Gold Pushing Higher on Soaring Tariff Risks

Tariff Impact

Following a correction lower from last week’s highs and some consolidation through the early part of this week, gold prices are now turning higher again. The move comes amidst an uptick in safe-haven demand in response to an escalation in tariff risks this week. Trump has announced a slew of measures including a 25% tariff on any countries buying Venezuelan oil, an across-the-board 25% tariff on all US autos imports/. Additionally, Trump has signalled that copper tariffs, originally thought to come in later this year, will now come in within weeks. These moves come ahead of the April 2nd deadline on which Trump will announce reciprocal tariffs against US trading partners.

Safe-Haven Demand

With the global trade environment turning more hostile, gold prices look poised to continue higher near-term with safe-haven demand expected to remain a driving force. The US Dollar has been mildly higher this week though it seems the reaction to fresh tariff announcements has not been a straight forward bullish catalyst for USD with traders concerned over US growth prospects given the risk that US trading partners announce countermeasures.

US Data & Fed Comments

Looking ahead, traders will be watching incoming US data today and tomorrow. Today, final USD GDP, weekly jobless claims and pending home sales will be on watch, alongside comments from Fed's Barkin. Tomorrow sees the headline core PCE print for last month along with comments from Fed’s Barr and Bostic.

Technical Views

Gold

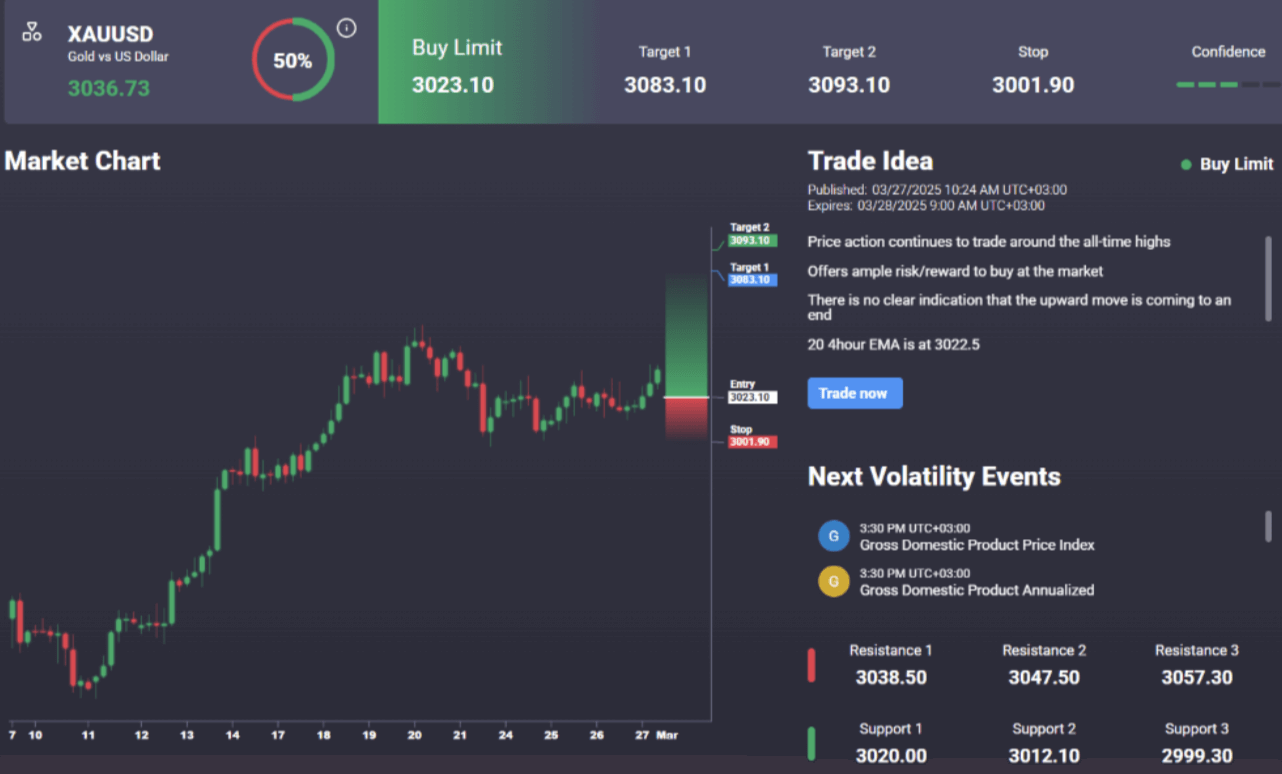

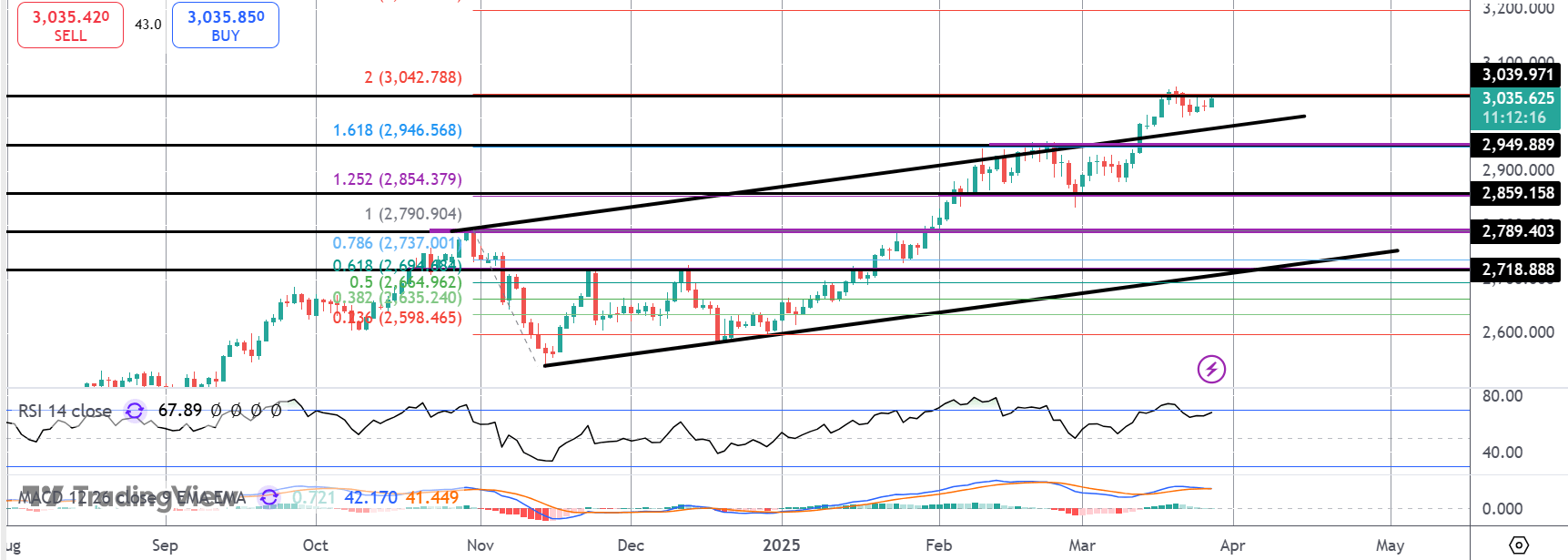

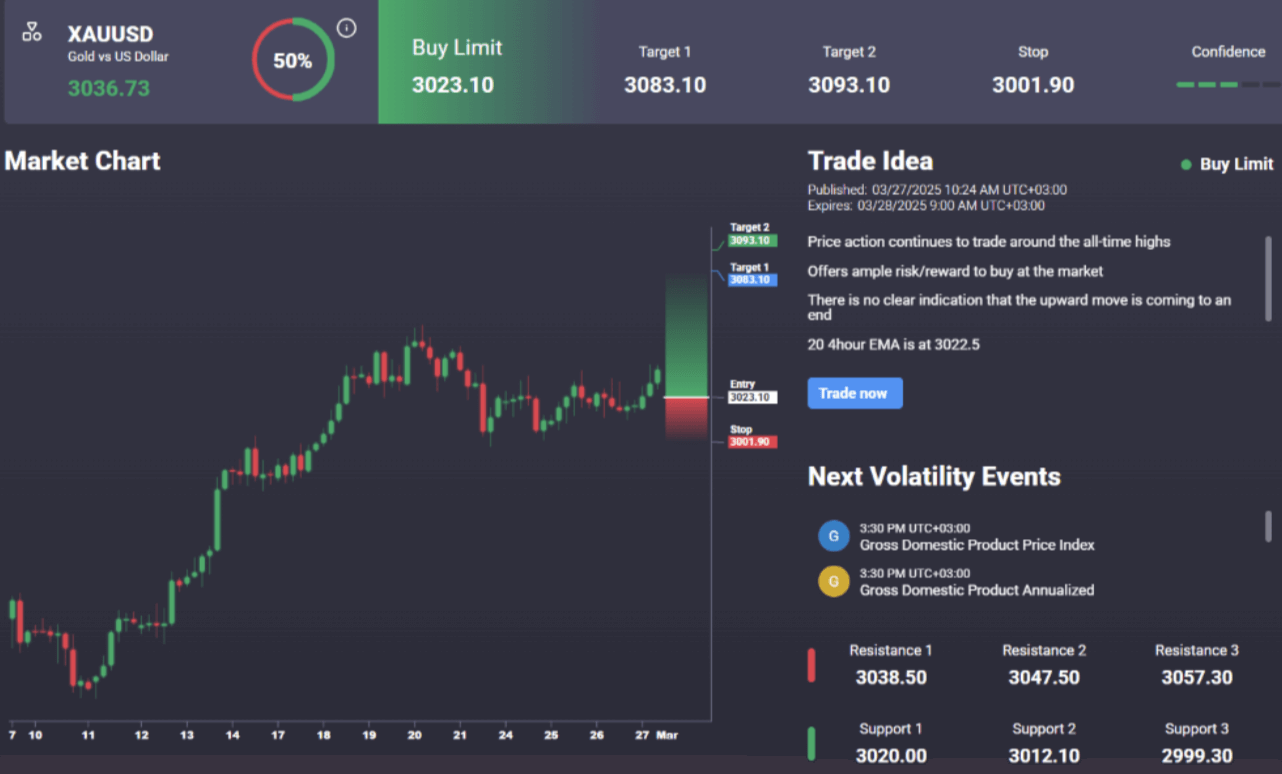

Gold prices are now once again testing the 3,039.97 level where price stalled last week. If we break higher here, focus will be on the 3,200 level next which marks the 2.618% Fib extension level. Near-term, the bullish outlook remains while price holds above 2,949.88. Notably, we have a buy limit in the Signal Centre today at 3023.10 suggesting a preference to stay long into any dips from current levels.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.