Dollar Holds Firm at Key Demand Zone as NFP Upside Counters Trendline Break

A key economic development in the last week was the November NFP report. The BLS release showed that the U.S. economy created 194K jobs in November, surpassing the market consensus of 160K. The largest gains were concentrated in health care, leisure, hospitality, and government industries, i.e., in the service sector. This is likely to have significant implications for service-driven inflation, which is more responsive to macroeconomic developments and prone to producing second-round inflation effects — a key concern for central banks, including the Fed.

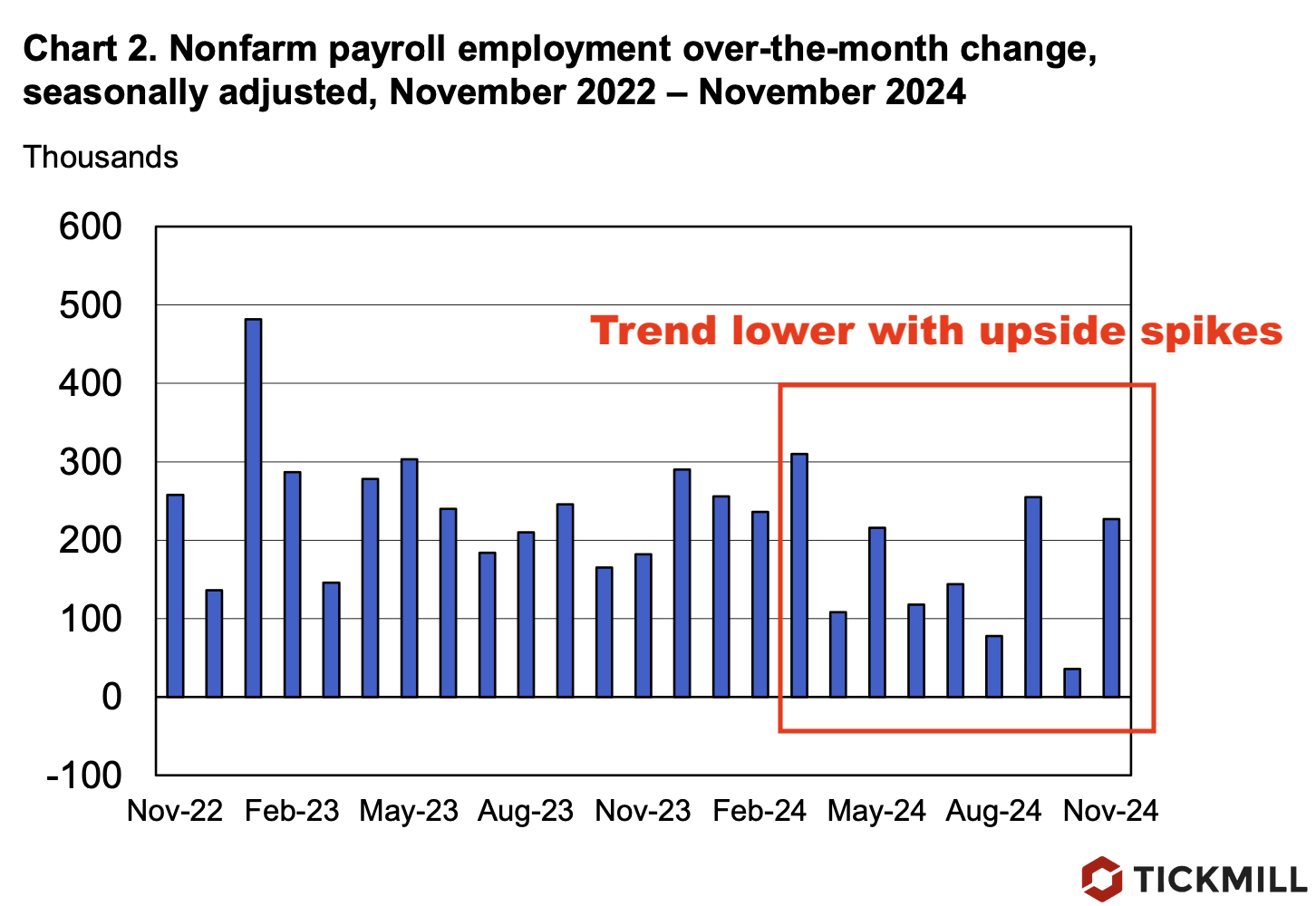

Regarding the near-term employment trend, there were two spikes in September and November, despite the overall picture reflecting a contraction in the rate of job creation in the U.S. since the start of the year. This calls for caution when interpreting November’s gains, especially in relation to the hypothesis that the upside surprise could significantly alter the Fed's policy easing trajectory:

A more serious headwind for the Fed's policy easing path is the acceleration in average hourly earnings growth. The report revealed that wages rose 0.4% MoM, higher than the 0.3% estimate, continuing the robust trend seen in October (also a 0.4% gain).

The increasing rate of wage growth is likely to exert additional inflationary pressures in the coming months. An increase in consumers' disposable income typically supports higher spending (spending channel), while firms may become more inclined to pass on higher wage costs to consumers through price increases (cost-push channel).

The change in the unemployment rate was in line with estimates, rising from 4.1% to 4.2%. The U-6 unemployment rate also increased, moving from 7.7% to 7.8%. This broader measure of unemployment includes discouraged workers and part-time workers seeking full-time employment, offering a more comprehensive view of labor market conditions.

