Daily Market Outlook, August 16, 2023

Daily Market Outlook, August 16, 2023

Munnelly’s Market Commentary…

Asian equity markets faced downward pressure in response to declines on Wall Street, reflecting a broad risk-off sentiment triggered by global macroeconomic challenges, notably the recent string of weak data from China. The Nikkei 225 index extended its losses, falling below the 32K handle. Major stock markets across the region were all impacted by the prevailing negative sentiment. The Hang Seng index and the Shanghai Composite index remained under pressure due to concerns about China's growth prospects. Poor recent data releases prompted several banks, including JPMorgan, to lower their growth forecasts for the world's second-largest economy. JPMorgan now anticipates 4.8% GDP growth for China this year. Additionally, the latest House Price data indicated a year-on-year contraction, adding to the ongoing challenges faced by property developers in China.

In the Eurozone, the second reading of Q2 GDP is not expected to deviate from the original estimate of 0.3% growth. Simultaneously, new data for Eurozone industrial production in June is also anticipated to be released. Any significant surprise compared to the expected 0.0% monthly change could prompt a revision of the GDP outlook. Despite the initial faster-than-expected Q2 GDP growth, more recent indicators suggest the possibility of slower growth or even negative growth in Q3.

The stronger-than-anticipated US retail sales data for July indicated that consumer spending was continuing to support economic growth at the start of Q3. The day also featured additional readings for July, including industrial production and housing starts, which were both expected to show growth. Despite stronger economic growth, the Federal Reserve is expected to pause its interest rate hikes in September. The minutes of the Fed's July policy meeting will be closely examined for confirmation of this stance. As the likelihood of a September rate hike is only around 10% in the markets, investors will be seeking clarity on the factors that Fed policymakers will consider when making their decision.

FX Positioning & Sentiment

According to market expectations, the UK interest rate is anticipated to rise to 6% and remain at that level until June 2024. In comparison, the Eurozone deposit rate is expected to peak around 3.75% before starting to decline, trailing behind the UK's trajectory. This prolonged period of higher interest rates in the UK could exert downward pressure on the EUR/GBP exchange rate. The EUR/GBP currency pair has been testing the 100-day Moving Average (100-MMA) at 0.8541. It's important to note that the pair has been trading above the 100-MMA since August 2022. A break below this level would hold significance and might result in a decline towards 0.83. This potential downward move in the EUR/GBP exchange rate would equate to an increase in GBP/EUR from 1.17 to 1.20. Market participants will closely monitor interest rate differentials and central bank policies between the UK and the Eurozone, as these factors are likely to influence the movement of the EUR/GBP.

CFTC Data As Of 11-08-23

USD net spec short cut significantly in Aug 2-8 period; $IDX +0.52%

EUR$ -0.31% in period; specs -22,251 contracts now +149,811

$JPY +0.1% in period; specs -3,964 contracts as pair rises to key 145 lvl

GBP$ -0.22% in period; specs -2,542 contracts, long cut to +47,020

AUD$ -1.13% in period; specs +8,600 contracts, specs bottom-fish

$CAD +1.05%; specs -6,988, position flips to -623

BTC +2.64% specs -610 contracts into strength, now short 1,149 (Source: Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0850 (1.5B), 1.0900 (715M), 1.0935 (570M), 1.1000 (1.0B)

EUR/USD: 1.1025 (870M), 1.1070/75 (875M)

USD/JPY: 144.50 (750M), 145.00 (785M). GBP/USD: 1.2775 (490M), 1.2890 (300M)

AUD/USD: 0.6500 (680M). NZD/USD: 0.6300 (585M). USD/ZAR: 18.60/65 (955M)

