Daily Market Outlook, August 17, 2023

Daily Market Outlook, August 17, 2023

Munnelly’s Market Commentary…

Asian equity markets mostly experienced another day of selling, in line with losses on Wall Street. Yields in the market continued to rise following the release of FOMC Minutes, which highlighted that most officials saw significant upside risks to inflation, possibly necessitating further tightening measures.

The Nikkei 225 index in Japan declined, driven by soft data releases that included a miss on machinery orders. Although exports and imports saw declines that were not as severe as anticipated, exports registered contraction for the first time in 29 months. The Hang Seng index and the Shanghai Composite index opened under pressure. The Hang Seng index's decline of more than 20% from its January high pushed it into bear market territory, attributed to disappointing earnings results from companies like Tencent and JD.com. However, the Chinese markets managed to recover most of their earlier losses following another liquidity injection by the central bank and recent economic commitments by Premier Li.

With no major data on the docket in the UK for the day, attention shifts to Friday's early releases, which include the August GfK consumer confidence survey and official retail sales figures for July. Earlier this week, key labor market and Consumer Price Index (CPI) inflation reports indicated upside surprises in wage growth and services inflation. This has heightened expectations for another interest rate hike by the Bank of England next month. However, concerns remain that the impact of interest rate increases in the UK will be more pronounced in the second half of the year. The upcoming July retail sales figures could provide insight into this scenario, with a projected 1.5% monthly decline – equal to the largest drop observed in the past two years. Retail sales data can be volatile, though, and this potential outcome might partly be attributed to unseasonably wet weather. Nevertheless, it may raise concerns regarding the impact of interest rate hikes. The August GfK confidence measure is also expected to rise, albeit only partially reversing the drop seen in July. Overall, while these data points may not significantly alter market expectations for another rate hike in September, they are likely to contribute to the ongoing economic narrative.

Stateside there are expectations for initial jobless claims to ease slightly following last week's larger-than-expected increase. Additionally, continuing claims are projected to be slightly lower. Market participants will also be closely watching the Philadelphia Fed regional manufacturing report, particularly in the context of the disappointing Empire survey data released earlier in the week.

FX Positioning & Sentiment

Traders have placed bets totaling over $16 billion on the anticipation of a decline in the US dollar. These short positions are taken against major currencies including the Euro, British Pound, Mexican Peso, and Brazilian Real. The EUR/USD has seen particularly large bets, reaching $20.5 billion. The USD index, which is weighted about 58% against the EUR, has surpassed the 200-day moving average and risen to 103.59. Should the index remain bid above 103 the next target is 104.39, a level that could open a move to test the March high of 105.88.

The MSCI Emerging Markets FX index has declined close to its low for 2023, suggesting potential challenges ahead. Given these developments, hedging against the risk of an increase in foreign exchange volatility could be a prudent move.

CFTC Data As Of 15-08-23

EUR$ -0.47% in Aug 9-15 period hints at further reduction in EUR long

EUR specs have sold 27k contracts last 2-wks as Fed seen high-for-longer

$JPY +1.55% in period; pair hits new 2023 high amid steady BoJ view

Fri's data will hint at degree of intervention fear as yen approaches 150

GBP$ -0.36% in period, support at rising daily cloud base

Well-above target UK inflation to keep BoE hiking, even as Fed halts

AUD$ -1.29%, $CAD +0.59%; China econ woes weigh on commod-centic pairs

BTC -2.7% in period; higher rate view capping BTC gains even as more fin'l firm seek to gain ETF approvals (Source: Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0850 (700M), 1.0880 (1.1B), 1.0940 (1.3B), 1.0950 (2.6B)

EUR/USD: 1.0985 (975M), 1.0995 (1.2B), 1.1000 (915M)

USD/JPY: 142.00 (1.5B), 142.50 (975M), 143.00 (1.5B), 145.00 (1.2B)

USD/JPY: 145.50 (1.1B), 146.00 (600M). EUR/JPY: 158.00 (450M), 160.00 (1.7B)

GBP/USD: 1.2500 (600M), 1.2530 (385M), 1.2700 (725M), 1.2845 (465M)

EUR/GBP: 0.8600 (460M), 0.8750 (1.3B). EUR/NOK 11.5000 (530M)

AUD/USD: 0.6550 (1.5B), 0.6675 (600M). AUD/NZD: 1.0850 (1.0B), 1.1075 (1.2B)

USD/CAD: 1.3210 (865M), 1.3490 (1.2B).

