Institutional Insights:Goldman Sachs Tactical Flow of Funds: Slowing Equity Demand

.jpeg)

GS Tactical Flow of Funds: Slowing Equity Demand

FICC and Equities | 12 February 2025 |

GS Tactical Flow of Funds: 2H February

A bearish equity trend is emerging:

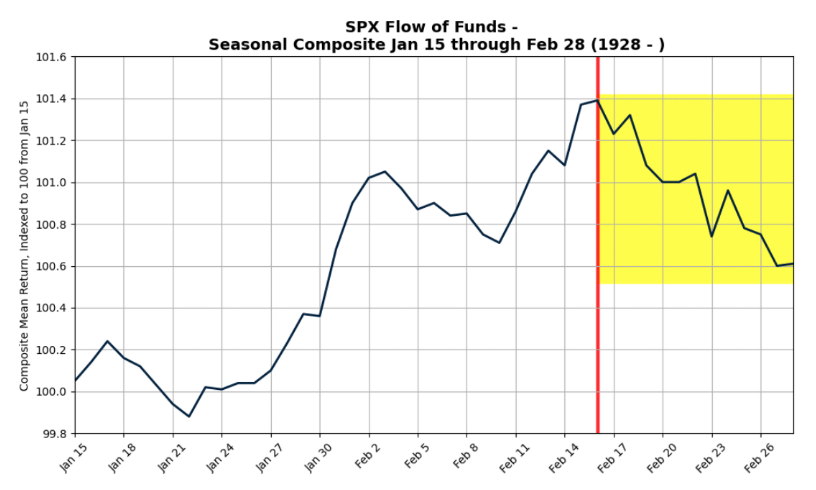

a. This will be my final bullish update for Q1 2025, as demand dynamics are shifting rapidly, and we are approaching unfavorable seasonal trends.

b. The U.S. equity market will be closed on Monday for Presidents’ Day. Options expiration on Friday, February 21st, may trigger gamma unwinding. Fixed strike volatility opened lower today, despite a 1.5x realized move—indicating no panic at the outset.

c. There is broad market participation, particularly in Florida, encompassing retail investors, 401(k) contributions, early-year allocations, and corporate activities. Retail traders are actively buying this morning’s dip following the CPI report.

d. However, I believe the strong inclination to seize dip-buying opportunities is beginning to wane.

e. The ES1 is currently hovering near its 50-day moving average, while the GS short-term threshold is set at 6017 (SPX cash). This level was surpassed today.

CTA Levels:

- We have moved through the short-term level today. There is an asymmetric skew to the downside.

Over the Next 1 Week:

- Flat Market: Sellers: $1.71B ($0.431B into the US)

- Up Market: Buyers: $0.084B ($0.196B into the US)

- Down Market: Sellers: $35.66B ($13.19B out of the US)

Over the Next 1 Month:

- Flat Market: Buyers: $5.43B ($4.44B into the US)

- Up Market: Buyers: $28.59B ($9.55B into the US)

- Down Market: Sellers: $170.78B ($61.49B out of the US)

Key Pivot Levels for SPX:

- Short Term: 6017 (below today)

- Medium Term: 5856

- Long Term: 5394

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!