Crude Collapses on Tariff & OPEC+ Shocks

Crude Plunging

Crude oil prices continue to push heavily lower on Friday with the futures market now trading fresh YTD lows and its lowest level since 2023. The market has dropped more than 11% this week as a result of the shift in sentiment we’ve seen on the back of Trump’s tariff announcement earlier in the week. Sweeping tariffs against all US trading partners, including higher rates for key partners, means that global growth forecasts have now been slashed for the year ahead with trade expected to suffer sharply as a result of the tariffs.

Risk-Off Hits Markets

Risk markets have fallen across the board this week in response to the tariffs with equities and commodities seeing significant losses. A rebound in USD on Friday (which had also been heavily sold) is now adding to bearish sentiment. Looking ahead today, traders will be watching the latest US labour market data with any further USD strength likely to amplify selling in crude.

OPEC+ Output Boost

Alongside the tariff announcement, crude prices have also been hit this week by news that OPEC+ will push ahead with planned output increases. News sources report that the group plans to return more than 400k bpd to the market next month, up from the 135k bpd initially planned. This marks a significant increase in output and is likely to keep prices pressured heavily lower near-term.

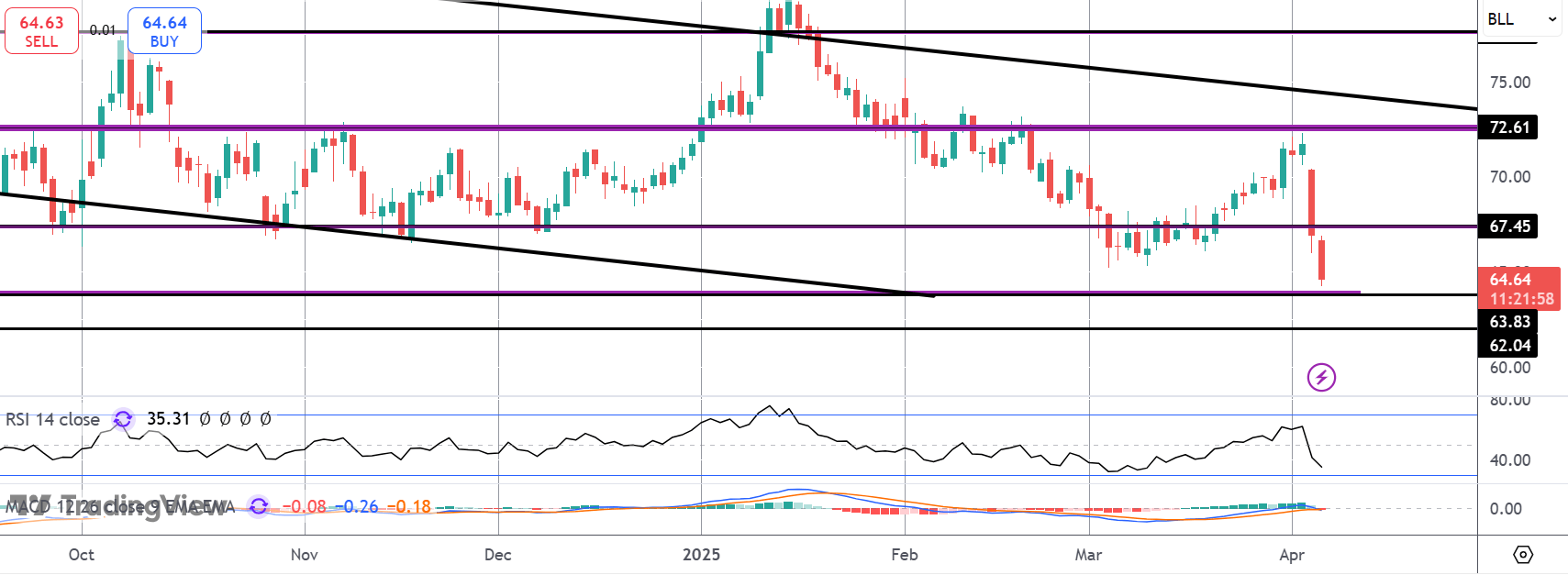

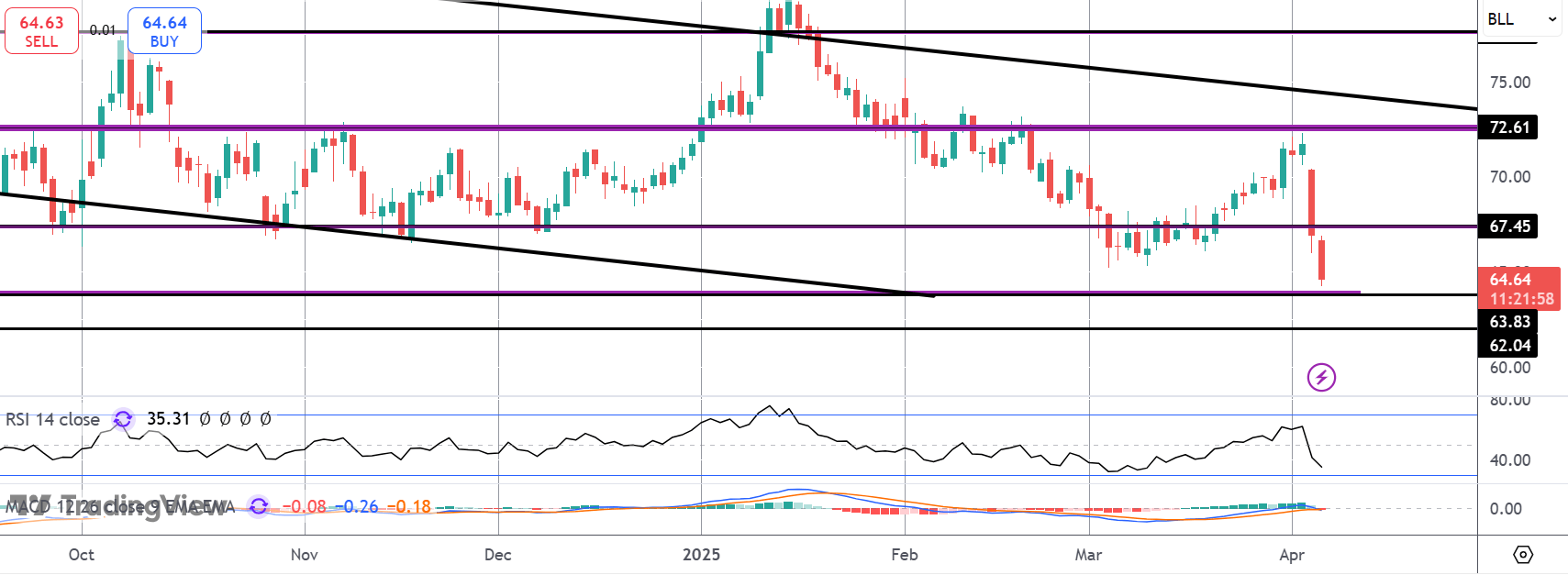

Technical Views

Crude

The failure at the 72.61 level has seen price reversing sharply lower, now trading below the 67.45 level and down at new YTD lows. With momentum studies bearish focus is on a continuation lower with 63.83 the next big test for bears. If we break below that level, 62.04 is the next support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.