Dissecting the Markets: USD Searches for Solid Support as Traders Lock in Gains Ahead of Thanksgiving

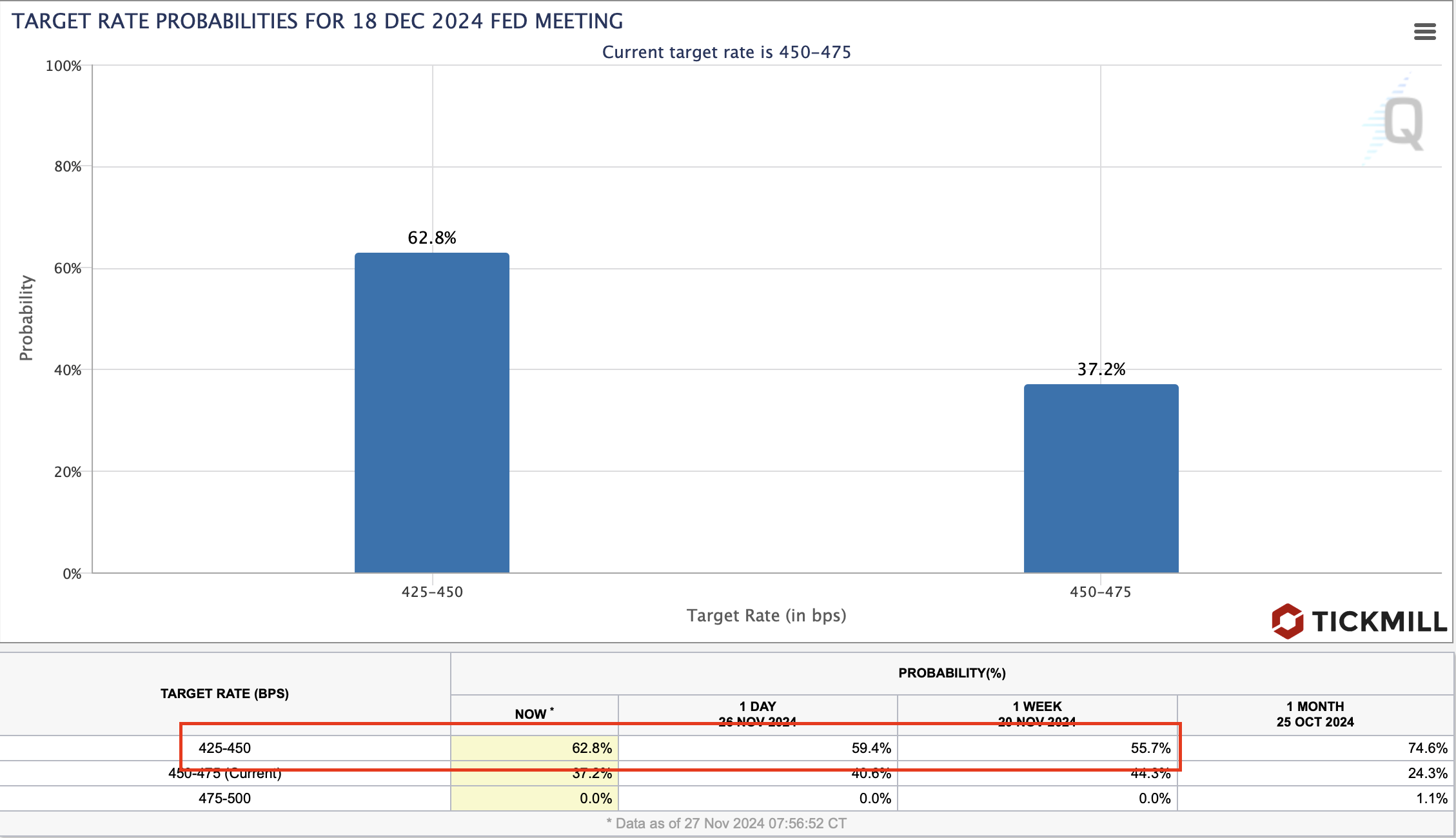

The US Dollar edged lower against most major currencies today, with the DXY index slipping towards the 106 threshold. Market participants are digesting signals from the Federal Reserve, particularly after the release of the latest FOMC Minutes. While the minutes didn't rock the boat significantly, they appear to have tilted the odds in favor of easing, reflecting a dovish undercurrent among policymakers keen on sustaining economic momentum. Federal funds rate futures indicate a 62.8% probability of a 25 bp point rate cut at the Fed's December 18 meeting, up from previous estimates. The remaining 37.2% of market participants anticipate that rates will hold steady:

The technical chart of the DXY indicates that market participants are locking in gains from the recent Dollar rally ahead of the Thanksgiving holidays. This trend is further supported by speculative momentum, as traders search for a support level where buying interest might resurface. A likely candidate for such a level is the short-term trendline that has been underpinning the Dollar's uptrend. In this context, the target for the current bearish pullback could be around the 105.50 level:

With the Thanksgiving holiday compressing the week's economic data into a single trading day, investors are gearing up for a flurry of key releases. The spotlight is firmly on the October Core PCE—the Fed's preferred inflation gauge—which could sway expectations ahead of the December meeting. Alongside this, data on October Durable Goods Orders, revised Q3 GDP estimates, and the latest Initial Jobless Claims are set to provide a comprehensive snapshot of the US economic landscape.

Forecasts suggest that the monthly headline PCE will maintain a steady growth of 0.2%, mirroring the previous month, while the core PCE is expected to inch up by 0.3%. On an annual basis, headline inflation is projected to accelerate to 2.3% from 2.1%, with core inflation anticipated to rise to 2.8% from 2.7%.

The British Pound is gaining traction against its peers, buoyed by the Bank of England's measured approach to policy easing. Deputy Governor Clare Lombardelli emphasized the need for more concrete evidence of cooling price pressures before backing additional rate cuts. She flagged the risk of inflation settling above the bank's target, particularly if wage growth stabilizes around 3.5%-4% and CPI hovers near 3% rather than easing towards the 2% objective.

With the UK's economic calendar offering slim pickings this week, the Pound's direction is being steered largely by evolving expectations of the BoE's next move. Traders are currently pricing in a strong likelihood that the central bank will keep interest rates unchanged at 4.75% in the December meeting.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.