Daily Market Outlook, August 22, 2023

Daily Market Outlook, August 22, 2023

Munnelly’s Market Commentary…

Asian equity markets exhibited mixed trading overnight, mirroring a similar performance seen in the United States. In the US, the technology sector experienced a rally, although broader market gains were constrained due to the ongoing rise in global yields.

The Nikkei 225 index advanced as the technology sector in the Asia-Pacific region drew inspiration from its US counterparts. Notably, SoftBank registered noteworthy gains, partly driven by its Arm unit's filing for a US Initial Public Offering. On the other hand, the Hang Seng index displayed marginal gains, while the Shanghai Composite index recorded a slight decline. Investors in these indices were deliberating over the latest support measures announced by Premier Li and the State Council, in addition to the People's Bank of China's net liquidity withdrawal. This mixed trading sentiment across Asia-Pacific markets reflects a blend of tech-driven positive momentum and concerns stemming from global yield upticks.

Bond selling persisted on Tuesday, driving 10-year Treasury yields to new highs not seen in 16 years during Asian trading hours. This surge in yields has made stock markets that were already on edge proceed with caution. The catalyst behind this movement isn't immediately apparent. Contrary to what might be expected, it's not driven by inflation concerns, as inflation expectations have hardly moved. Instead, it seems that investors are demanding higher returns in order to continue purchasing bonds. Some analysts have pointed out the timing coincidence between the selloff and the Bank of Japan's indication that it might allow Japanese 10-year yields to reach as high as 1%. This has led to speculation that traders could be preemptively reacting to a potential withdrawal of Japanese capital from the bond markets. Additionally, the thematic focus of the upcoming Jackson Hole symposium by the Federal Reserve – centred around "structural shifts in the global economy" – has spurred speculation that bond markets need to adapt, particularly in the longer-term segment. In any case, with the prospect of earning relatively inflation-protected returns of 2% over a 10-year period, the consequences for risk appetite across the broader financial landscape could be substantial. Given the relatively sparse data docket for Tuesday, attention is likely to shift towards Wednesday's raft of PMI data while investors will be remaining equally attentive to yield moves and the anticipation surrounding Federal Reserve Chair Jerome Powell's speech at the Jackson Hole symposium, scheduled for Friday.

FX Positioning & Sentiment

On Friday, Nomura made a strategic shift in its trading positions, moving from a long EUR/GBP (euro to British pound) position to a short GBP/USD (British pound to US dollar) position. The target for this short position is set at 1.22, a level at which the GBP/USD exchange rate was last seen on March 24. To manage potential losses, Nomura has established a stop-loss point above 1.30. This move comes as Nomura identifies the possibility of a squeeze on GBP (British pound) long positions. The latest CFTC (Commodity Futures Trading Commission) data revealed that net GBP long positions increased to 50,988 contracts in the week ending on August 15. A squeeze on these long positions could potentially lead to a decline in the British pound's value.

CFTC Data As Of 15-08-23

Friday's IMM data release showed USD short grew by 0.55bn in Aug 9-15 period

Current Aug 16-22 reporting period will not include Jackson Hole Symposium

Data released 25 Aug likely to be mooted by J-Hole comments by Powell, et al

EUR$ -0.45% in prior period; -0.7% in new may stall EUR buying

Slow glbl growth tempers hawkish ECB outlook after China cut, lwr German PPI

$JPY +0.33% in new period, expect USD buying amid widening US-JP rate view

GBP$ +0.43% since Aug 16; UK CPI well-above target to keep BoE in hike mode

AUD, CAD big sellers in prior period on China slowdown short likely to keep growing amid less-dovish Fed view (Source: Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0850 (507M), 1.0870 (488M), 1.0885 (490M), 1.0900 (1.3BLN)

USD/CHF: 0.8800 (394M), 0.8825 (200M), 0.8840 (250M). EUR/CHF: 0.9600 (276M)

USD/JPY: 145.00 (962M), 145.25-30 (432M)

AUD/USD: 0.6400 (861M), 0.6425 (519M), 0.6440 (250M).

