Daily Market Outlook, July 10, 2023

Daily Market Outlook, July 10, 2023

Munnelly’s Market Commentary…

Asian equity markets showed a positive start to the week, although gains were limited due to investors digesting softer-than-expected inflation data from China. The Nikkei 225 initially extended last week's slump but managed to rebound in late trade, ending with a marginal decrease. On the other hand, the Hang Seng and Shanghai Composite traded higher, with the Hang Seng also in the green supported by the tech sector, as hopes grew that China's tech crackdown might be easing. However, gains in mainland China were constrained by disappointing Chinese inflation figures, which revealed zero consumer inflation and a deeper contraction in factory gate prices. US Treasury Secretary Yellen commented on making progress during her trip to Beijing, stating that ties were put on a "super footing." It's important to note that expectations for her visit were set at a low level, with the primary objective being to establish and deepen ties with the new Chinese economic team and reduce the risk of misunderstandings. These comments may have influenced market sentiment regarding US-China relations.

Today's data calendar is relatively light, with only the Eurozone Sentix investor confidence survey scheduled for release. UK Chancellor Hunt and Bank of England Governor Bailey will be delivering speeches at the annual Mansion House dinner this evening. The text of Governor Bailey's speech will be published at 16:00 BST, although it remains uncertain how much he will address the monetary policy outlook.

In recent days, market expectations for central bank policy rates have been on the rise. Forecasts suggest that UK interest rates could reach 6.5% by early 2024, while US interest rates are also expected to peak at a higher level. The release of hawkish Minutes from the US Federal Reserve's latest policy meeting confirmed that the pause in US interest rates witnessed in June is likely to be short-lived. Despite a drop in the unemployment rate and stronger-than-expected growth in wages according to the latest US labour market report, concerns about inflationary pressures persist, even though the increase in payrolls fell short of expectations. Although a 25bps rate hike at the upcoming July meeting is widely anticipated by the markets, there is scepticism about whether the Fed will follow up with another increase in September. Today, several Fed officials, including Barr, Daly, Bostic, and Mester, will be speaking, and market attention will be focused on any indications of concern about recent data that could suggest a higher risk of a September rate hike.

CFTC Data As Of 07-07-23

USD net spec short pared in Jun 28-Jul 3 period, $IDX +0.58% in period

EUR$ -0.77% in period, specs -2,191 contracts into dip, now +142,837

$JPY +0.3% in period, specs -5,050 contracts on diverging rates now -117,920

GBP$ -0.29%, specs -1,729 contracts, now +50,265; less-dovish Fed lifts USD

$CAD +0.21% specs +7,374 contracts flip position to +4,527

AUD$ +0.09% in period, specs -5,158 contracts now -44,582

BTC +0.5% in period specs +18 contracts now short 2,076 contracts(Source: Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0800 (941M) 1.0840-50 (700M), 1.0920 (1.2BLN)

1.0970-80 (2.1BLN), 1.1000 (804M)

USD/CHF: 0.8955 (401M), 0.9100 (502M)

GBP/USD: 1.2765-70 (590M). EUR/GBP: 0.8510-25 (275M), 0.8635 (200M)

AUD/USD: 0.6685 (1.1BLN), 0.6700 (331M), 0.6720 (264M)

USD/JPY: 143.00 (1.1BLN), 143.30 (250M)

Overnight News of Note

China’s Factory-Gate Price Index Tumbles Deeper Into Deflation

Japan Logs Current Account Surplus For Fourth Month As Trade Gap Narrows

NZIER: RBNZ Shadow Board Recommends No Change To OCR

EU Signs New Zealand Trade Deal To Boost Exports, Investments

Yellen Sees 'Progress' In Rocky US-China Ties, Expects More Communication

Yellen Says Still Too Early To Rule Out Risk Of US Recession

ECB’s Villeroy: ECB Rate Hikes To End Soon At ‘High Plateau’

