Goldman Sachs CPI PREVIEW

FICC and Equities | 11 March 2025 |

From GS Research:

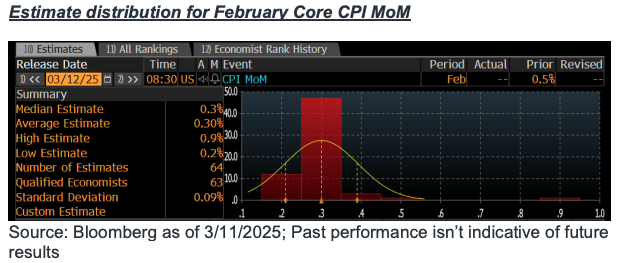

We project a 0.29% rise in February core CPI (compared to the +0.3% consensus), translating to a year-over-year growth rate of 3.21% (vs. +3.2% consensus).

Key Highlights:

- Headline CPI: Anticipated to grow by 0.27% in February (vs. +0.3% consensus), driven by a 0.2% increase in both food and energy prices. This aligns with our forecast of a 0.32% rise in CPI core services (excluding rent and owners’ equivalent rent) and a 0.25% increase in core PCE for the month.

- Component-Level Trends:

1. Auto Prices: Used car prices are expected to climb by 0.6%, reflecting higher auction prices, while new car prices are forecasted to rise by 0.3% due to reduced dealer incentives.

2. Car Insurance: A significant 1.0% increase is anticipated, driven by higher premiums observed in our online datasets.

3. Seasonal Distortions: Categories such as communications (+0.3%) and airfares (+2.5%) are likely to see notable boosts.

- Future Outlook:

We foresee continued disinflation over the next year, supported by rebalancing in the auto, housing rental, and labor markets. However, this may be partially offset by escalations in tariff policies. By December 2025, we estimate year-over-year core CPI inflation at 3.2% and core PCE inflation at 2.9%.

Thoughts from around Goldman Sachs Trading Floor:

Dom Wilson (Senior Markets Advisor)

The CPI is expected to take a backseat to broader concerns about U.S. growth, which have dominated discussions in recent weeks. The primary focus will be whether the significant growth downgrades we’ve seen so far sufficiently account for the rising downside risks to the U.S. economy stemming from policy and policy uncertainty.

Our core CPI forecast—29bp month-over-month, translating to an expected PCE forecast of 25bp—is largely in line with consensus. Such an outcome would likely keep attention on other dynamics. That said, we believe the risks around this forecast are somewhat asymmetric. A notably higher CPI print—especially ahead of the anticipated inflationary effects of tariffs—could heighten market concerns about Fed constraints and the limits of monetary policy. However, with tariff-induced price increases still on the horizon and inflation expectations subdued, a stronger CPI reading may have limited impact on shifting market views.

What the market needs most is reassurance about a floor under growth. The core concern stems not from the Fed or economic data but from the effects of policy uncertainty, tariffs, and spending cuts. The quickest path to stabilization would likely involve a shift in communication or messaging from the Administration regarding its policies.

Karen Fishman (Senior FX Strategist)

Markets remain heavily focused on the downside risks to U.S. growth and the potential end of U.S. exceptionalism, particularly in comparison to Europe. This has overshadowed any consideration of the inflationary—and Dollar-positive—effects of tariffs recently imposed and the likelihood of additional tariffs.

If we see another upside surprise in CPI, this dynamic could shift, reviving the Dollar’s positive correlation with higher tariffs. A stronger-than-expected CPI print would likely lead to higher front-end U.S. yields and further declines in equities, creating a broadly supportive environment for the Dollar, including against the JPY. However, a more sustained, pro-risk Dollar appreciation would likely require better U.S. activity data in the coming weeks—such as persistently low initial jobless claims—to alleviate concerns about the U.S. outlook and equity performance.

On the other hand, an in-line or softer CPI print would likely allow markets to extend their current momentum. As long as the focus remains squarely on downside risks to U.S. growth and the potential for better returns in non-U.S. markets, it will be difficult to counter the prevailing trends: lower equities, lower yields, and a weaker Dollar, particularly against JPY, CHF, and EUR.

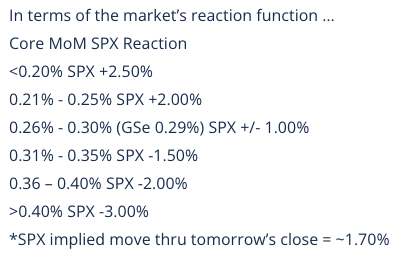

Joe Clyne (Index Vol Trading)

As we approach the CPI release, the equity market teeters on the edge of correction, with 10% drawdowns across U.S. equities. The volatility market reflects this heightened stress, with short-dated vols sitting above the 90th percentile on a 10-year lookback. The breakeven move for tomorrow in the SPX is estimated at over 1.5%, based on the one-day SPX straddle.

Given the significant pain already absorbed by the market and the elevated volatility levels, a solid CPI print could provide an opportunity for a relief rally tomorrow. However, with volatility still elevated, we prefer short-dated call spreads or call ratios to avoid becoming overly long on vol. Additionally, we’ve observed that QQQ volatility is slightly elevated relative to SPX, and we favor call spread collars in QQQ within the three-month horizon.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!

.jpeg)