EUR/AUD: 1.6900 (201M). AUD/JPY: 95.00 (302M)

Overnight Newswire Updates of Note

Treasury Yields Hit Highest Since 2007 On Elevated Rate Fears

BoJ’s Ueda: Discussed Economy, Financial Markets With PM Kishida

More Economists Cut China Forecasts As Real Estate Gloom Deepens

Fed Officials More Split Over Interest Rate Path Than They Used To Be

Dollar Falls Despite Yield Spike; Yen Under Watch Tuesday

China Ramps Up Yuan Defence With Most Forceful Fixing On Record

New Zealand’s Dollar Is On Brink Of Longest-Ever Losing Streak

Japan’s Benchmark Bond Yield Hits Nine-Year High In Test For BoJ

Wells Fargo Strategists Recommend 10-Year TIPS With Yields Hitting 2%

Oil Holds Loss On Signs Of Supply Rebound As Demand Woes Linger

Asian Stocks Advance, Poised To Snap Seven-Day Losing Streak Tuesday

S&P Joins Moody’s In Cutting US Banks Amid ‘Tough’ Environment

SoftBank’s Arm Files For IPO That Could Be 2023’s Biggest

BHP’s Full-Year Profit Falls 37% As China’s Metals Demand Wanes

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

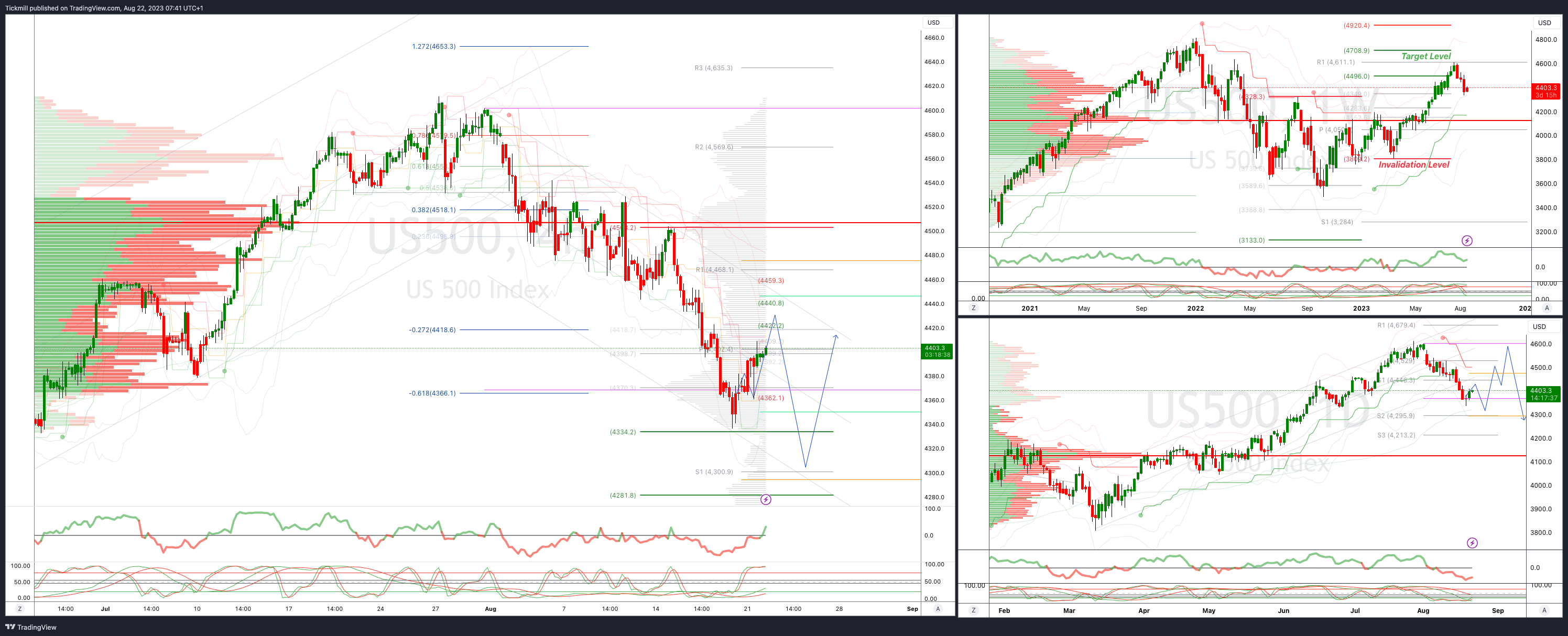

SP500 Intraday Bullish Above Bearish Below 4445

Above 4450 opens 4475

Primary resistance is 4510

Primary objective is 4335

20 Day VWAP bearish, 5 Day VWAP bullish

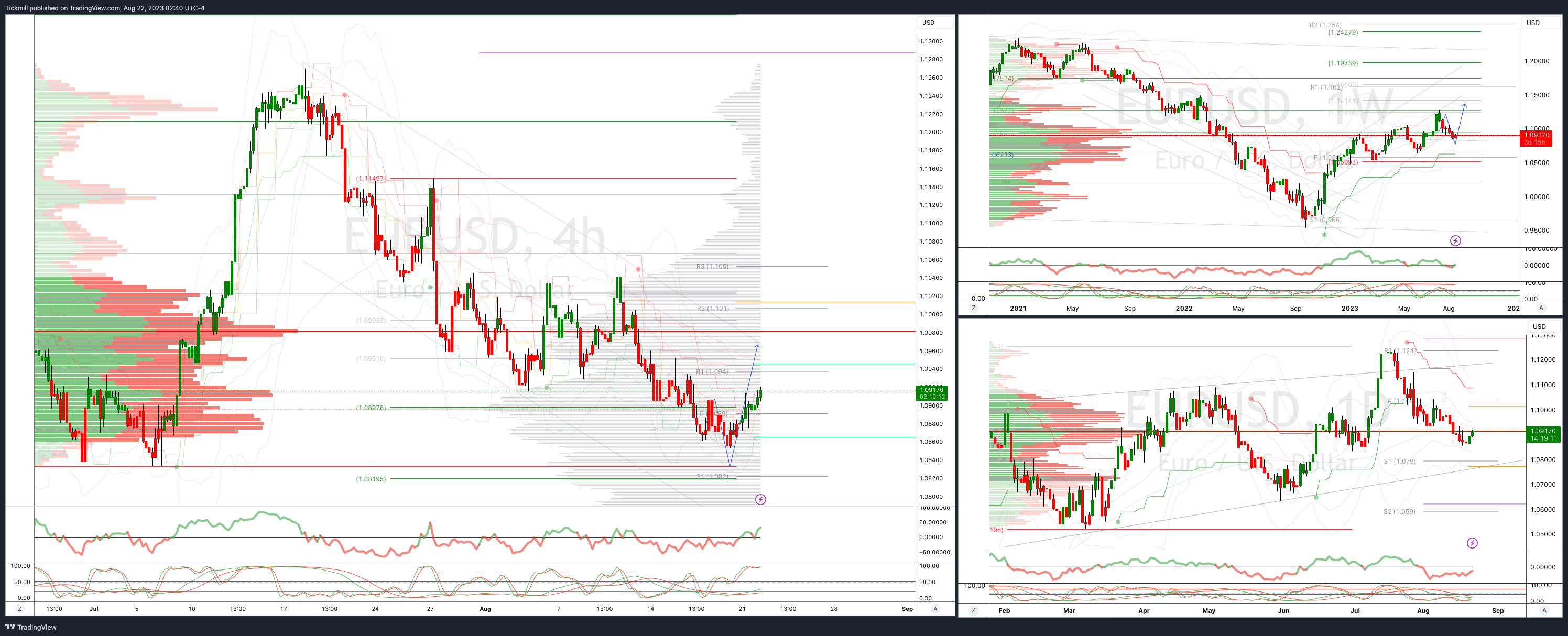

EURUSD Intraday Bullish Above Bearsih Below 1.0860

Below 1.860 opens 1.0830

Primary support is 1.830