ECB’s Centeno Sees Inflation Slowing With Core Prices To Follow

BoE's Bailey Rejects Calls To Raise Inflation Target Above 2%

Markets Turn Against UK As Inflation And Growth Outlook Darkens

SNB’s Schlegel Not Deterred By Recent Inflation Dip

Rutte’s Gambit Risks Unravelling As Dutch Rivals Seek His Ouster

Alibaba Mulls Selling Shares To Ant For Buyback As Probe Ends

Apple’s Vision Pro Will Take Far Longer Than iPad, Watch To Spur Big Revenue

'Chinese Storm' Looming Over Europe's EV Sector, Renault Chairman Warns

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

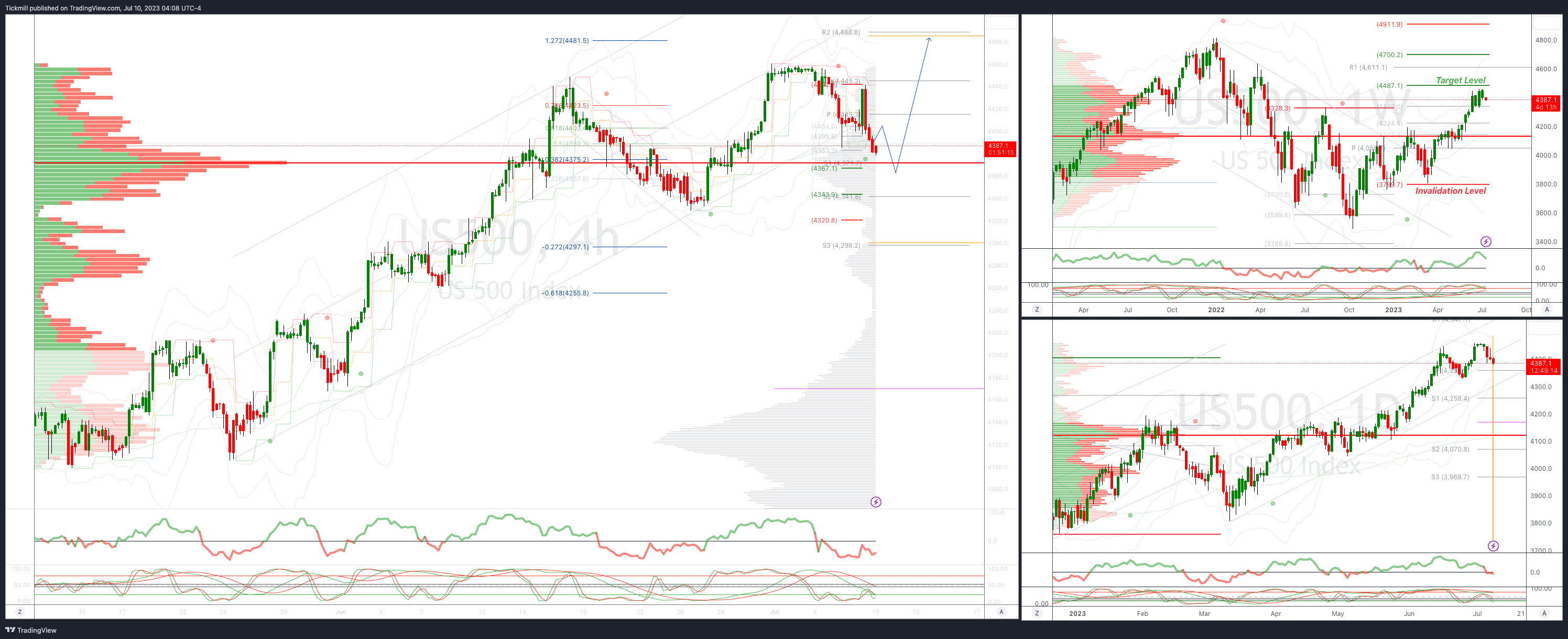

