Crude Falls on Israel-Iran Ceasefire News

Crude Falls Further

Oil prices continue to reverse heavily lower from initial weekly highs as markets digest news of a ceasefire between Israel and Iran. Trump declared overnight that Israel and Iran have agreed to a ceasefire, ending the 12-day war. However, there is some confusion around the timeline of the agreement with reports of missile attacks from both sides after the ceasefire was announced. For now, though, it appears that markets are responding to the headline news and the positive development with foreign ministers from both Israel and Iran confirming the ceasefire. While the truce holds, oil prices should continue to cool on reduced supply disruption fears. However, if the ceasefire breaks, oil prices are likely to spike sharply higher.

Iran Retaliates Against US

Oil prices are also cooling this week in response to news of the Iranian military retaliation against the US which saw airstrikes on a US airbase in Qatar. The US was warned of the attacks and missiles were intercepted with only one hitting its target and no casualties reported. The news likely means that Iran isn’t going to block the Strait of Hormuz (for now, at least), meaning that energy supply should remain stable. Given that around 20% of the world’s oil/gas supply passes through the Strait, any blockage from Iran would have severe upside repercussions for energy prices. As such, traders will be carefully monitoring incoming headlines for any sense of a resurgence in this threat.

Technical Views

Crude

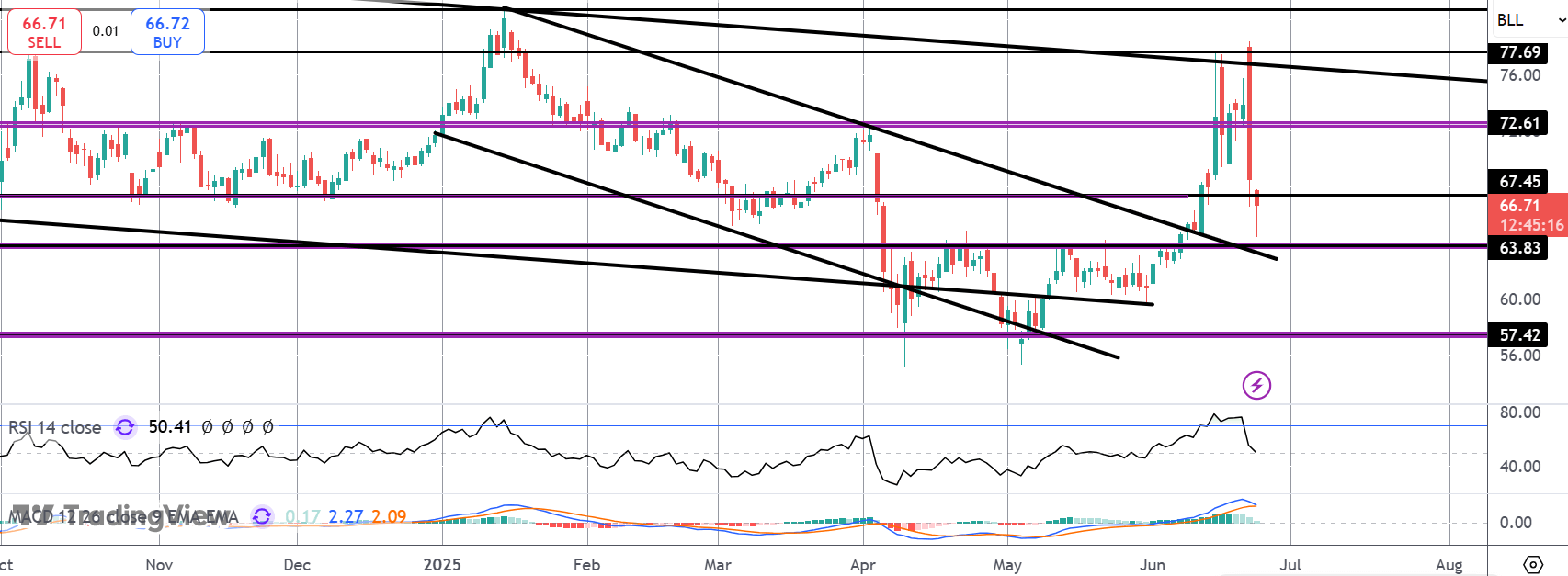

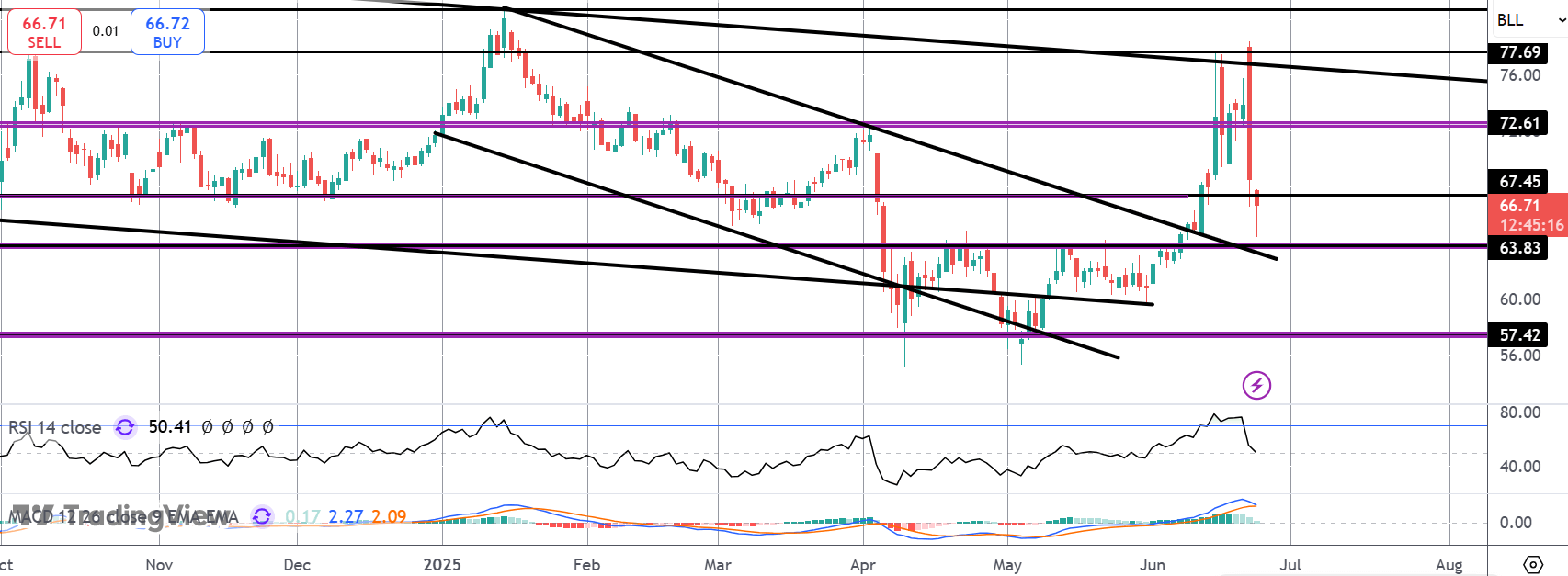

The latest failure at the bear channel highs and 77.69 level has seen the market reversing sharply lower price now testing support at the 63.83 level. This area is holding for now and bulls are trying to get back above the 67.45 level. If seen, this will keep focus on a return to highs and a fresh upside move. Below there, focus turns to deeper support at the 57.42 level medium-term.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.