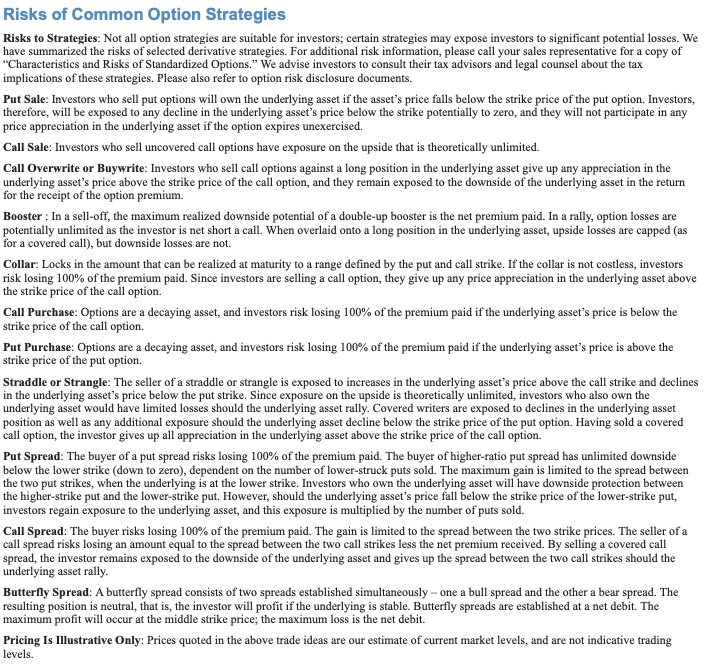

Institutional Insights: JPMorgan - Hedge short-term upside for “very, very big announcement”

.jpeg)

US Equity Derivatives Strategy Hedge short-term upside for “very, very big announcement”

President Trump, during a press conference in the Oval Office alongside Canadian Prime Minister Carney, hinted at a significant announcement ahead of his Middle East trip next week. He described it as “a very, very big announcement, as big as it gets, and very positive,” while withholding specifics. The announcement is expected between Thursday and Monday, with Trump noting it is not “necessarily on trade.”

Markets initially reacted positively to Trump’s comments, briefly rallying, but quickly reversed course to close down approximately 0.8% for the day. Futures experienced further declines after hours, driven by reports of clashes between India and Pakistan.

While the subject of Trump’s announcement may not necessarily impact markets, it is prudent to hedge against short-term upside risks. This is especially relevant given the presence of other significant market catalysts in the coming week, the potential for systematic strategy re-leveraging to amplify any upward movement, and the normalisation of short-term implied volatility levels in recent weeks.

Investors may recall Trump’s previous market-moving remarks, such as his widely noted social media post on April 9 stating, “THIS IS A GREAT TIME TO BUY,” which preceded the suspension of Liberation Day reciprocal tariffs and sent stocks soaring. Over the next week, two additional major events could influence markets: the May FOMC meeting on May 7 and the April CPI release on May 13.

Should markets rally due to any of these catalysts, the upward momentum could be further supported by CTA re-leveraging, as key momentum signals hover around the ~5800 level on the S&P 500. Equity Strategists have also observed that, in the short term, the equity pain trade likely remains biased to the upside, with markets positioning for potential tariff de-escalation.

As a strategy, investors might consider purchasing May 13 expiry SPX 102% calls, which are indicatively priced at approximately 34 basis points of notional. This approach could provide a cost-effective hedge against potential upside market moves.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!