SP500 Bias: Intraday Bullish Above Bearish Below 4365

Below 4350 opens 4330

Primary support is 4300

Primary objective is 4540

20 Day VWAP bullish, 5 Day VWAP bearish

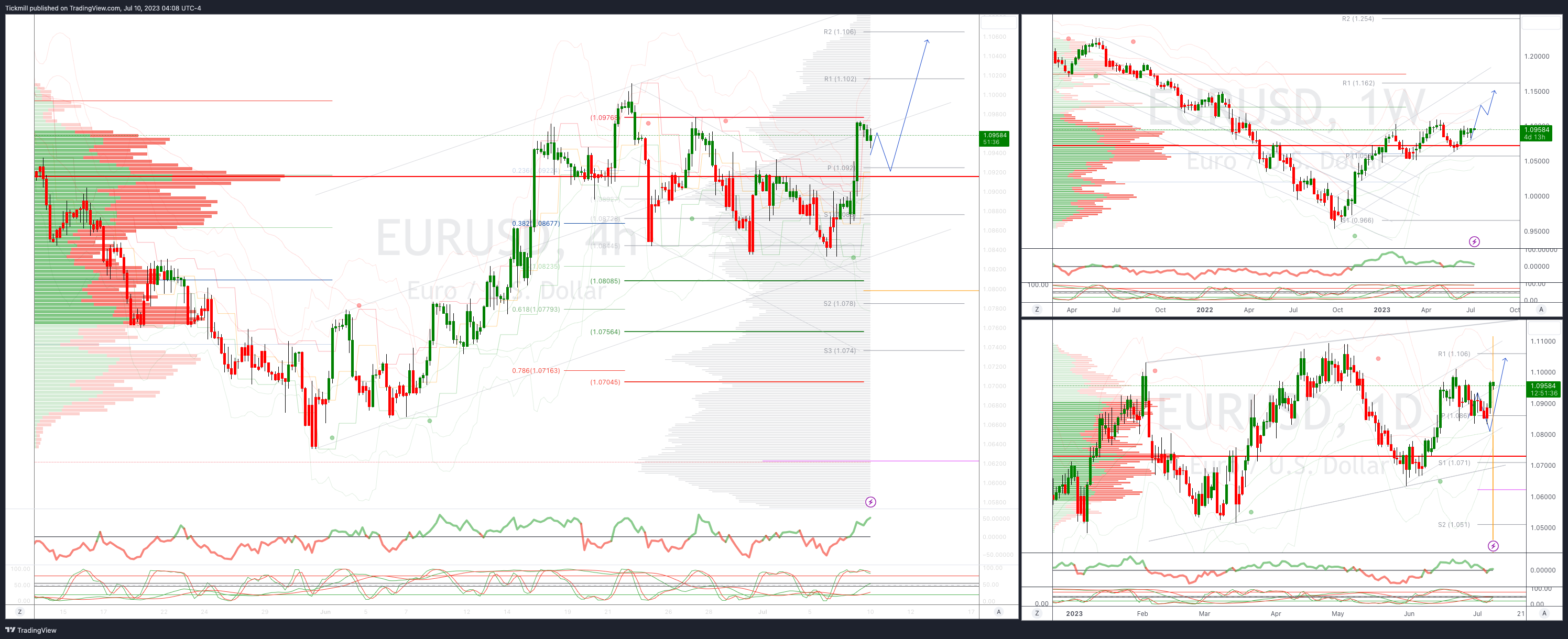

EURUSD Intraday Bullish Above Bearsih Below 1.09

Below 1.0890 opens 1.0830

Primary support is 1.07