Overnight Newswire Updates of Note

Hong Kong Stocks On Edge Of Bear Market As Contagion Fears Mount

Fed Saw ‘Significant’ Inflation Risk That May Merit More Hikes

Australia Unemployment Rises To 3.7% As Rate Hikes Take Toll

Japan Exports Fall For First Time Since 2021, Stoking Outlook Concerns

RBNZ’s Orr Says Recession Is Bare Minimum To Tame Inflation

China’s Housing Slump Is Much Worse Than Official Data Shows

China’s Troubled $137Bln Shadow Bank Plans Debt Restructuring, Taps KPMG

China PBoC Expected To Maintain Liquidity With Various Tools - CSJ

Morgan Stanley Sees China Missing Its Growth Target This Year

China Is Headwind For US, Global Economy, Treasury Official Says

Treasury Market 2023 Gains Evaporate Once Again In Latest Rout

Japan 20-Year Bond Auction Has Longest Tail Since 1987

China Escalates Battle Against Yuan Bears With Fixing Guidance

China's Major State Banks Sell Dollars For Yuan In London, NY Hours

Oil Prices Wobble On Jitters Over China Economy, US Rates Path

Hong Kong Stocks On Edge Of Bear Market As Contagion Fears Mount

Cisco Gives Tepid Annual Forecast, Renewing Fears Of Slowdown

Goldman Sachs Blames Zero-Day Options For Fuelling S&P 500 Selloff

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

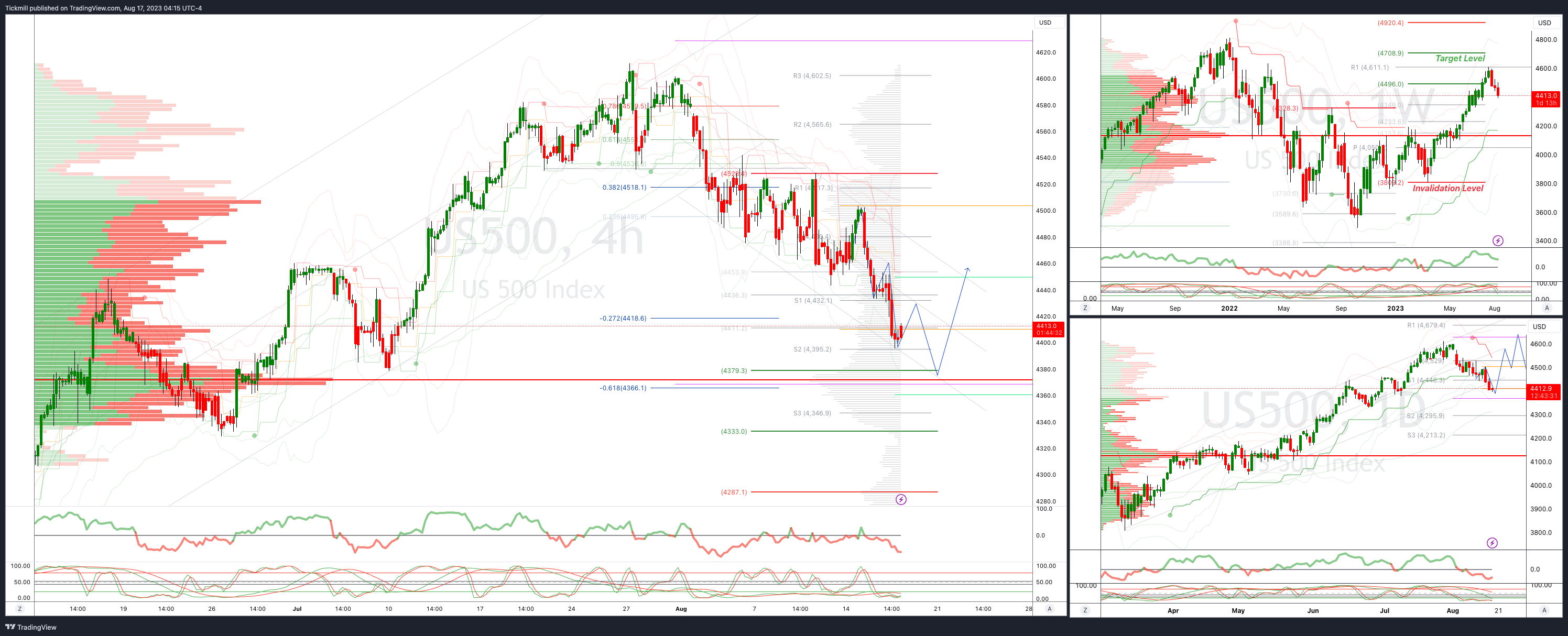

SP500 Intraday Bullish Above Bearish Below 4460

Above 4460 opens 4500

Primary resistance is 4560

Primary objective is 4380

20 Day VWAP bearish, 5 Day VWAP bearish

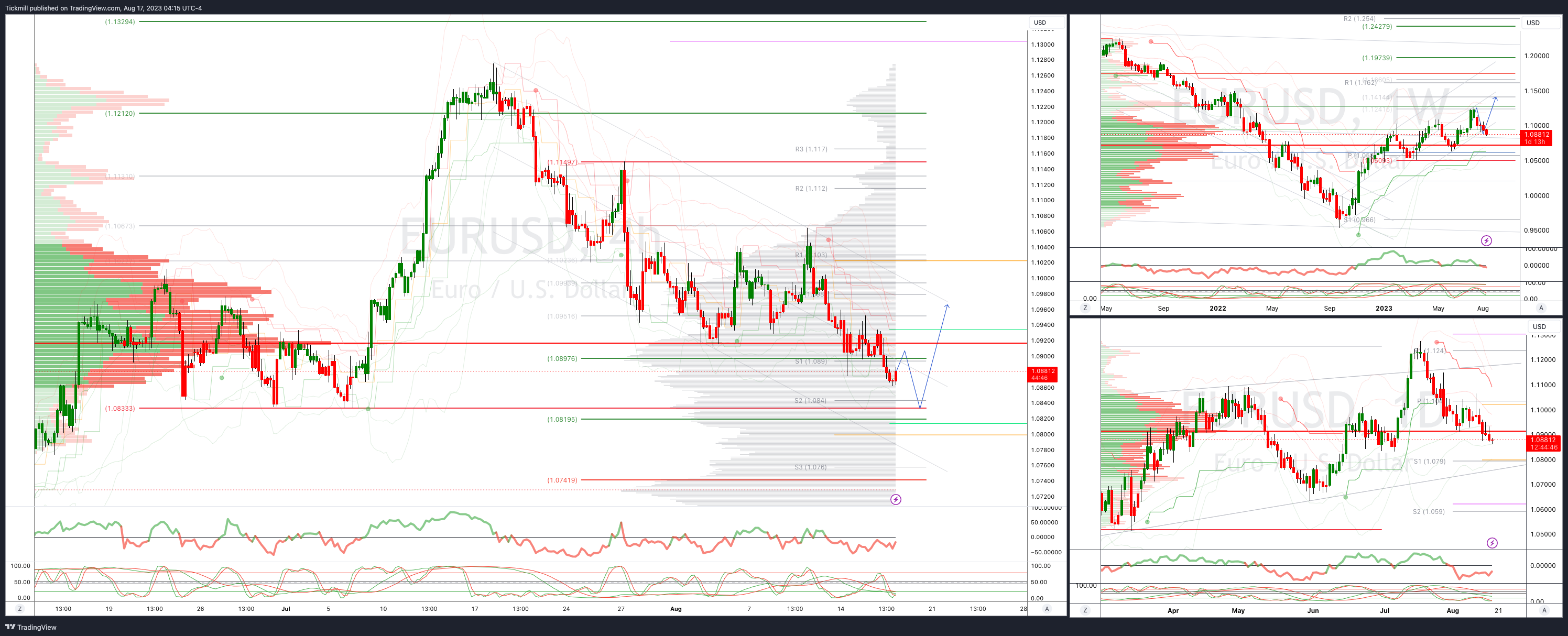

EURUSD Intraday Bullish Above Bearsih Below 1.10