Primary objective is 1.13

20 Day VWAP bearish, 5 Day VWAP bullish

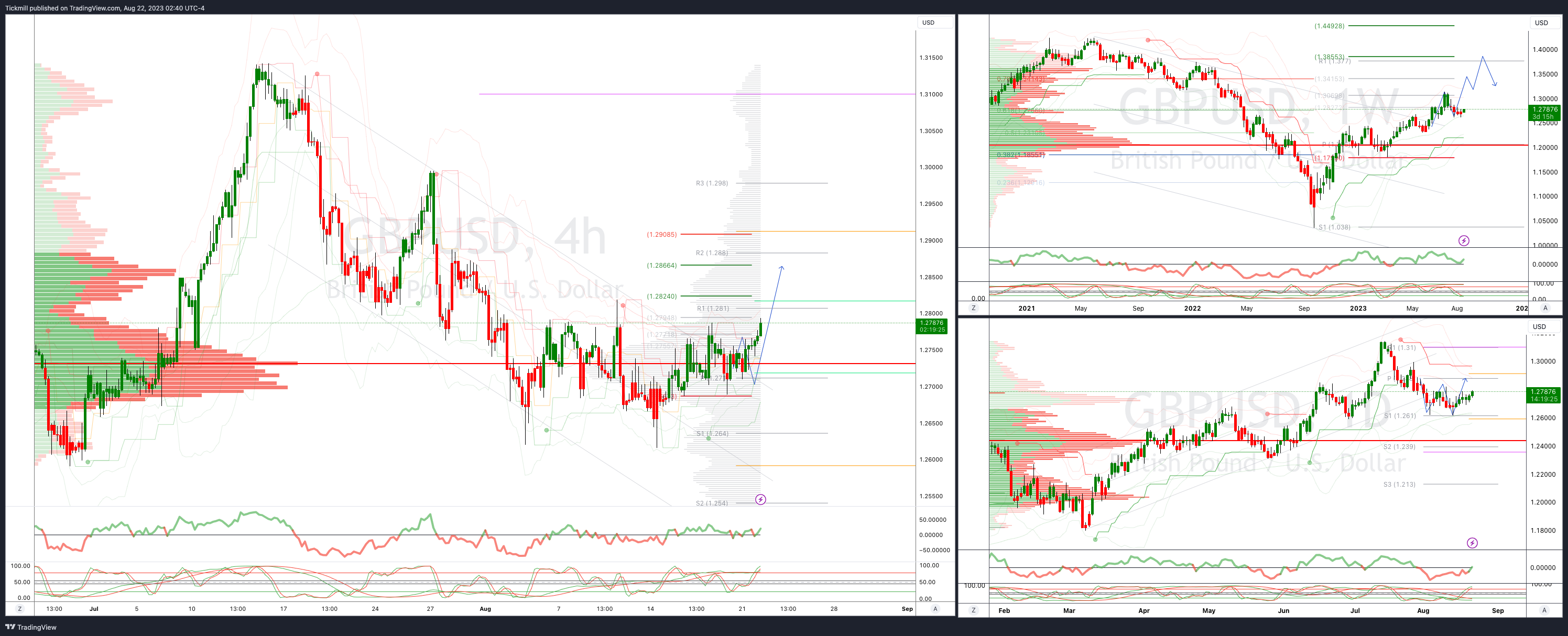

GBPUSD: Intraday Bullish Above Bearish Below 1.28

Below 1.2680 opens 1.2620

Primary support is 1.2590

Primary objective 1.3850

20 Day VWAP bullish, 5 Day VWAP bullish

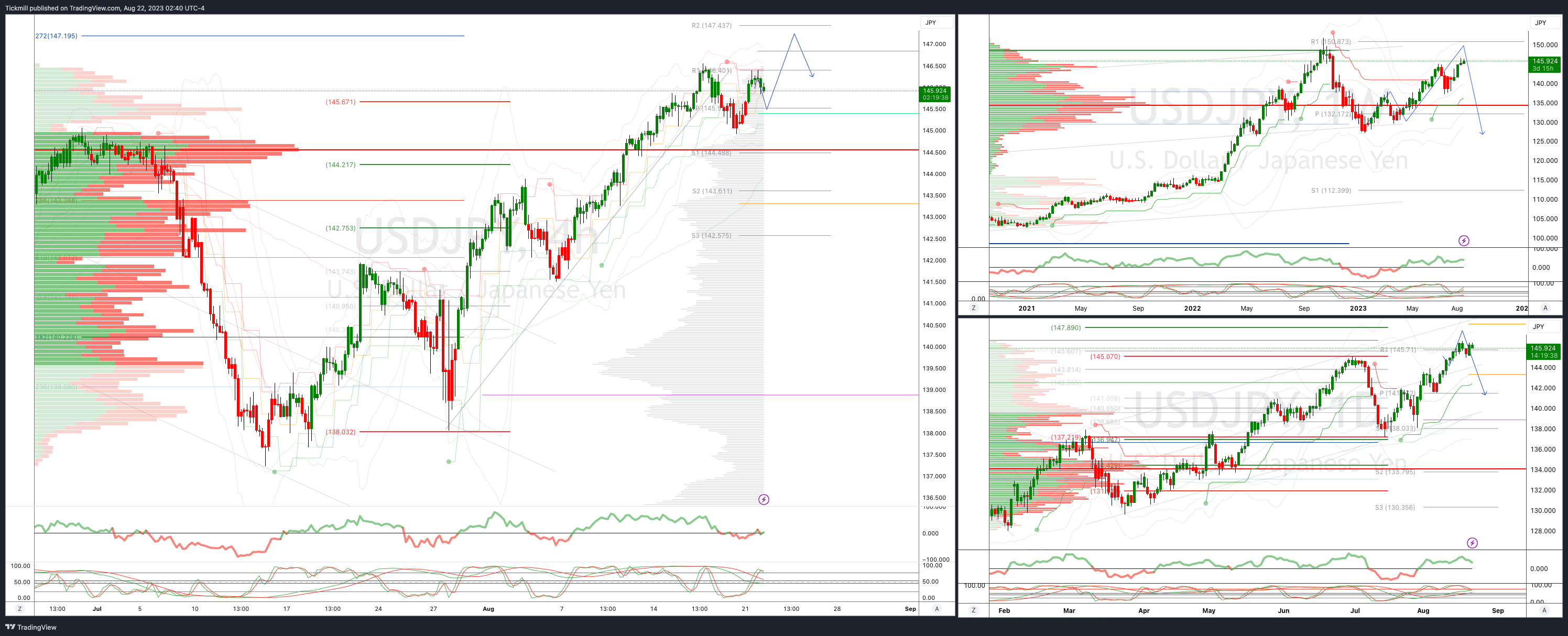

USDJPY Bullish Above Bearish Below 145

Below 144.90 opens 143.90

Primary support 141.90

Primary objective is 147.20

20 Day VWAP bullish, 5 Day VWAP bullish