Another major development was the release of the University of Michigan report on Friday. The report showed that 1-year inflation expectations accelerated to 2.9% in December, beating the market estimate of 2.7% and rising from 2.6% in November. This was a significant surprise that could impact expectations regarding a potential December Fed rate cut. It also helped contain the USD sell-off, which had begun in the second half of last week.

The NFP report provided support for the U.S. Dollar, enabling it to regain ground after breaching a key bullish trendline, as reflected in DXY price action on Thursday. The DXY recovered from 105.50 to 106, eventually stabilizing near this round level in the absence of other catalysts on Monday:

The 105.50–106 zone has proven to be a solid area of buying interest, as downside breakouts consistently attract demand. Without further fundamentally bearish developments for the USD, technically driven pressure is likely to keep the USD within this range or even push it higher. A potential move above this zone could trigger a retest of the trendline, potentially driving the DXY up to 106.30.

For EUR/USD, this implies that the 1.06–1.0630 zone will remain a significant near-term resistance for bulls.

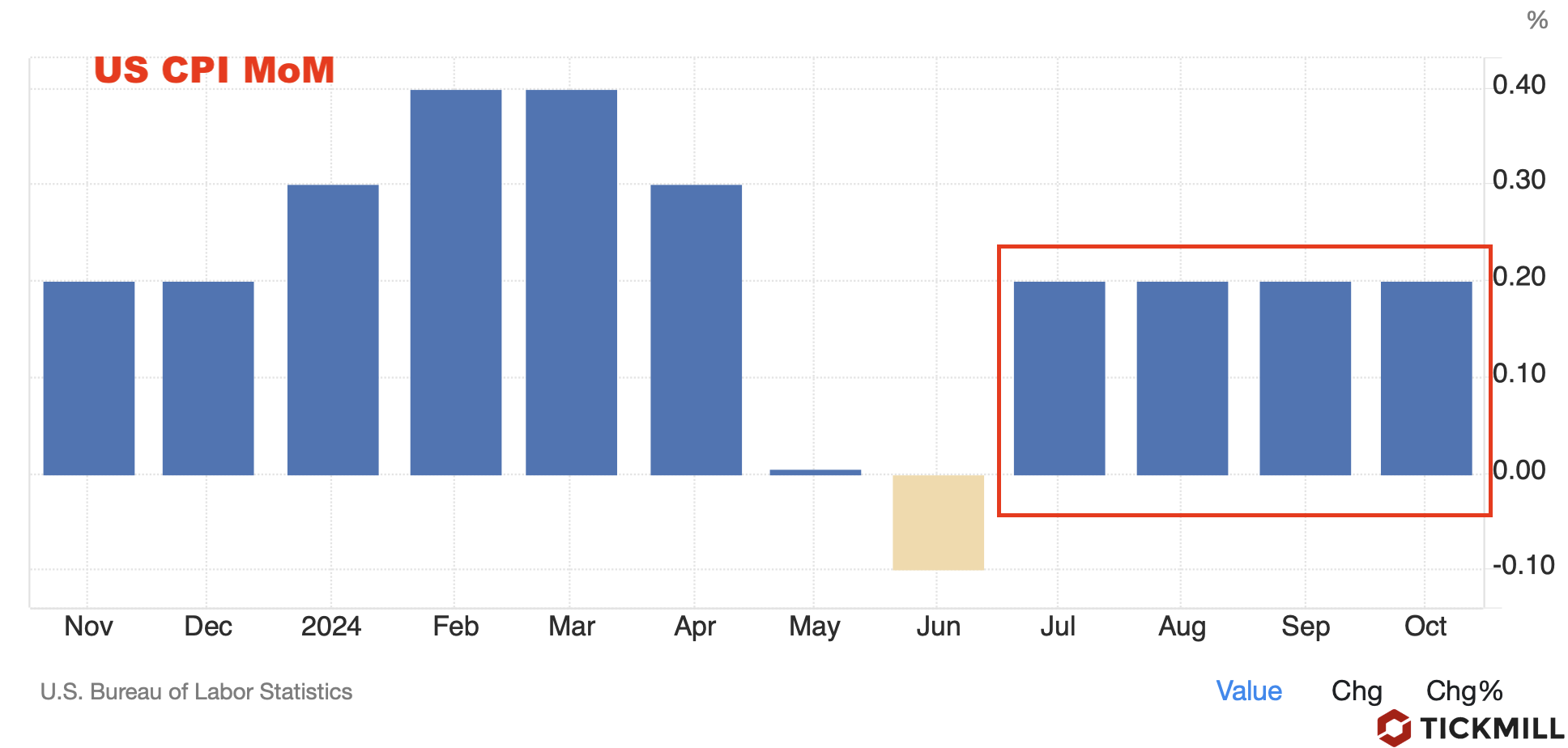

Markets will now shift their focus to the upcoming U.S. inflation report on Wednesday, the ECB meeting on Thursday, and the Initial Unemployment Claims report. Headline U.S. CPI is expected to accelerate to 2.7% from 2.6% in October, while core CPI is expected to maintain its growth rate at 0.2% MoM.

The biggest market impact will likely stem from the change in core CPI, as it serves as a more reliable measure of the underlying inflation trend. Core CPI is less volatile and offers a better approximation of the persistent inflation trend in the economy. Any deviation from expectations could trigger a significant market reaction, especially since the MoM growth rate has remained stable at 0.2% for the past 4 months, offering little evidence of a clear disinflation trend:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.