Primary objective is 1.1050

20 Day VWAP bullish, 5 Day VWAP bullish

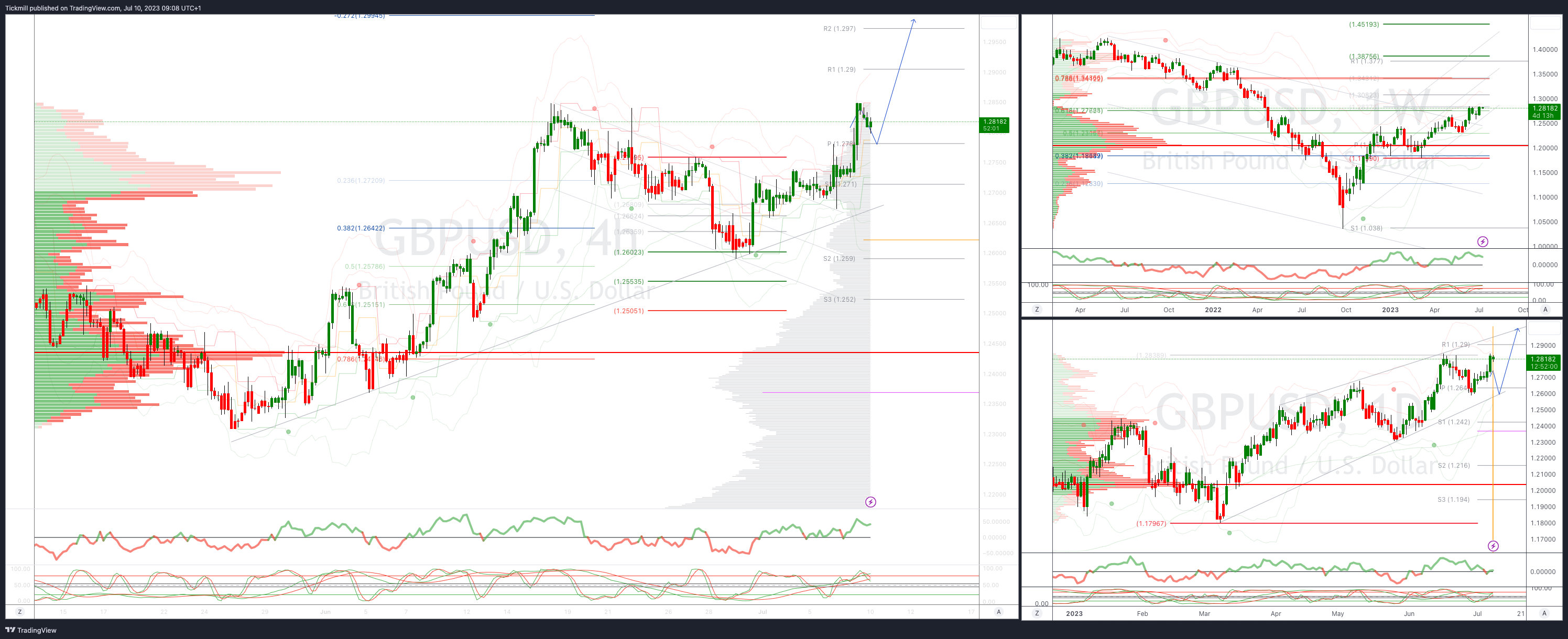

GBPUSD Bias: Intraday Bullish Above Bearish Below 1.2750

Below 1.2730 opens 1.268

Primary support is 1.26

Primary objective 1.2880

20 Day VWAP bullish, 5 Day VWAP bullish

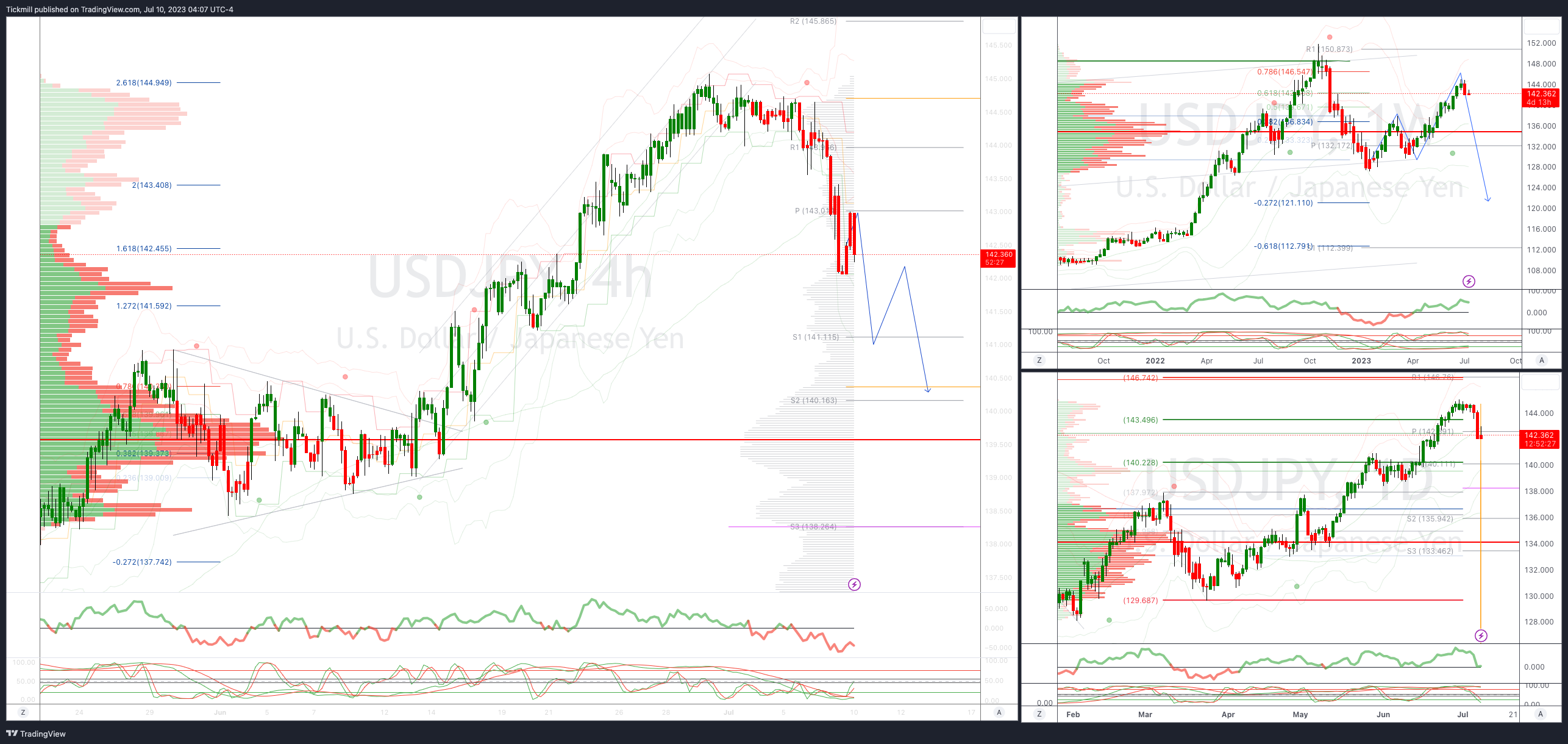