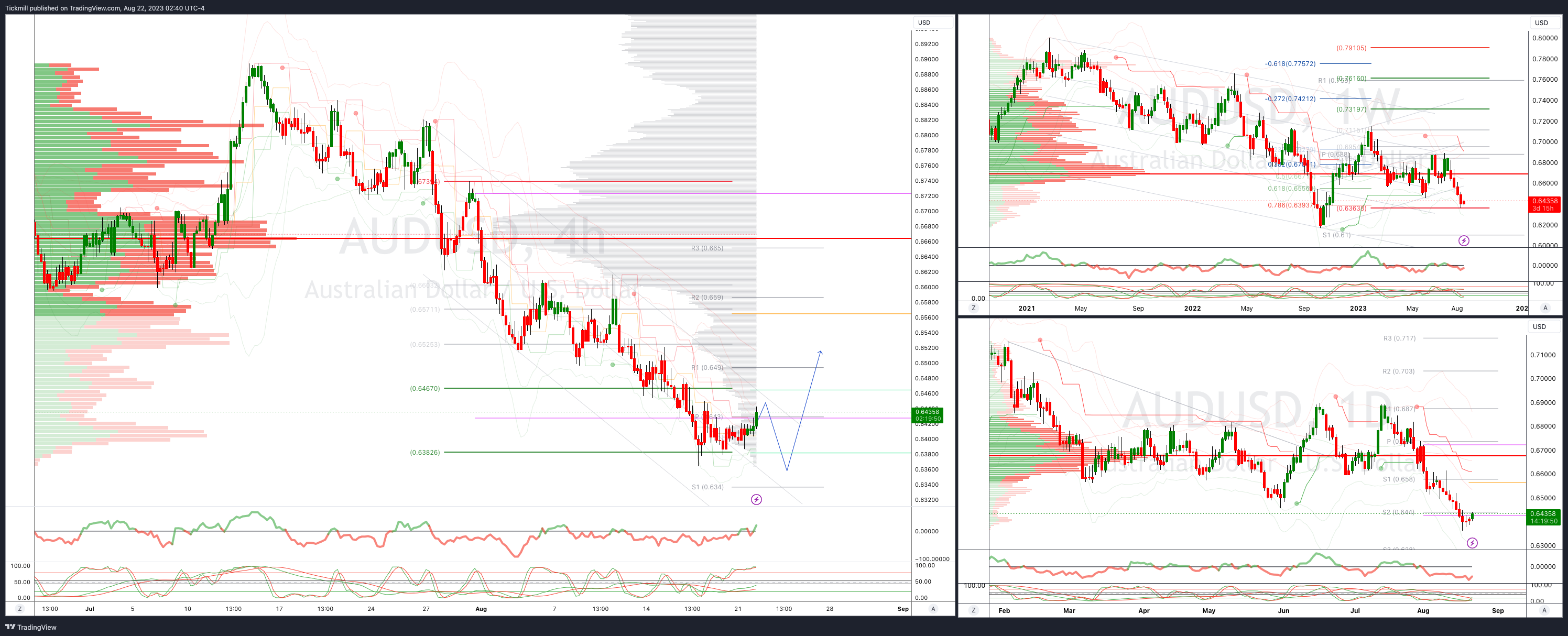

AUDUSD Intraday Bullish Above Bearish Below .6450

Above .6500 opens .6600

Primary resistance is .6670

Primary objective is .6200

20 Day VWAP bearish, 5 Day VWAP bullish

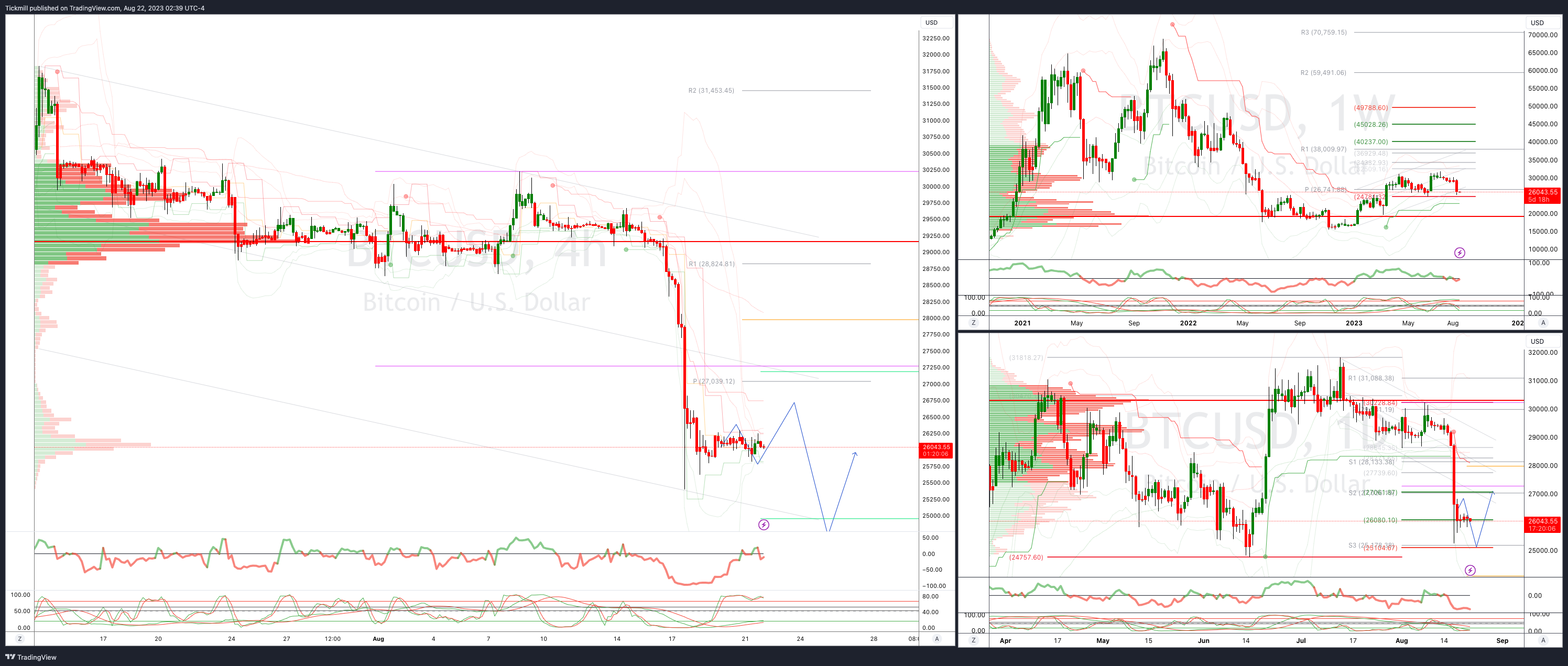

BTCUSD Intraday Bullish Above Bearish below 27000

Above 29000 opens 30000

Primary resistance is 28750

Primary objective is 24757

20 Day VWAP bearish, 5 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!