Below 1.890 opens 1.0830

Primary support is 1.830

Primary objective is 1.13

20 Day VWAP bearish, 5 Day VWAP bearish

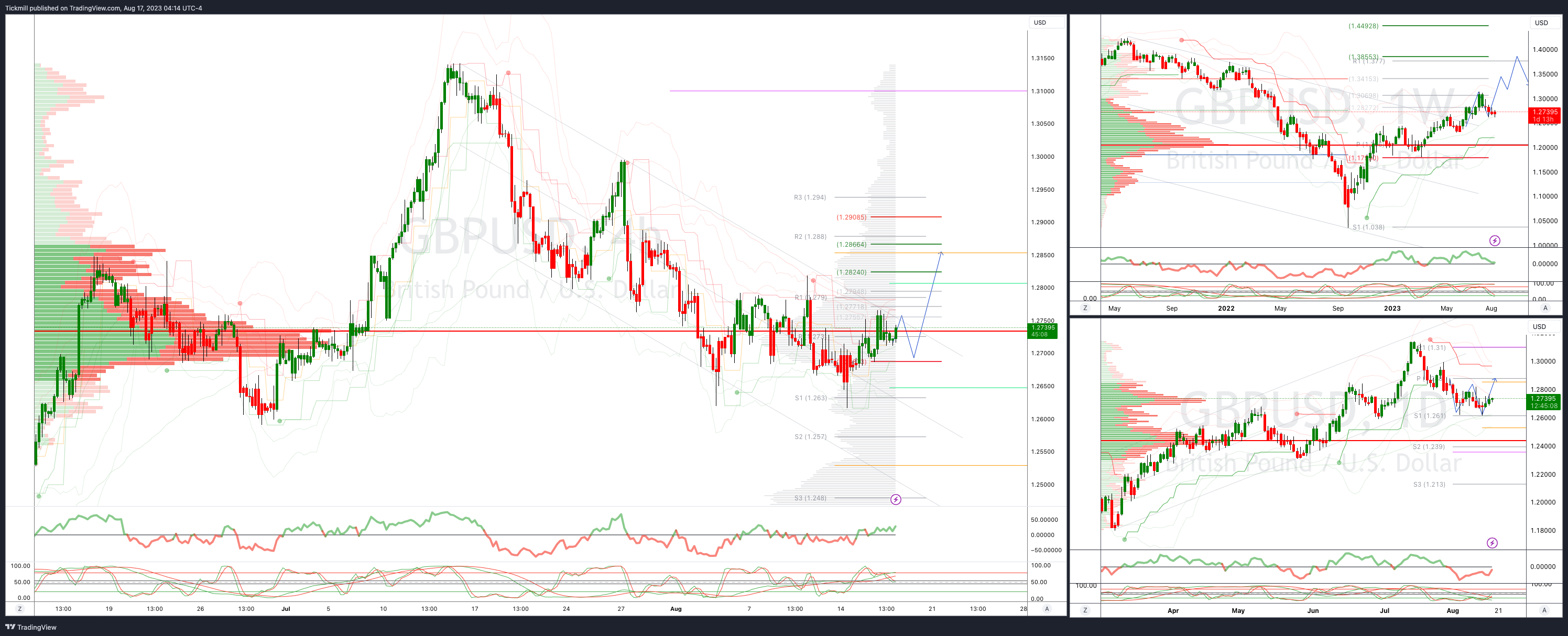

GBPUSD: Intraday Bullish Above Bearish Below 1.28

Below 1.2680 opens 1.2620

Primary support is 1.2590

Primary objective 1.3850

20 Day VWAP bearish, 5 Day VWAP bearish

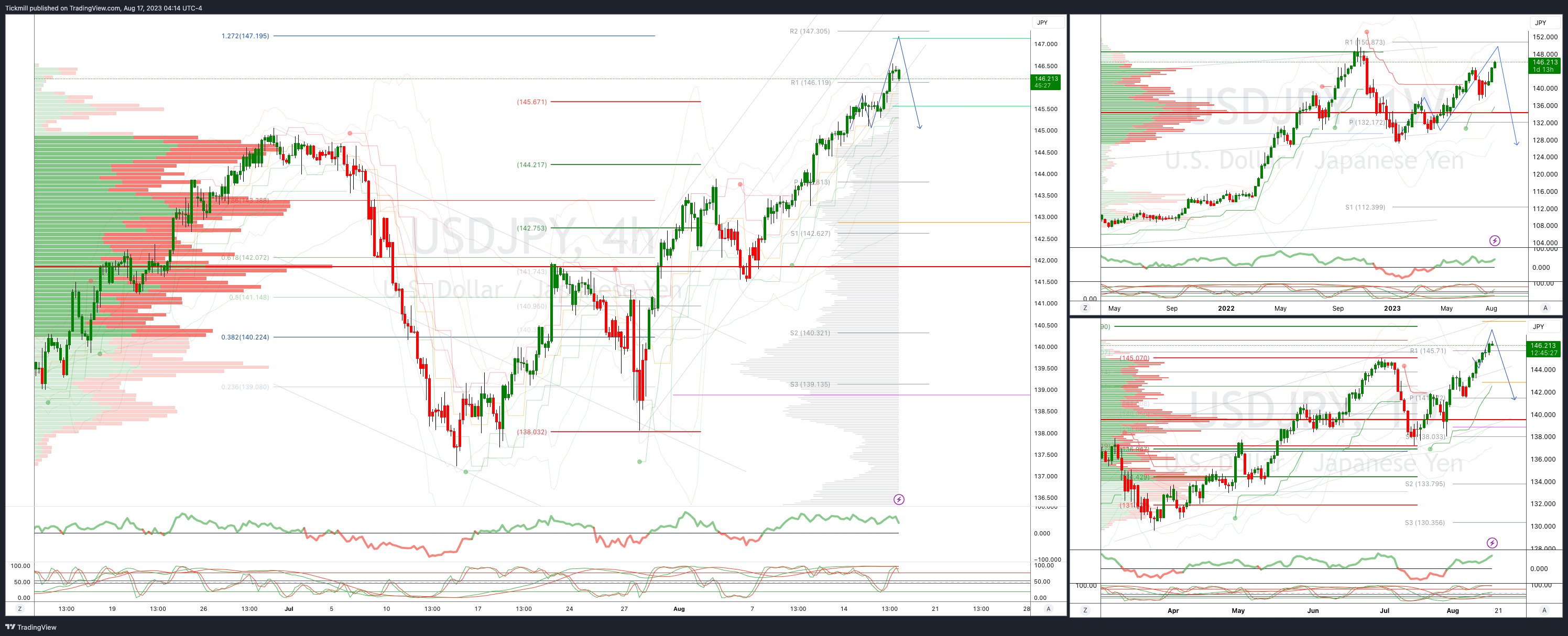

USDJPY Bullish Above Bearish Below 145

Below 144.90 opens 143.90

Primary support 141.90

Primary objective is 147.20

