Institutional Insights: BCA Research - The Crypto Top Is In

.png)

The Top Is In: Cashing Out Of Our Bullish View On Crypto

In early 2023, we wrote a series of reports examining the crypto market, offering a much more bullish stance than the consensus at BCA or in the wider investment market at the time.

• Since then, Bitcoin prices have quadrupled, and the consensus has shifted to our view. Institutional investors are now embracing crypto, with discussions around pension fund allocations and Bitcoin price targets reaching extreme levels.

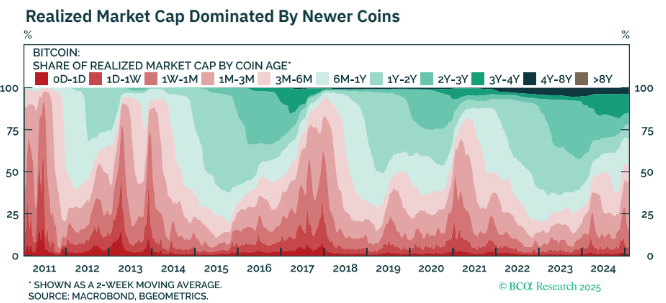

• But is this the right time to enter? We do not think so. The surge in memecoins, record-breaking Bitcoin ETF inflows, and retail speculation suggests excess optimism, historically a warning signal.

• Less fiscal policy than expected, moderating growth, and declining inflation could also create a less favourable macro environment for crypto in the coming months.

• While we remain long-term positive on Bitcoin, we believe now is a prudent time to take profits and wait for a more attractive entry point.

• To hedge against the possibility that financial markets have fully embraced the absurd, we are launching Liquidity Trap (LTRAP)—a memecoin that is, quite literally, a trap for your liquidity.

Bottom Line: We are cashing out of our bullish Bitcoin view for now. We will be more willing buyers once Bitcoin drops closer to $75,000.

We maintain an optimistic outlook on Bitcoin and believe it has a role in a diversified portfolio. That being said, market sentiment is important, and even the finest asset should not be purchased at any price. Therefore, we feel it is wise to start taking profits and holding off on any further investments for now. We would be more inclined to buy again when the price approaches $75,000.

There are two key risks to our perspective:

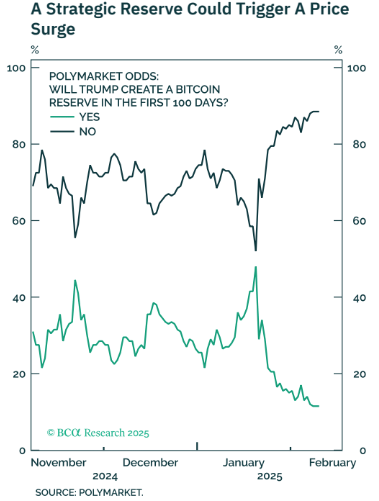

The first is that Trump may fulfill his campaign promise and establish the Strategic Bitcoin Reserve, which betting markets estimate has a 12% chance of occurring. To clarify, this Reserve will not entail purchasing additional coins. The US government currently possesses approximately 200,000 bitcoins acquired through law enforcement seizures. The Reserve would solely commit the federal government to retain these coins. Nevertheless, the news would be slightly positive in the short term, though we believe it would signify the peak of the cycle.

The second risk is that, contrary to our expectations, we may have entered a new era where memecoins serve as the primary means of raising capital. A scenario where all financial regulations are completely disregarded, allowing anyone with a few social media followers to raise billions easily.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!