Institutional Insights: Goldman Sachs SP500. Positioning & Key Levels 29/05/25

US Equity Positioning and Key Levels

FICC and Equities

Date: April 28, 2025

Summary:

1. CTA Corner:

- Systematic macro community purchased $26 billion last week following prior rebalancing sales, which is less than one standard deviation in size. This figure is expected to increase over the next week. CTAs are anticipated to be buyers of US equities in all scenarios over the upcoming week and month.

2. GS PB:

- The GS Equity Fundamental Long/Short Performance Estimate increased by 2.16% from April 18 to April 24, compared to MSCI World TR's 3.56% rise. This was driven by a beta of 1.73% and alpha of 0.43%, mainly due to gains on the long side. The GS Equity Systematic Long/Short Performance Estimate rose by 0.44% during the same period, with alpha contributing 0.52% from short side gains, partially offset by a beta of -0.08%.

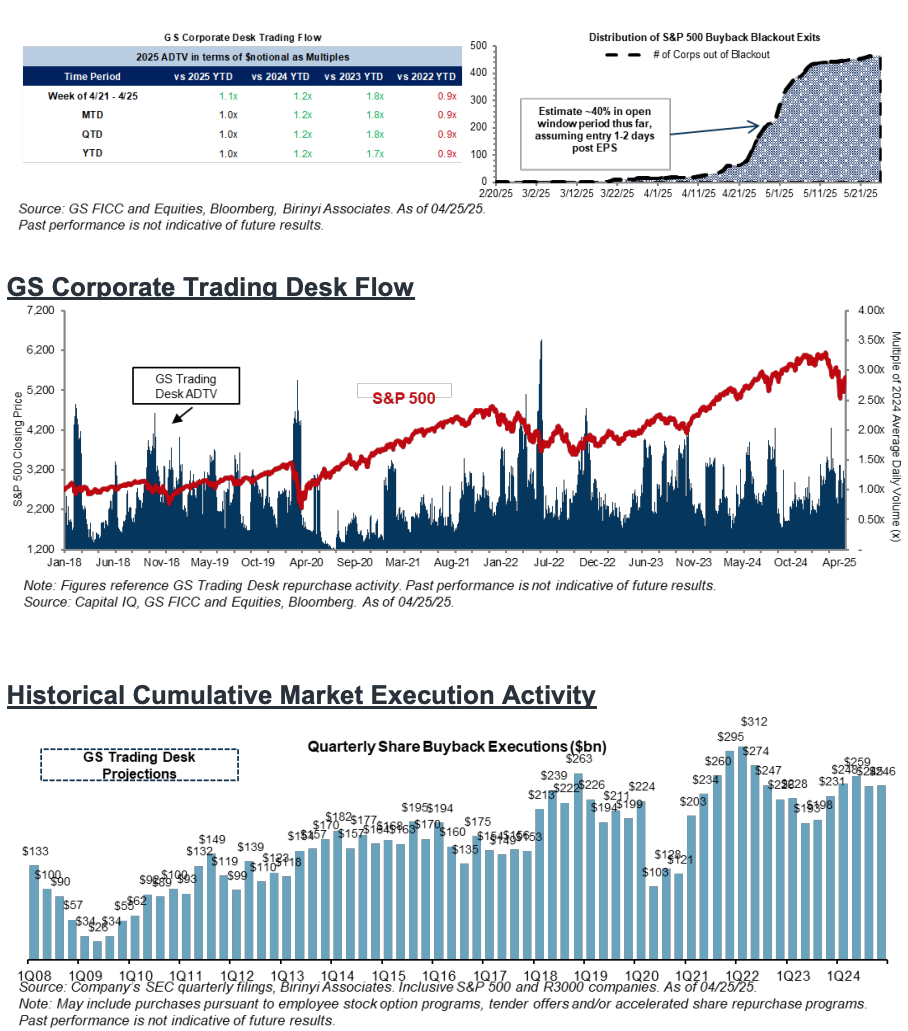

3. Buybacks:

- We are currently in an open window buyback period, estimated to continue until June 13. Approximately 40% are in open window status now, with an expected increase to 65% by the end of the week.

CTA Flows:

- Next Week Projections:

- Flat market: Expected purchases of $44.65 billion ($7.15 billion in the US)

- Rising market: Expected purchases of $55.77 billion ($12.47 billion in the US)

- Declining market: Expected purchases of $30.86 billion ($4.02 billion in the US)

- Next Month Projections:

- Flat market: Expected purchases of $54.13 billion ($13.75 billion in the US)

- Rising market: Expected purchases of $121.80 billion ($41.74 billion in the US)

- Declining market: Expected purchases of $5.47 billion ($6.33 billion in the US)

Key Pivot Levels for SPX:

- Short term: 5555

- Medium term: 5754

- Long term: 5480

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!