Daily Market Outlook, September 19, 2023

Daily Market Outlook, September 19, 2023

Munnelly’s Market Commentary…

Asian equity markets mostly traded lower, mirroring the flat performance in the United States. The lack of significant catalysts and mounting caution ahead of upcoming central bank decisions contributed to the subdued market sentiment. The Nikkei 225 underperformed as recent regional losses caught up with the index after returning from a holiday closure. Additionally, market sentiment was dampened as investors questioned whether Bank of Japan (BoJ) Governor Ueda would use this week's events to lay the groundwork for a potential future policy exit.The Hang Seng and Shanghai Composite indices experienced choppy trading, influenced by pressure in the technology sector and mixed fortunes among property stocks. However, some downside was mitigated following further talks between the United States and China and the People's Bank of China's (PBoC) ongoing efforts to maintain liquidity.

In the UK, August Consumer Price Index (CPI) inflation data is scheduled for release early Wednesday morning, just before the Bank of England's (BoE) announcement. Expectations are for annual headline CPI inflation to increase to 7.1% from July's 6.8%, driven by recent petrol price rises and an increase in alcohol duty. On a more positive note, 'core' CPI inflation, which excludes energy and food prices, is expected to dip to 6.8% from 6.9%. Nevertheless, the rebound in headline inflation may strengthen the BoE's determination to raise rates this week.

Later today, the Eurozone will release its final reading of August CPI, which is expected to confirm preliminary 'flash estimates.' These estimates indicated that headline CPI would remain at 5.3%, compared to expectations of a decline to 5.1%. Core inflation was forecasted to drop from 5.5% to 5.3%, in line with expectations. Energy prices played a significant role in the headline figure. Upgrades to near-term inflation forecasts were a key factor behind the European Central Bank's (ECB) recent rate hike, which was viewed as a finely balanced decision.

Stateside, housing starts and building permits data will be released in the afternoon. Although stronger-than-expected outcomes are anticipated, these reports are unlikely to alter expectations for the Federal Reserve, which is expected to announce its second pause this year during Wednesday's meeting.

FX Positioning & Sentiment

The USD has seen a slight uptick, supported by sustained elevated U.S. yields that are hovering near multi-year highs. However, during the Asian trading session, the USD remained largely unchanged as traders adopted a cautious stance, awaiting upcoming risk events.

In the coming week, there will be central bank meetings for six out of the ten most heavily traded currencies, including the Federal Reserve (Fed), Bank of Japan (BOJ), and Bank of England (BoE). Additionally, there will be rate decisions and guidance from six emerging market central banks. Key events to watch include the decisions and announcements from the Fed, BOJ, BoE, and China's Loan Prime Rate (LPR) announcement. These will likely have a significant impact on the currency markets. Furthermore, the Eurozone's August Harmonized Index of Consumer Prices (HICP), scheduled for release on Tuesday, will be closely monitored as it plays a crucial role in shaping expectations for the European Central Bank's (ECB) interest rate policies.

CFTC Data As Of 15-09-23

EUR net spec long drops to 113,080 contracts from 136,231

JPY short rises to 98,713 from 97,136

AUD short lower at 79,533 from 83,537

GBP long slightly smaller at 46,174 from 46,384 (Source: Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0625-30 (855M), 1.0645-55 (220M)

1.0700-10 (1.34BLN), 1.0730-35 (496M), 1.0750-60 (765M)

1.0765-75 (3.25BLN), 1.0795-05 (766M)

USD/JPY: 145.15-25 (1.95BLN), 145.30 (451M)

145.50-55 (471M), 147.00-10 (1.2BLN), 147.95-05 (702M)

148.15 (300M), 148.50 (584M): EUR/JPY 155.00 (400M)

GBP/USD: 1.2290-00 (1.0BLN), 1.2400 (388M)

1.2455-65 (587M), 1.2500m (572M), 1.2700 (905M)

AUD/USD: 0.6395 (450M), 0.6415-20 (416M), 0.6525 (600M)

0.6550 (334M), 0.6650 (562M)

NZD/USD: 0.5850 (719M), 0.5910 (279M)

USD/CAD: 1.3150 (569M), 1.3655-65 (332M), 1.3670-80 (370M)