Overnight Newswire Updates of Note

China Stocks Approach Grim Milestones As Selloff Deepens

New Zealand Holds Rates, Signals Small Risk Of Another Hike

PBoC Adds Most Cash Since February Via Reverse Repo On Net Basis

China New-Home Prices Drop At Faster Pace As Downturn Worsens

Chinese Shadow Bank Misses Dozens Of Payments As Fallout Spreads

Banks Slash China Growth Forecasts, With JPMorgan Seeing 4.8%

12th Consecutive Negative Print For The Australian Leading Index

Fed Minutes Set To Show Only A Minority Saw End Of Tightening

Fed’s Kashkari: Not Ready To Say Fed Is Done Raising Rates

White House Sees No Reason For A Government Shutdown

Yen Option Traders Unfazed By Risk Of Intervention From Japan

Binance To Shut Down Crypto Payments Service, Refocus On Core Products

Oil Steadies After Two-Day Loss As US Inventories Seen Dropping

LNG Strike Risks Drag On In Australia As New Talks Eyed

US In Talks To Develop Ukraine’s Grain Export Routes

China Stocks Approach Grim Milestones As Selloff Deepens

Intel Set To Call Off $5.4 Billion Purchase Of Tower Semiconductor

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

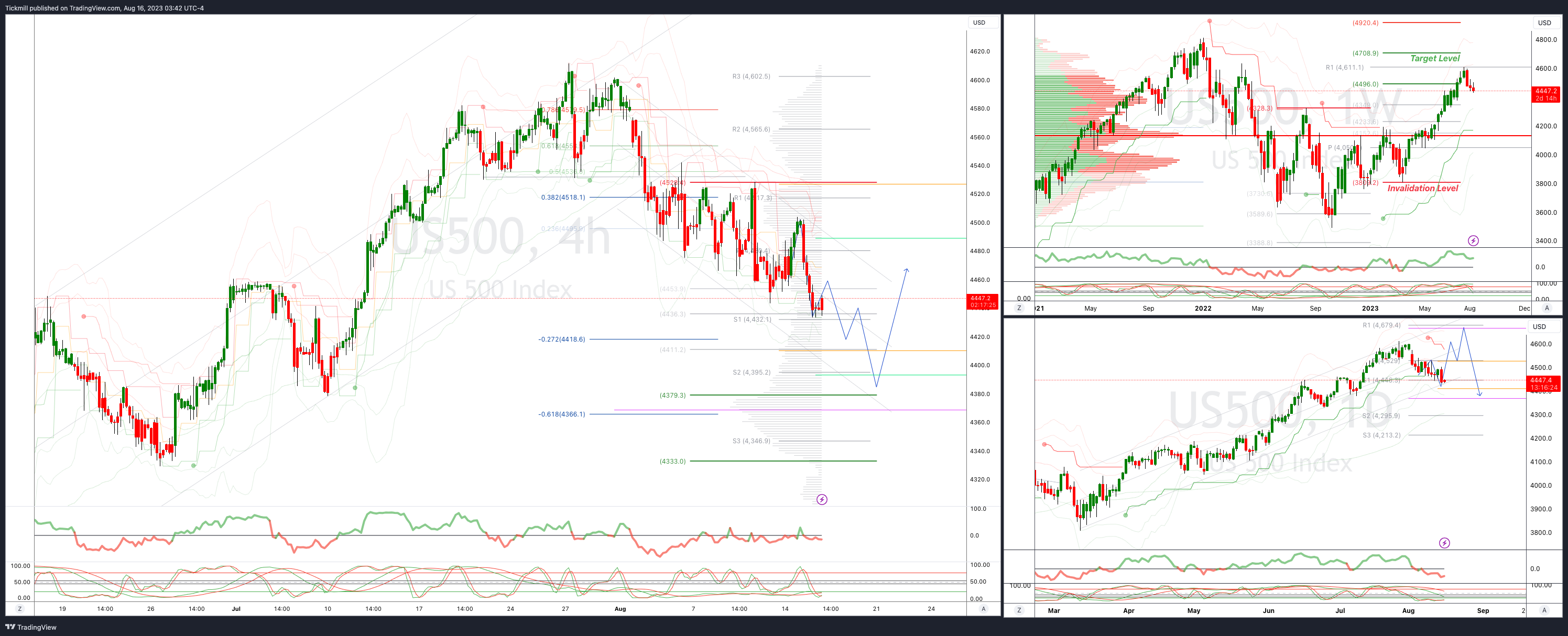

SP500 Intraday Bullish Above Bearish Below 4500

Above 4530 opens 4560

Primary resistance is 4560

Primary objective is 4380

20 Day VWAP bearish, 5 Day VWAP bearish

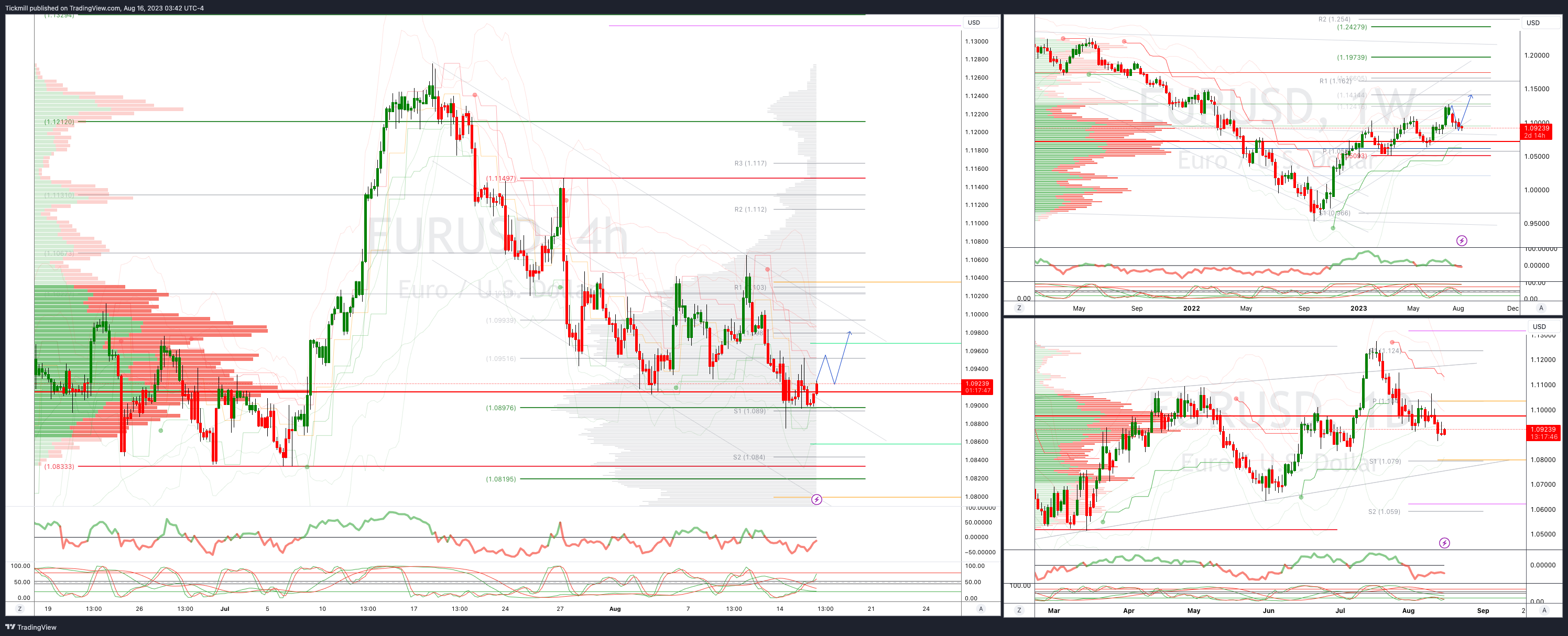

EURUSD Intraday Bullish Above Bearsih Below 1.1020

Below 1.890 opens 1.0830

Primary support is 1.830

Primary objective is 1.13

20 Day VWAP bearish, 5 Day VWAP bearish

