Crude Holds Key Support After Channel Break

Middle East Impact

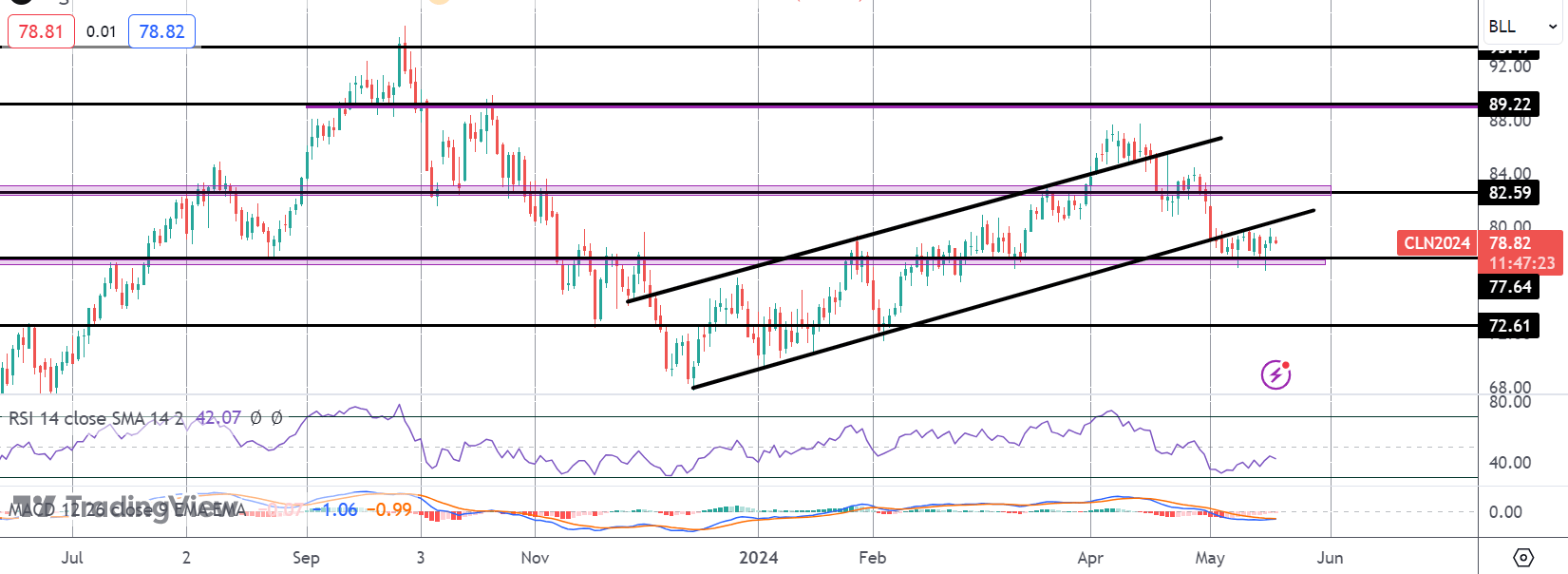

Following the heavy sell off on May 1st, oil prices have been muted over the month so far with crude futures settling into a tight range. Price have been caught between support at 77.64 and the underside of the broken bull channel. Hopes for a ceasefire between Israel and Hamas had been a big driver of the weakness into the start of the month with traders optimistic that an end to the fighting could be achieved. However, with no deal agreed and the violence still without resolution that downside momentum has subsided for now.

USD Impact

Traders are also keeping a close eye on movements within the Fed and USD landscape. A stronger Dollar in recent months has been a key headwind for oil prices. However, on the back of weaker US jobs data and CPI in April, focus is once again turning back to near-term Fed easing expectations. If traders start to build a stronger view that easing is coming in September this should start to weaken USD which in turn should create greater support for oil prices.

Demand in Focus

Demand remains a key issue for the market. Recent EIA data has reflected consecutive weekly drawdowns in the US showing the return of early summer demand there as driving season approaches. However, in its latest report this week, the IEA actually cut its demand forecasts for 2024, diverging further from OPECs outlook for higher demand. OPEC+ is due to meet in two weeks to agree on production levels beyond June. In light of the downturn we’ve seen in prices recently, the expectation is that current production curbs will be extended further out into the year to help shore up prices.