20 Day VWAP bullish, 5 Day VWAP bullish

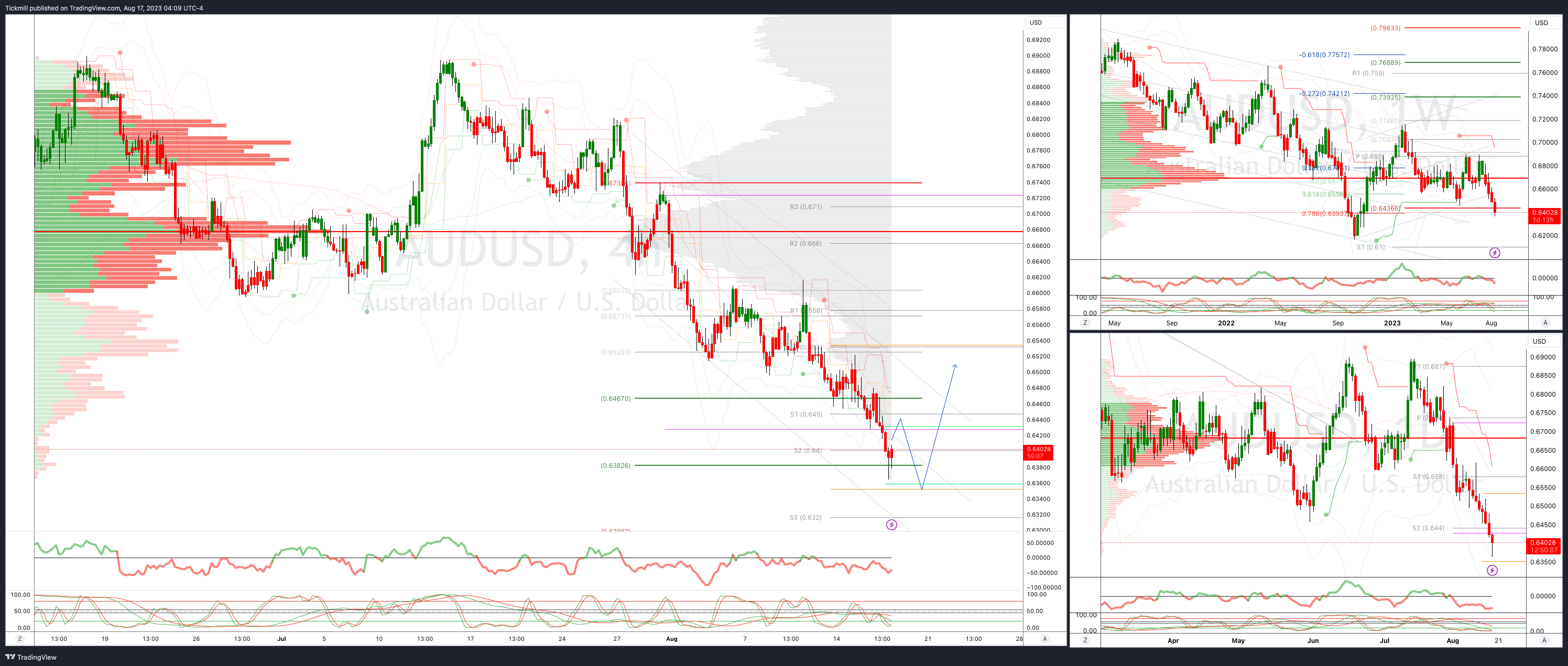

AUDUSD Intraday Bullish Above Bearish Below .6450

Above .6500 opens .6600

Primary resistance is .6670

Primary objective is .6200

20 Day VWAP bearish, 5 Day VWAP bearsih

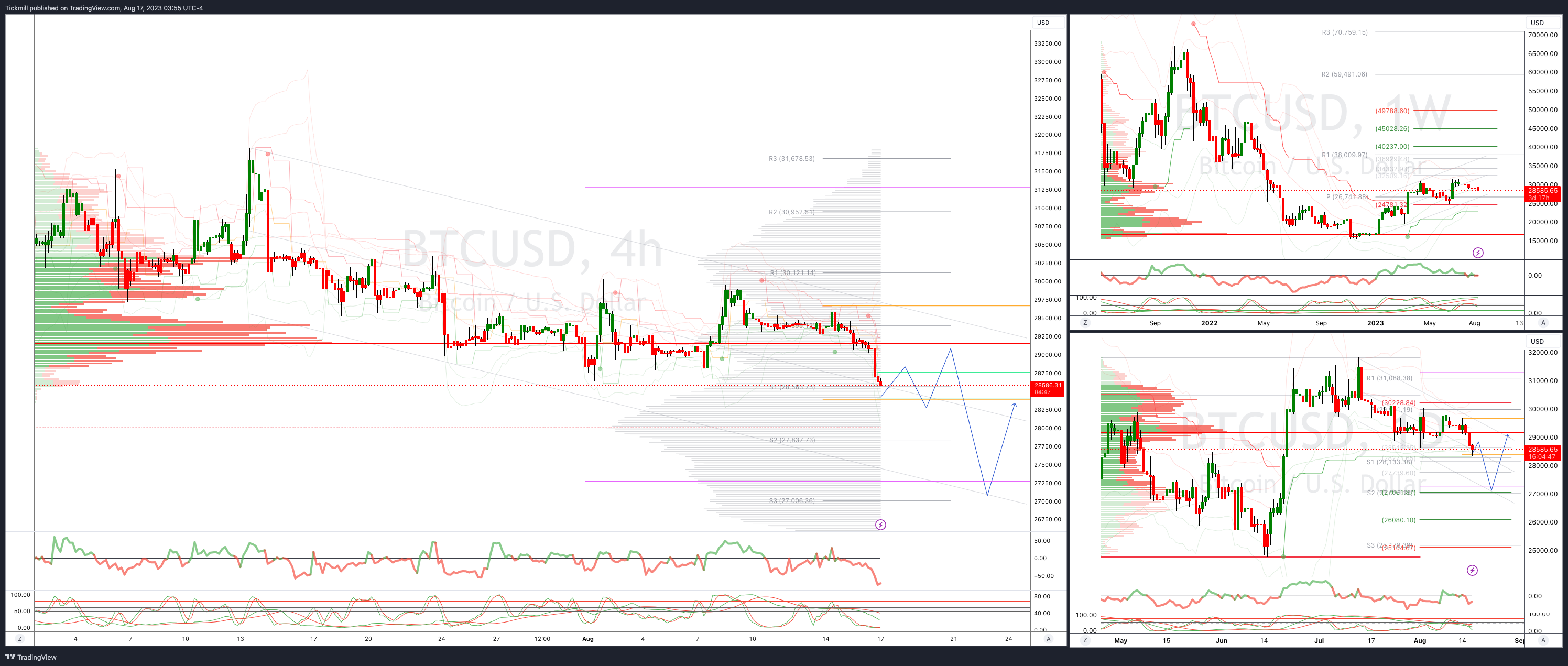

BTCUSD Intraday Bullish Above Bearish below 29300

Above 29400 opens 30000

Primary resistance is 30200

Primary objective is 27000

20 Day VWAP bearish, 5 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!