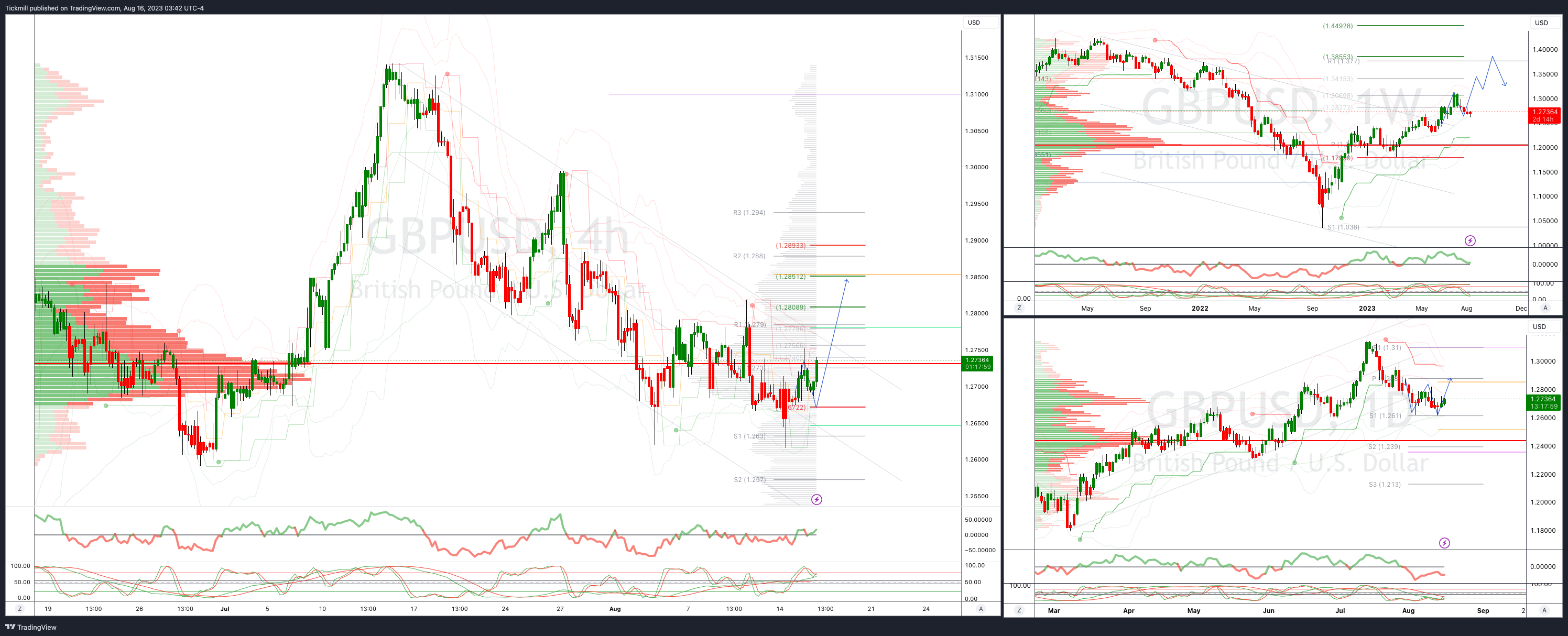

GBPUSD: Intraday Bullish Above Bearish Below 1.28

Below 1.2750 opens 1.2650

Primary support is 1.2590

Primary objective 1.3850

20 Day VWAP bearish, 5 Day VWAP bearish

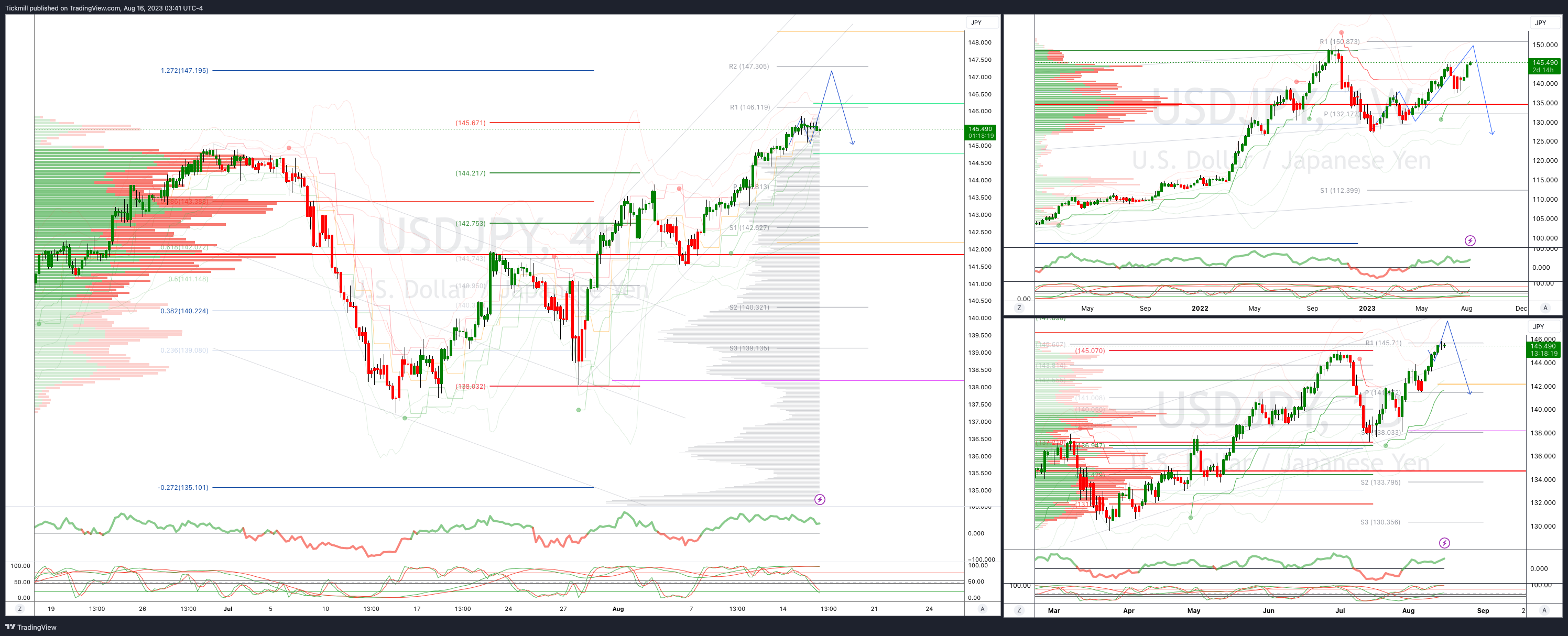

USDJPY Bullish Above Bearish Below 144.50

Below 143 opens 142

Primary support 140.50

Primary objective is 147.20

20 Day VWAP bullish, 5 Day VWAP bullish

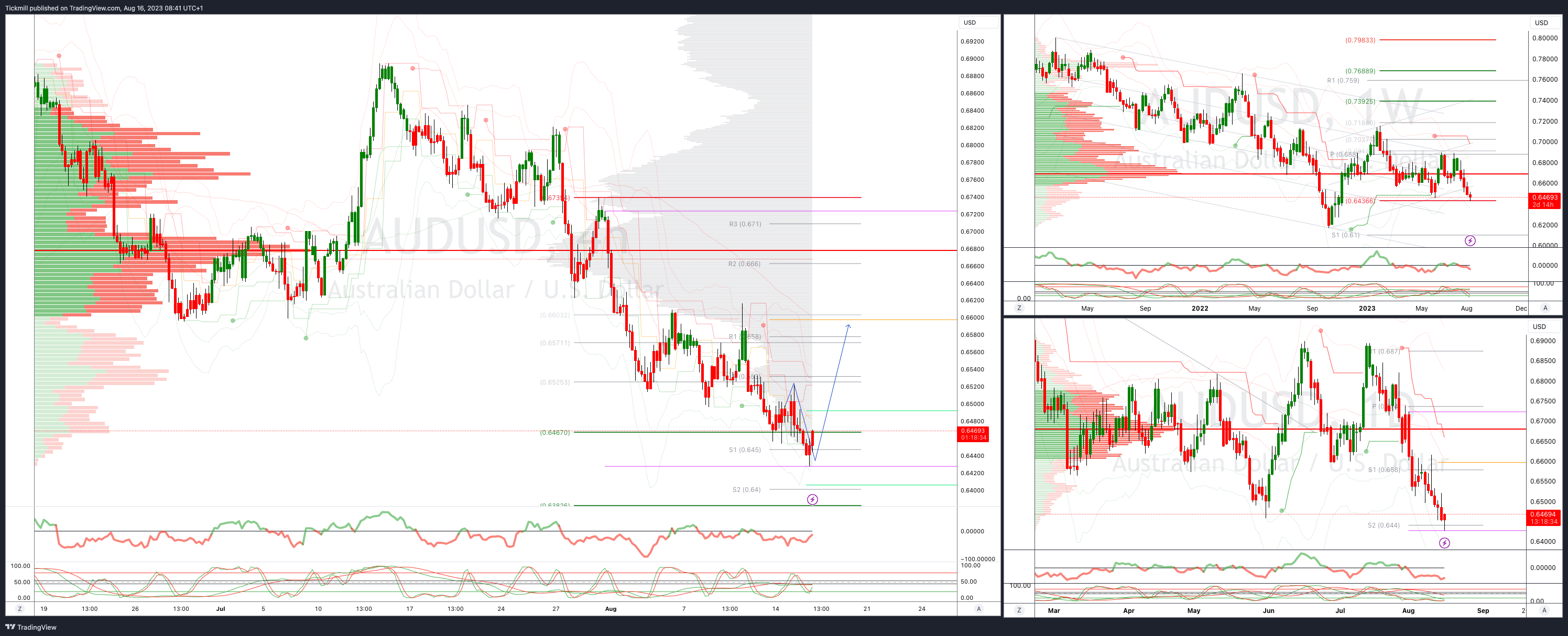

AUDUSD Intraday Bullish Above Bearish Below .6530 Target Hit 6466 New Pattern Emerging