Overnight Newswire Updates of Note

China Analysts: China May Keep LPR Steady In September, Cut Further In Q4

Japan's Industry Minister Predicts Eventual End To Ultra-Easy Policy

ECB To Keep Interest Rates At 4% As Long As Needed, Villeroy Says

Foreign Holdings Of US Treasuries Increase In July, China Holdings Plunge

Oil Rally Gathers Pace As Brent Crude Powers Above $95 A Barrel

S&P 500 Marks 100 Days Without 1.5% Drop, First Time Since 2018

UAW Will Strike At More Plants Without 'Serious Progress' By Friday

Stellantis Could Close 18 Facilities Under UAW Deal

US Companies Are The Gloomiest In Decades About China Outlook

Asia Stocks Drop On Concern Policy To Stay Hawkish

Country Garden Wins Approval to Extend Yuan Bond With Sweetener

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

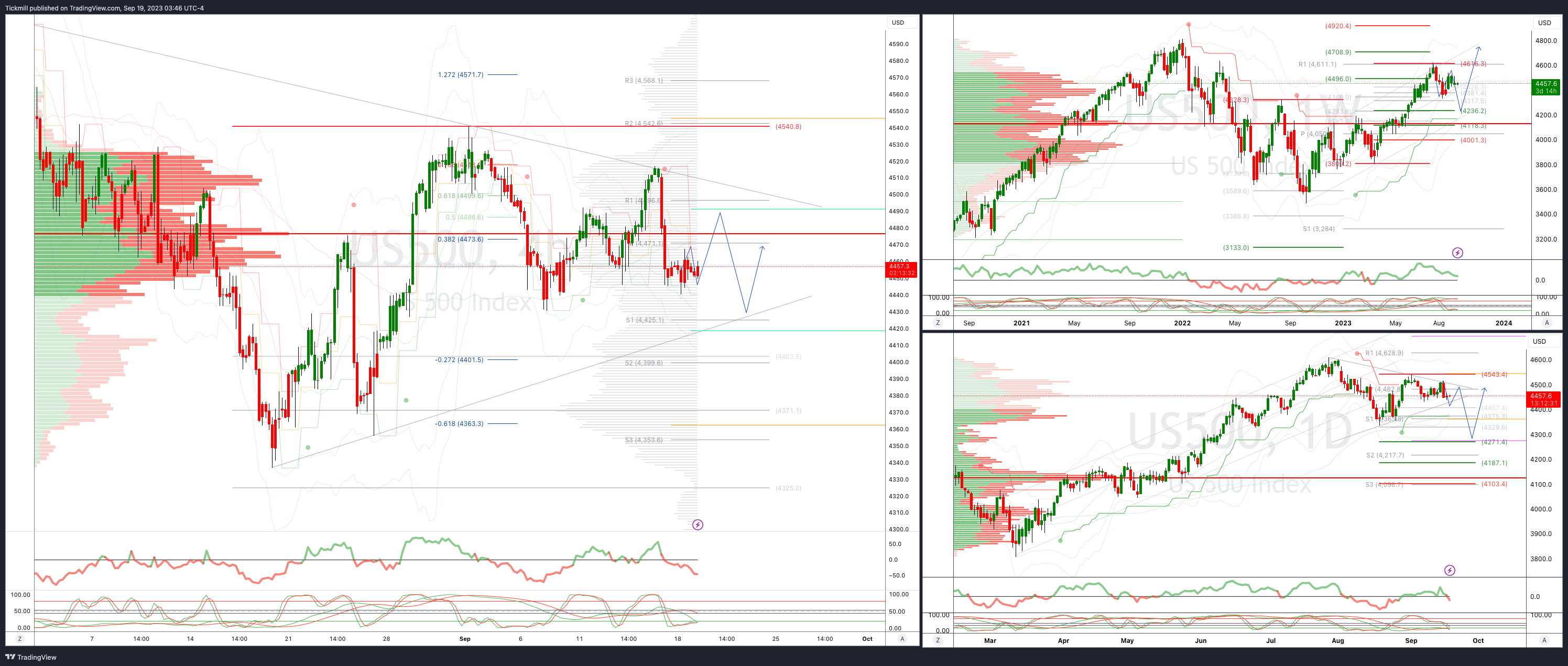

