Institutional Insights: TS Lombard On SP500 & Volatility Events

Institutional Insights: TS Lombard On SP500 & Volatility Events

Analysts at TS Lombard compare the recent volatility spike and the impact on markets

'Where do we go from here, and what does it all mean for asset allocators? Our view is that unless we get a US recession, the recent market rout will eventually blow off. But how long will volatility last? Also, are we sure a recession is not on the horizon?

We think the Fed has the tools to stave off a recession. We can hear the objection – central banks always cut too late, and they are behind the curve already. But unlike in a ‘typical’ economic cycle, there are no obvious excesses to correct in the US economy – and especially no debt excesses. In fact, there still is an excess of liquidity that could rotate into risk assets if real rates become unappealing. In other words, the Fed has the right tools this time – it just needs to use them, and use them aggressively. A recession could develop by year end if Powell hesitates

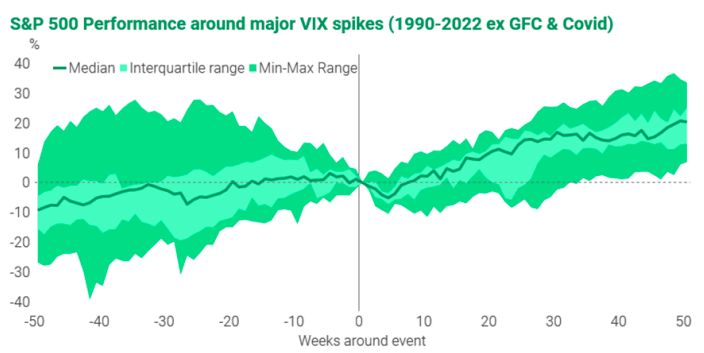

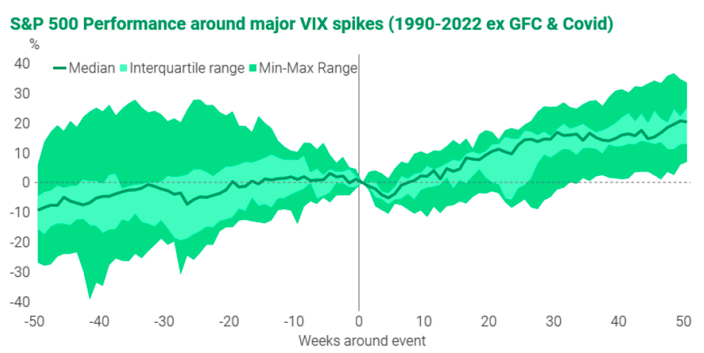

Even if there is no recession, volatility in markets can last for a while. Our analysis of past volatility bouts shows that equities take 4-5 weeks, on average, before a sustained recovery begins. Markets tend to rebound on oversold conditions such as the current ones, but investors often sell into that strength, which can lead to a relapse. This is what happened, for instance, in 2018, an episode that bears strong similarities to the current one

Active investors can probably take advantage of these market patterns over the next few weeks. Asset allocators, however, should probably wait for more clarity before switching to an exceedingly defensive stance. As Steve Blitz pointed out many times, recession is not an option for the Fed, and we should expect a response if markets failed to stabilize. Things would likely have to get worse before they get better, but getting the timing right may be impossible for all but the nimblest investors."

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!