Technical Views

Crude

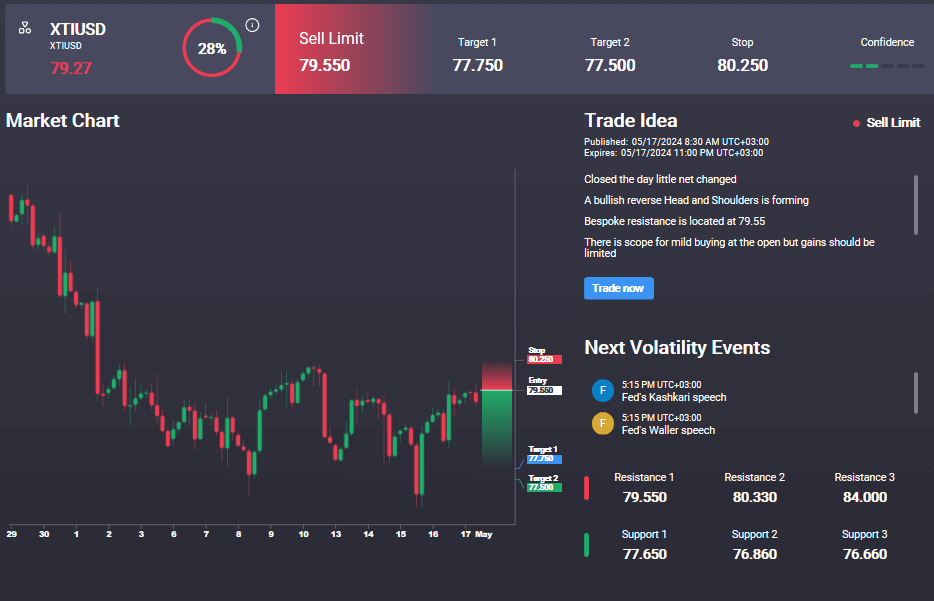

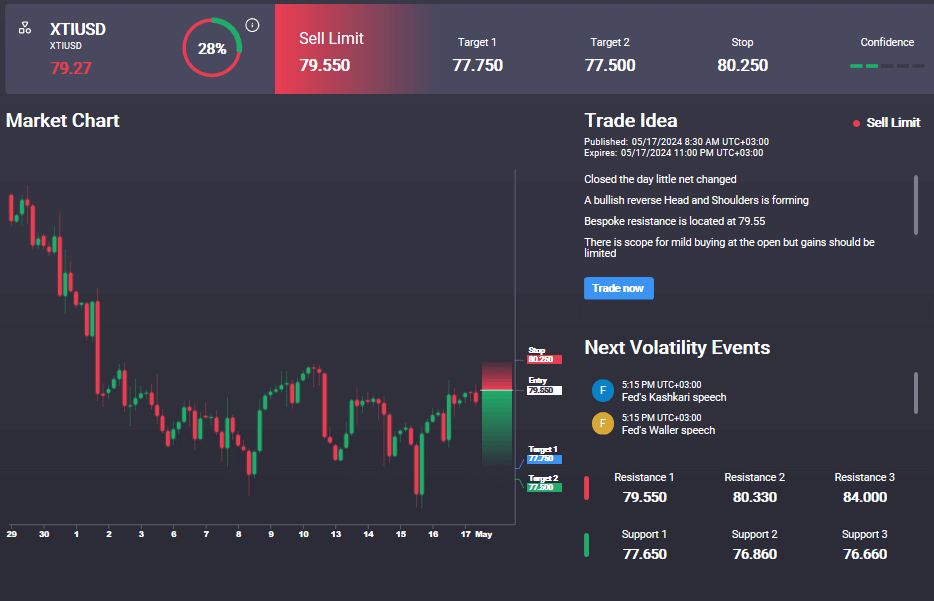

The sell off in crude has seen price breaking down through the bull channel lows but stalling into support at 77.64. With momentum studies having waned recently, risks of a further sell-off are seen. Below current support, 72.61 will be the next target for bears. Meanwhile, bulls need to see price back above 82.59 to alleviate the near-term bearish bias. In the Signal Centre today we have a sell signal at 79.55 suggesting a preference to stay short for an eventual continuation lower.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.