Dovish ECB Weighing on EURUSD

EURUSD Pulls Back From Highs

EURUSD remains down from recent highs with the single currency suffering today on the back of weaker-than-forecast economic data. The Eurozone Economic Sentiment Indicator (ESI) slipped to 93.6 today, down from 95 in March, marking its lowest reading since December. The decline comes amidst a backdrop of uncertainty linked to the ongoing US trade war as well as the continued impact of the Russia-Ukraine war. The breakdown of the data showed broad based declines across all sectors with consumer sentiment particularly weak (-16.7 vs -14.5 prior).

Dovish ECB Signals

Sentiment at the ECB appears to have shifted recently with the bank displaying a more dovish tone at recent meetings and during inter-meeting comments. Recently, we’ve heard member stressing the need for continued cuts to help keep the economy supported. Inflation concerns have largely disappeared recently with focus now instead turning to weaker growth prospects.

EUR Overstretched?

The recent rally in EURUSD has seen EUR moving into pole position as the most overstretched currency to the topside, according to the options market. With that in mind, the pair remains vulnerable to a long squeeze. Looking ahead, Friday’s US jobs data could be a catalyst for a near-term correction lower in EURUSD. Given the soft expectations for the headline NFP figure, there is a low barrier for a n upside surprise which could help lift USD into early next week, capping EURUSD for now.

