Mapping Markets: Why Haven’t the 2016 “Trump Trades” Worked This Time?

The 2016 “Trump trades” haven’t repeated their success this time, despite similar policies like tax cuts, deregulation, and higher tariffs. Here’s why:

Less Surprise in 2024

- Trump’s 2016 victory shocked markets, as polls heavily favored Clinton (e.g., FiveThirtyEight gave Trump a 28% chance).

- By 2024, Trump’s win was more anticipated, with Polymarket assigning him a 59% chance.

- Markets had also learned from underestimating Trump in 2016 and 2020, pricing in his potential victory earlier.

Equity Rally in 2024

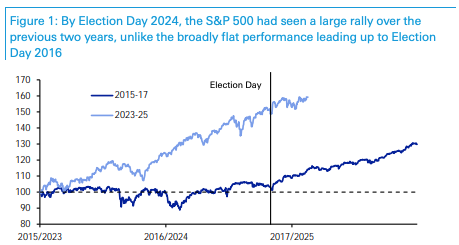

- In 2016, equities were flat or weak before the election (S&P 500 down -0.7% in 2015, up only +4.0% YTD by October 2016).

- By late 2024, equities had rallied for two years, leaving little room for a post-election surge.

Traditional “Trump trades” had less impact this time. By late 2024, equities had surged, with the S&P 500 up +24% in 2023 and +19.6% YTD by October 2024. Valuations were higher, as the CAPE ratio rose to 36.85 in October 2024 from 26.54 in October 2016. In 2016, there was more catch-up potential due to slower economic growth, which was just beginning to recover. In contrast, US growth is now robust (+2.9% in 2023, +2.8% in 2024), making a repeat of the 2016 pattern unlikely.

The Fed currently have an easing bias, whereas in 2016 they were tightening policy.

Back in 2016, Trump’s victory led to expectations of fiscal stimulus, which would in turn lead to tighter Fed policy. So that helped Treasury yields to move higher in the days after his victory. In addition, the Fed had only just begun their hiking cycle, delivering one hike the previous December 2015, which was followed up by another in December 2016. And in absolute terms, the federal funds rate was very low, still in a 0.25-0.5% target range in November 2016. n By 2024 however, the Fed were back in an easing cycle, which began in September with a 50bp cut. That was followed up by further cuts in November and December, and the December dot plot still signalled two more rate cuts in 2025. n So given the Fed have been dialling back their restrictive policy, it makes sense that markets would have reacted differently. On top of that, the economy doesn’t have the same amount of spare capacity as it did in 2016, so it’s more difficult to pursue stimulus without generating inflationary pressures.

Trump’s policy announcements have taken place on a much quicker timeline this time around, with an immediate push towards higher tariffs, leading to more uncertainty and volatility from the outset.

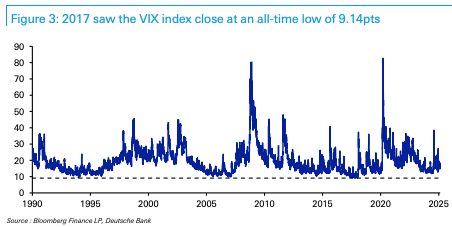

Quite aside from the broader economic context, the policies of the new administration have taken place on a very different timeline to Trump’s first term. Most notably, there has been an immediate push towards tariffs in the first month, including 10% additional tariffs on China, as well as the threat of 25% tariffs on Canada and Mexico (albeit delayed for now). n Back in Trump’s first term however, the trade war didn’t begin in earnest until 2018, the second year of his presidency. And even there, the tariffs threatened were not on the scale of what has been discussed this time, including reciprocal tariffs. n That meant in 2017, the first year of Trump’s first presidency, volatility was incredibly low. In fact, the all-time closing low for the VIX index was actually in November 2017, when it closed at 9.14pts. By contrast today, there has already been significant volatility in financial markets because of potential tariffs, particularly in the assets of affected countries like Canada.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!

.jpeg)