Dollar Lower As Fed Goes Big on Easing

Fed Opts For Larger Cut

Markets have had an interesting 12 hours on the back of the September FOMC meeting last night. The Fed slashed rates by a larger .5%, along with dovish revisions to the dot plot forecasts. Powell and co no project at least a further .5% of easing this year followed by 1% of easing next year. The initial market reaction saw USD swing sharply lower before Powell’s comments at the post-meeting presser curbed selling. The Fed chair was clearly trying to mitigate the bearish Dollar impact of a larger .5% cut, telling markets not to expect further .5% cuts saying that there was no clear cut path.

Powell Confident on Jobs

On the labour market, Powell said that the bank deems it to be in good health with this policy adjustment designed to offer further support. Interestingly, however, Powell noted that the Fed might have cut in July had the jobs data been received before that meeting, a nod to those accusing the central bank of acting too late with rate cuts.

Data Dependent

The decision to go big at the start of this easing cycle sends a strong message to markets that the Fed is willing to take action. Additionally, the dovish revision to the dot plot forecasts means that traders now have a much clearer view of the bank’s intentions. The broad takeaway is that if jobs and inflation data continue to weaken, a faster pace of easing will be seen. If these data points stabilise, easing will move at a slower pace. Near-term, USD looks likely to remain skewed lower though as traders digest the details of the meeting.

Technical Views

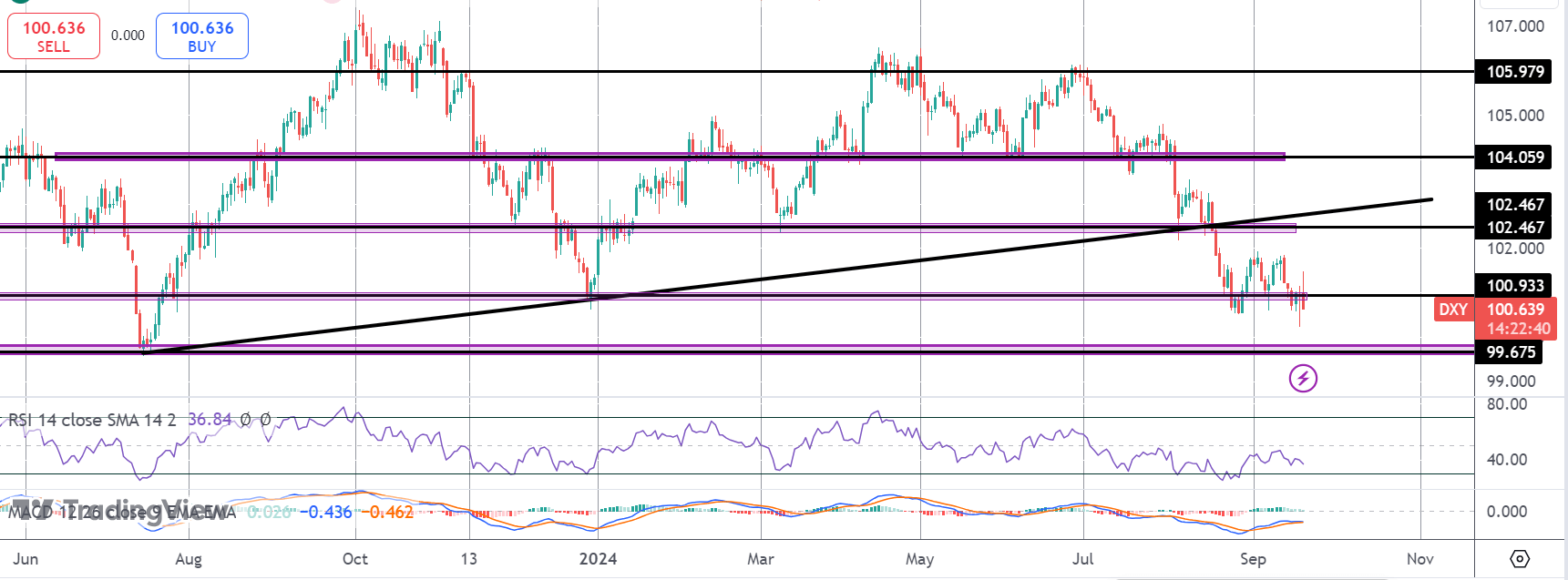

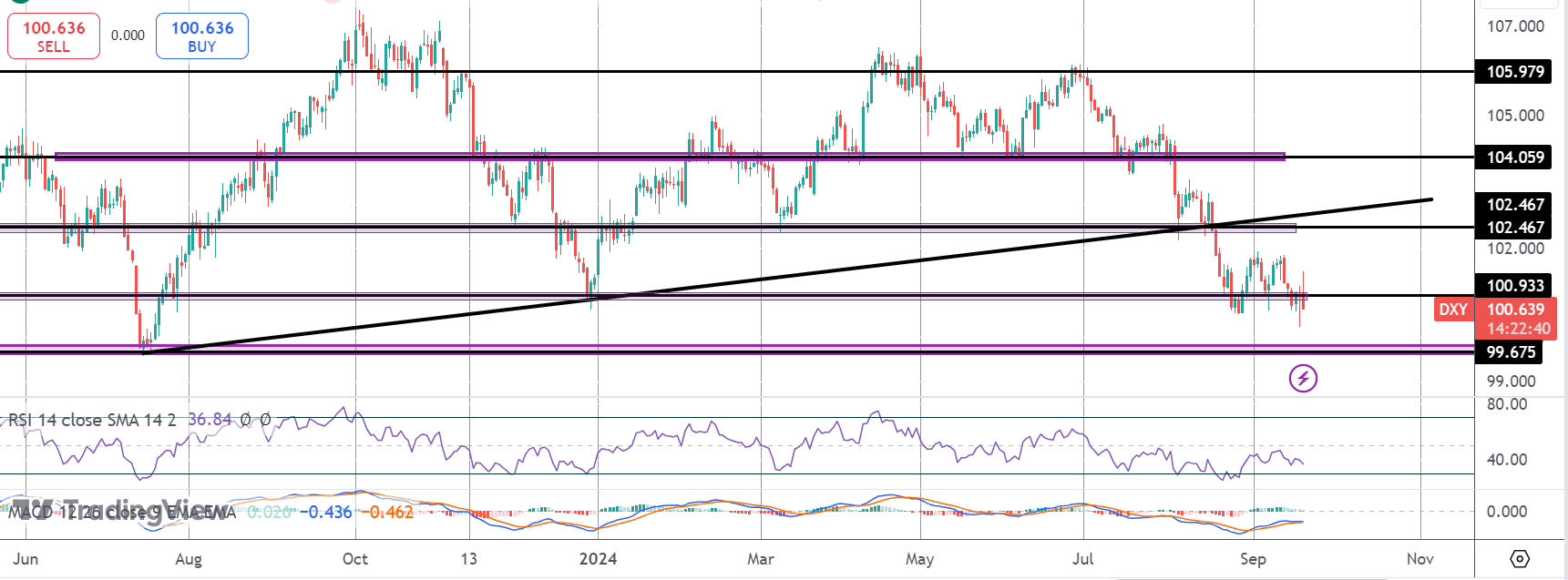

DXY

Following some volatility around the meeting yesterday, DXY is now trading back below the 100.93 level. With momentum studies turning lower, focus is on a fresh push to the downside with 99.67 the next support to watch. Outlook stays bearish while below 102.46.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.