Technical Views

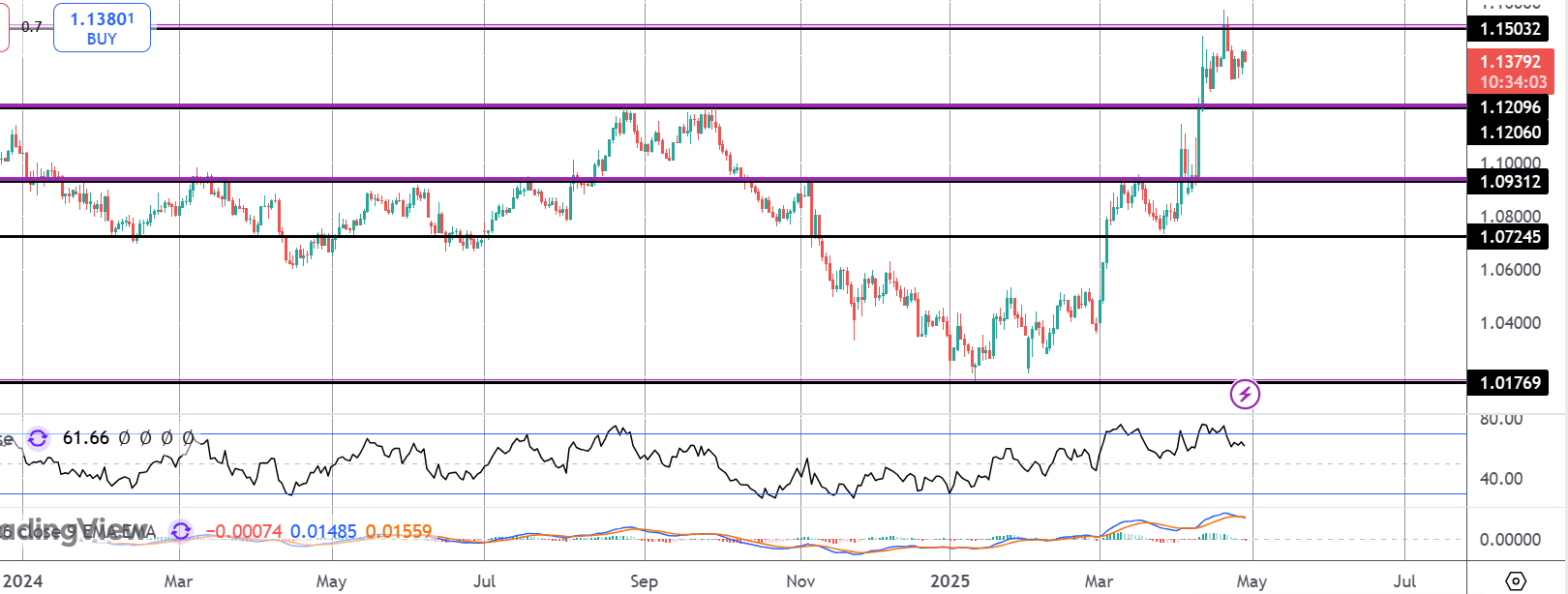

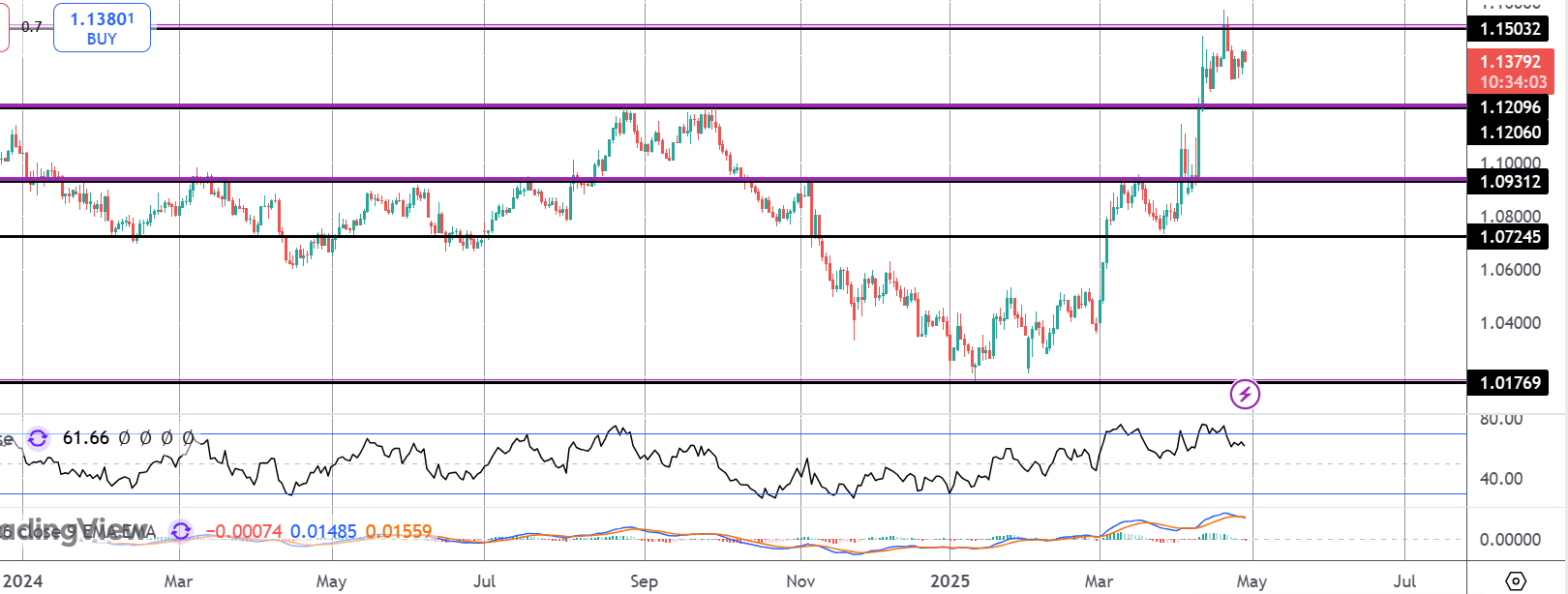

EURUSD

For now, the rally has been capped by the 1.1503 level. However, while price holds above 1.1209, a fresh push higher can be seen. If we slip below that level, however, focus shifts to 1.0931 as next support, in line with bearish momentum studies readings.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.