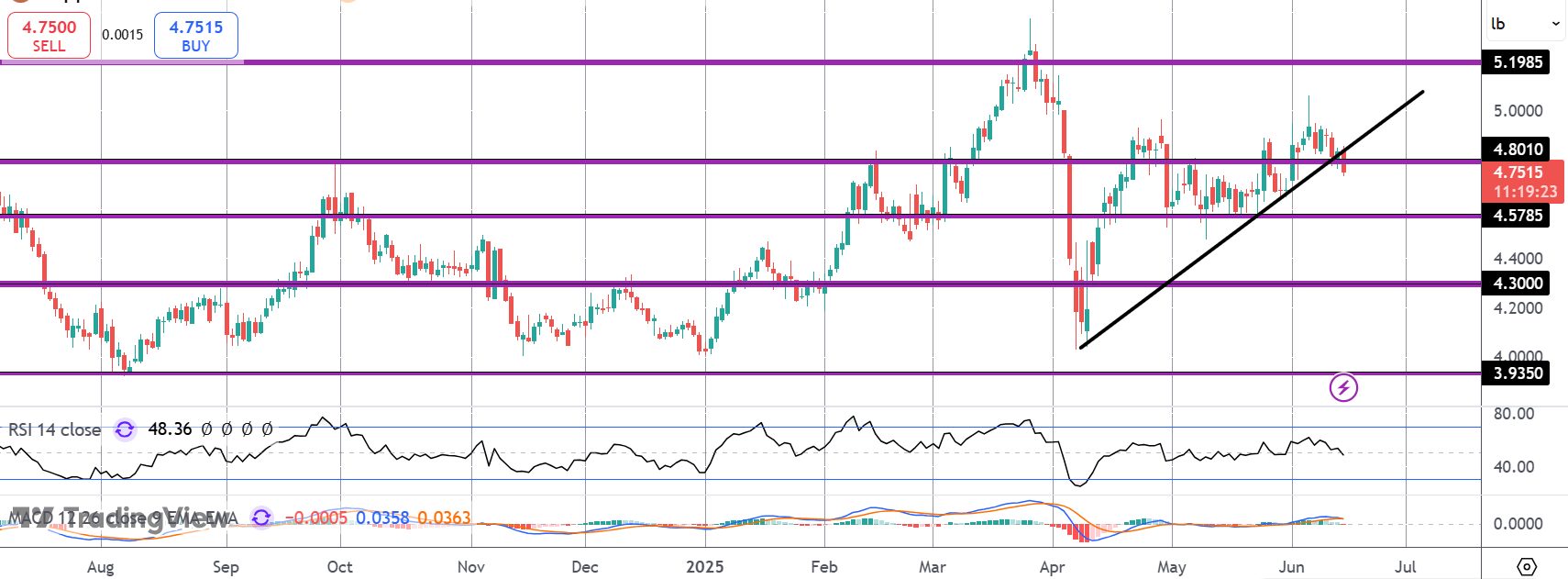

Technical Views

Copper

The sell off in copper has seen the market breaking down below the rising trend line from YTD lows and below the 4.8010 level. With momentum studies turning bearish, focus is on a fresh test of the 4.5785 level support next with 4.30 the deeper level to note if selling gathers pace.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.