SP500 Bias: Bullish Above Bearish Below 4475

Above 4500 opens 4540

Primary resistance is 4550

Primary objective is 4266

20 Day VWAP bullish, 5 Day VWAP bearish

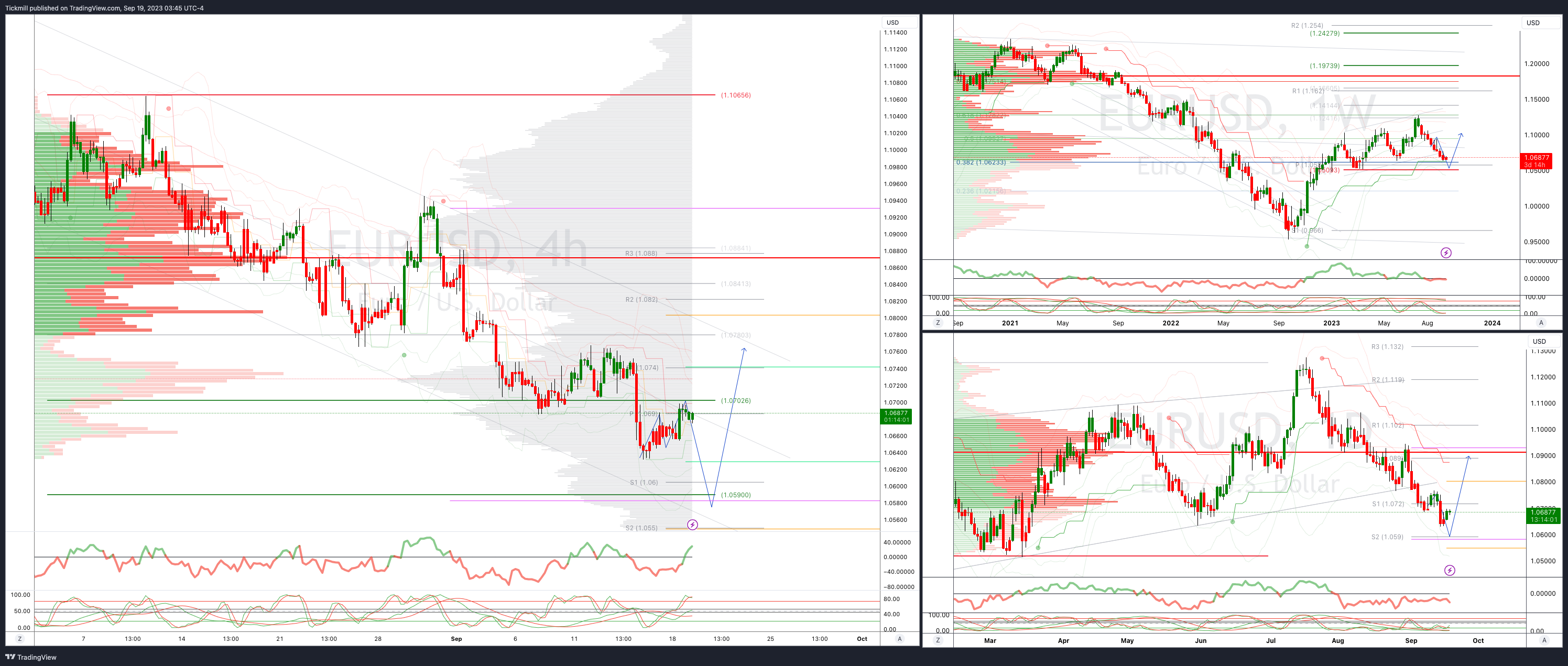

EURUSD Bias: Bullish Above Bearish Below 1.07

Above 1.860 opens 1.0945

Primary resistance is 1.1066

Primary objective is 1.06

20 Day VWAP bearish, 5 Day VWAP bullish

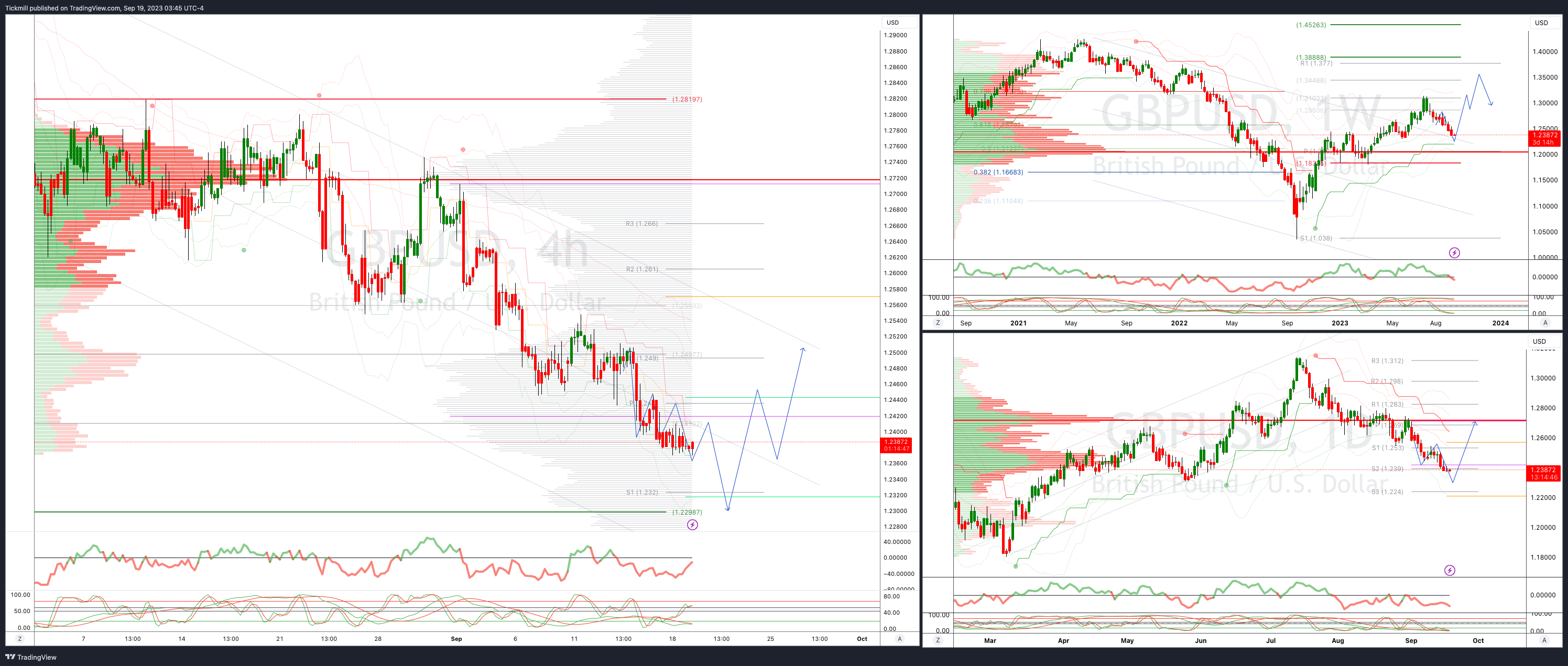