USDJPY Bullish Above Bearish Below 143

Below 143 opens 142.30

Primary support is 141

Primary objective is 140.50

20 Day VWAP bullish, 5 Day VWAP bearish

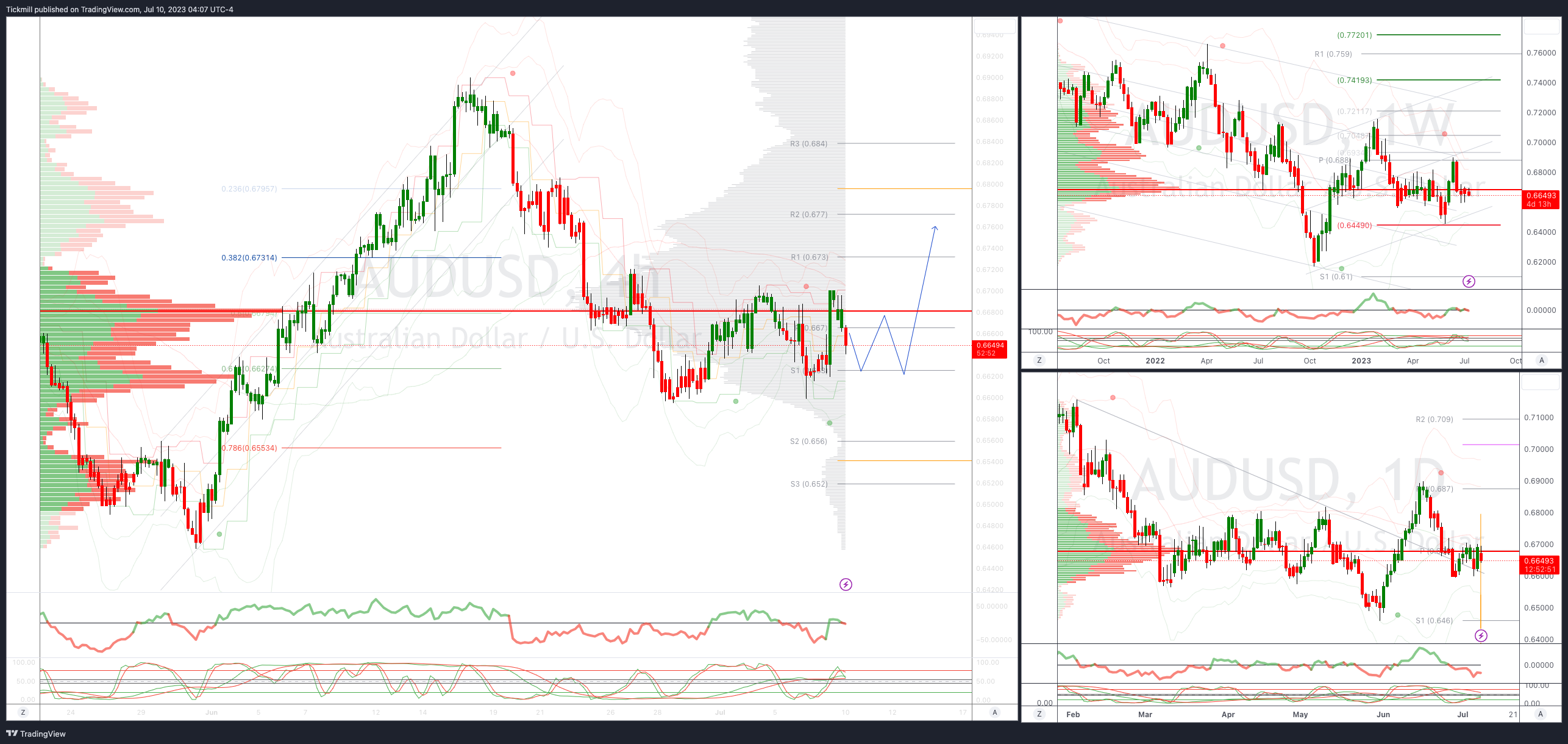

AUDUSD Bias:Intraday Bullish Above Bearish Below .6660

Below .6600 opens .6550

Primary support is .6448