Above .6550 opens .6610

Primary resistance is .6730

Primary objective is .6466

20 Day VWAP bearish, 5 Day VWAP bearsih

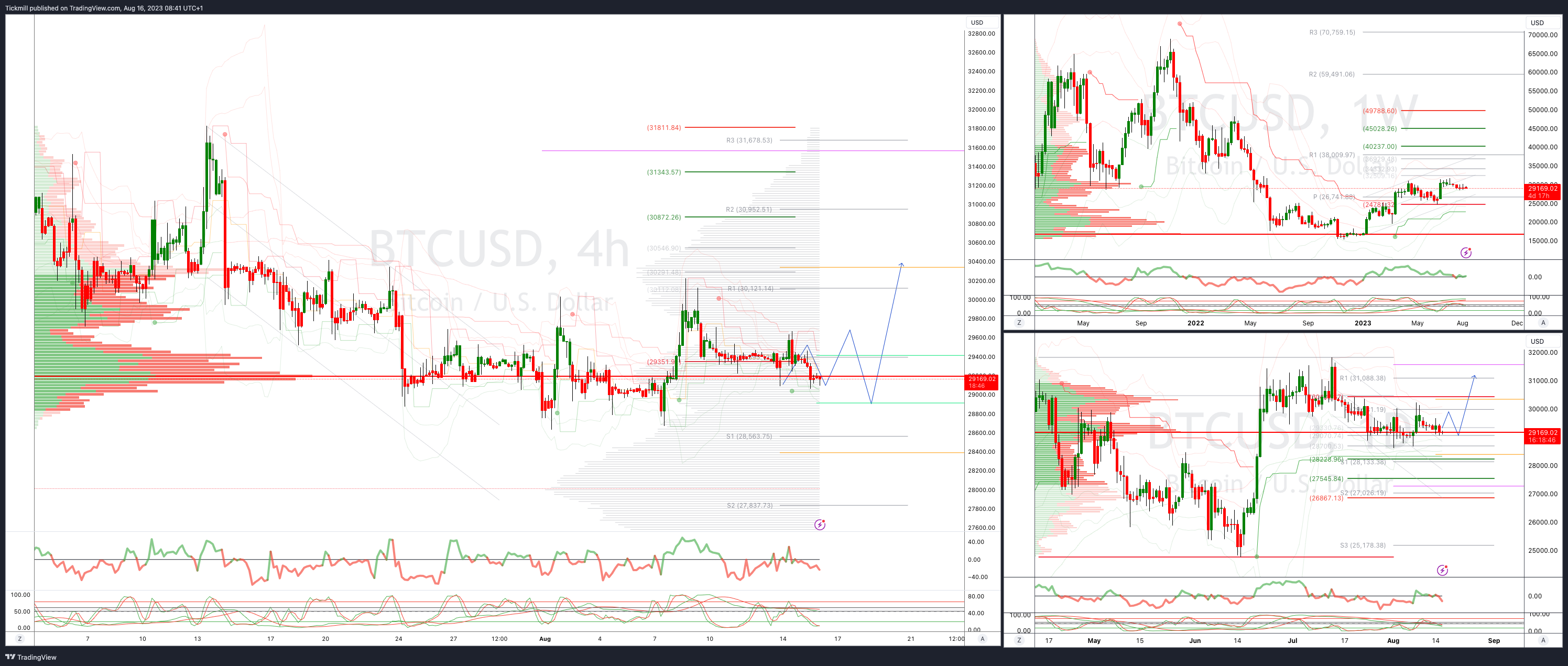

BTCUSD Intraday Bullish Above Bearish below 30000

Below 29400 opens 28300

Primary support is 28300

Primary objective is 32750

20 Day VWAP bearish, 5 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!