USD Rallies on Safe Haven Demand

President Biden and Speaker of the House Kevin McCarthy met for the latest round of US debt ceiling talks yesterday. While both sides were seen showing a willingness to co-operate and achieve a deal, greenlighting staff-level negotiations, a resolution is yet to be agreed. With markets wary over the time limit at play here, the lack of progress yesterday is concerning and increases the likelihood of an historic US debt default. Given the looming deadline, Biden will cut his G7 trip short in order to keep negotiations on course to agree a deal before the June 1st deadline.

EUR Correction Continues

USD has been firmly bid on the back of the talks with safe-haven demand flooding the Dollar. Given that traders were looking for more concrete signs of progress from yesterday’s talks, a mere commitment to continue negotiating has clearly underwhelmed markets. With uncertainty likely to persist near-term, USD looks poised for further upside. In the FX space, EURUSD has come under sustained selling pressure as long positions continue to unwind. For now, the move remains a USD play and once late longs have been cleared out, EURUSD is expected to find a floor. The test of the bull channel lows will be the real decider, however.

Technical Views

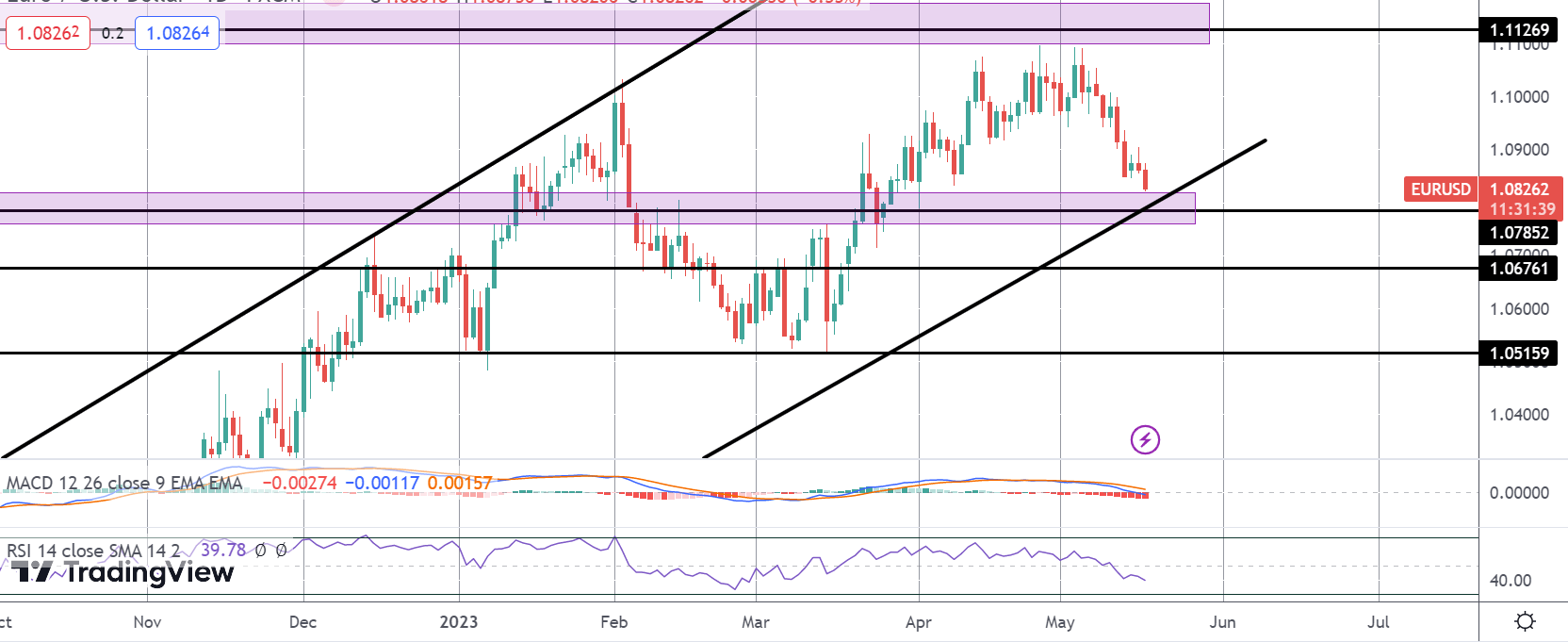

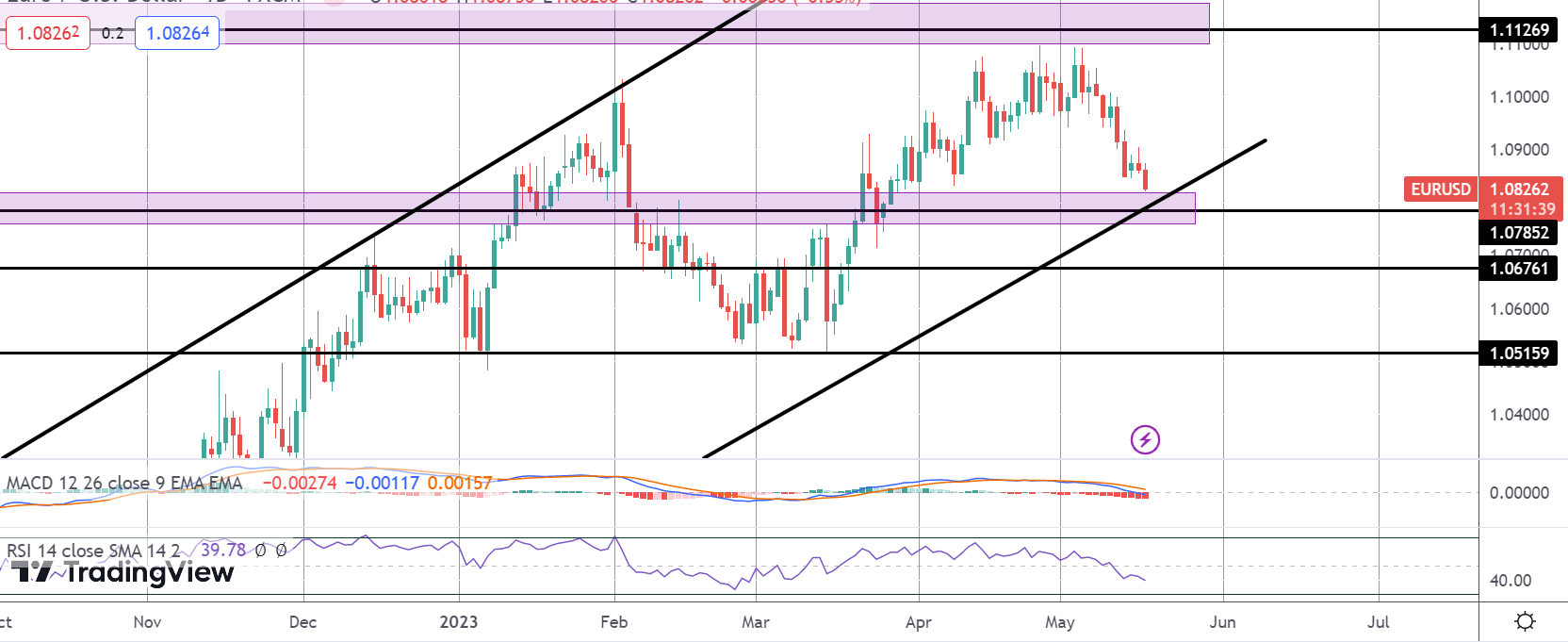

EURUSD

The reversal lower in EURUSD has seen the market trading sharply down from the recent highs around 1.11. The pair is fast approaching a test of the bull channel lows and the 1.0758 structural support. Bulls need to defend this area to maintain the broader bullish view. Should we break below here, however, there is room for a much deeper push towards 1.0676, in line with bearish momentum studies readings.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.