Institutional Insights: UBS Equity Positioning

US Equity Positioning – Three Observations

Analysts at UBS note that 'US equity market price action underneath the surface has been violent since the US June CPI print, released on July 11. RTY has outperformed NDX by a staggering 18% as AI winners and Mag7 have corrected 17% and 12%, respectively. A few observations:

1) The correction in NDX simply reversed the exuberance of the June-July rally. Importantly, fundamental equity long/short hedge funds had started cutting risk in late June amidst growing consensus that the rally had gone too far. The de-risking shielded hedge funds from significant losses during the large factor unwinds over the last three weeks (hedge funds have lost just 12bps MTD). Similarly, active equity managers cut risk at the end of June (from -0.3 standard deviation to -1.2 standard deviation below average). This leaves dry powder for discretionary investors to step in if tech earnings deliver this week. MSFT and AMD will be the first signposts, followed by META, AAPL and AMZN later this week.

2) RTY appears to be running out of steam. The index has failed to make a new high since July 17. With the market now pricing over 25bp of Fed cuts for September and Trump arguably having had his best month in this election cycle, it is hard to see another positive short-term catalyst for RTY. In fact, more cuts would only be priced in a recessionary scenario, which would be negative for RTY.

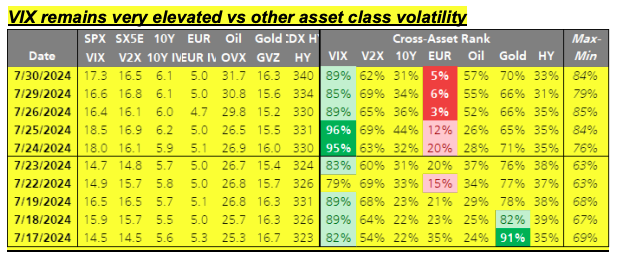

3) SPX at-the-money straddles cost 1.75% (about $95) through Friday's close, which screens cheap considering the slew of upcoming catalysts (tech EPS, FOMC and NFP) and recent realized volatility. However, if this week's catalysts pass without any meaningful surprises, equity vol will be a sale considering that the VIX cross-asset rank is trading about 90%. VIX Aug 14-13 put spreads = 0.15'

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!

.jpeg)