Primary objective is .6917

20 Day VWAP bearish, 5 Day VWAP bullish

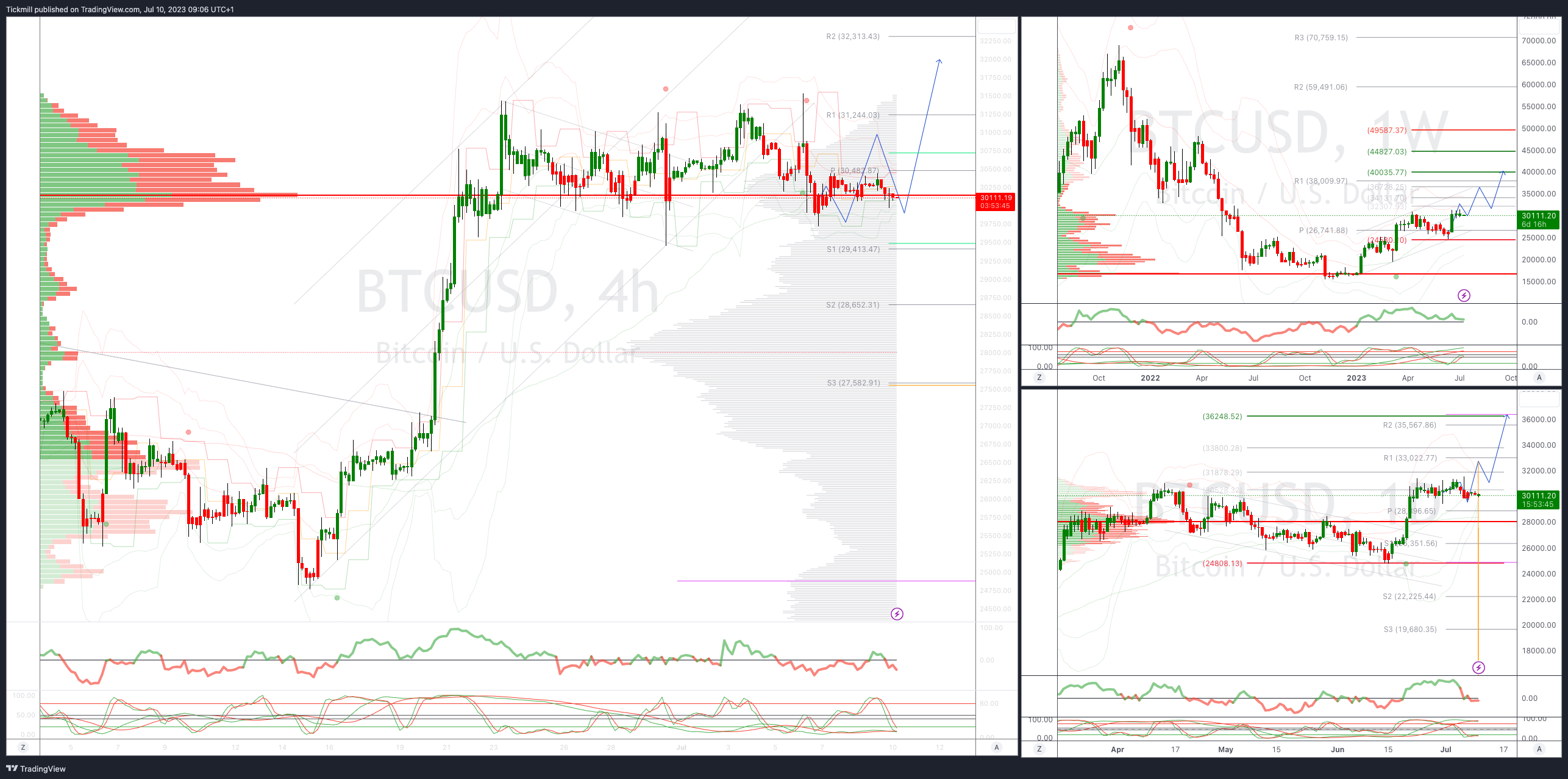

BTCUSD Intraday Bullish Above Bearish below 30000

Below 29400 opens 28600

Primary support is 28400

Primary objective is 32750

20 Day VWAP bullish, 5 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!