GBPUSD Bias: Bullish Above Bearish Below 1.2450

Above 1.2450 opens 1.25550

Primary resistance is 1.2750

Primary objective 1.23

20 Day VWAP bearish, 5 Day VWAP bearish

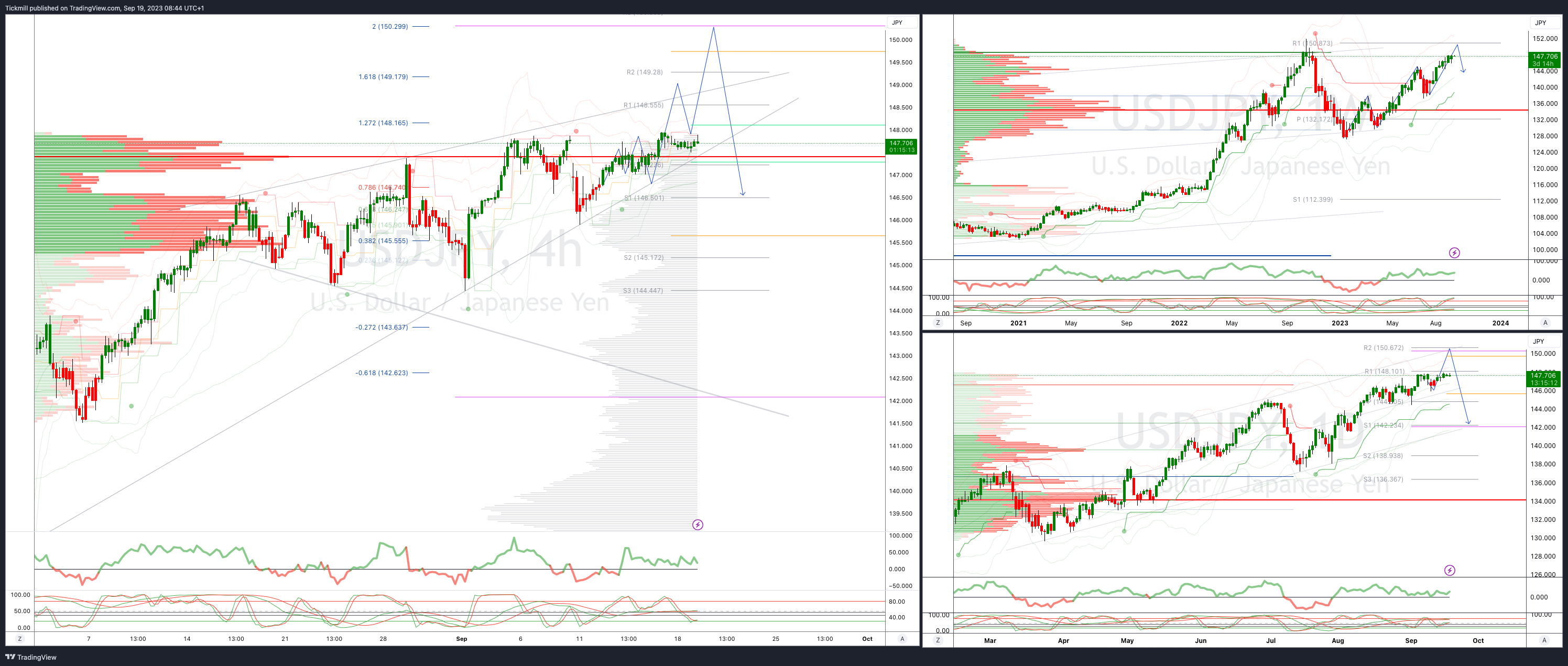

USDJPY Bias: Bullish Above Bearish Below 146.50

Below 146 opens 144.90

Primary support 144.50

Primary objective is 150

20 Day VWAP bullish, 5 Day VWAP bullish

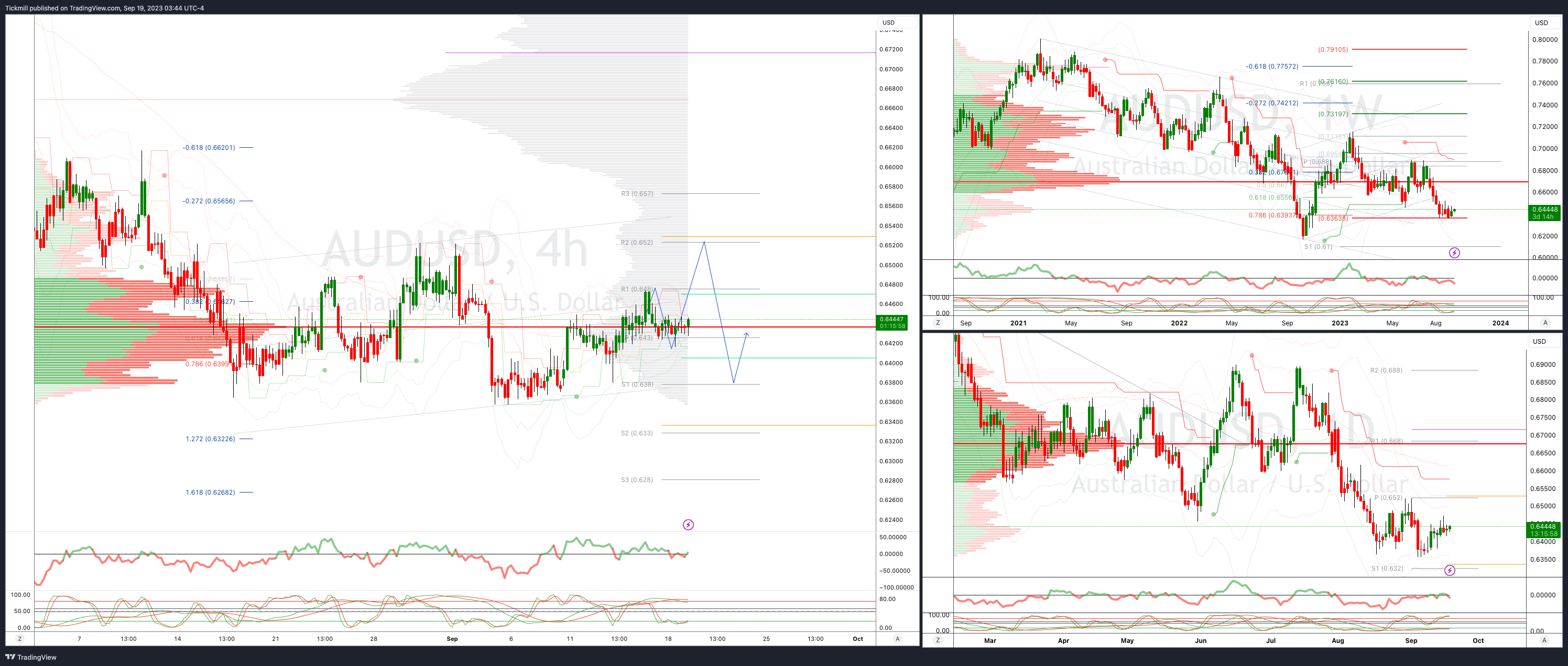

AUDUSD Bias: Bullish Above Bearish Below .6450

Above .6475 opens .6525

Primary resistance is .6620

Primary objective is .6320

20 Day VWAP bearish, 5 Day VWAP bullish

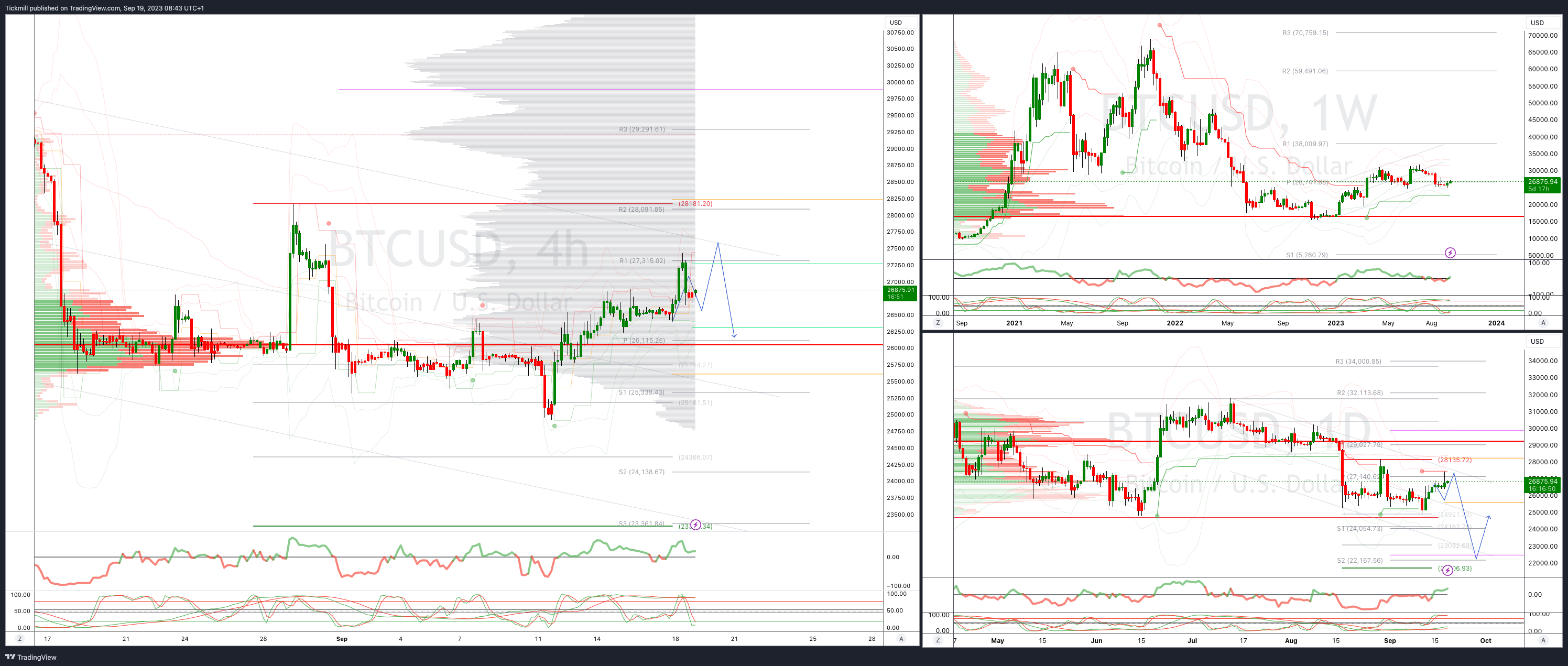

BTCUSD Bias: Bullish Above Bearish below 27500

Above 28200 opens 30000

Primary resistance is 28175

Primary objective is 23300

20 Day VWAP bearish, 5 Day VWAP bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!