#Institutonal Insights: Goldman Sachs Morning Update 09/09/24

GS Sales Trading: Good Morning Update 09.09.202

Sloppy price action to finish out a very macro-heavy week (JOLTS slightly dovish, ADP softer, jobless claims inline, NFP right at whisper numbers & ISM Manf slight miss, and ISM services at consensus). Highly anticipated NFP employment data came in line with negative whispers but below consensus( could have been better / could have been worse ). Fedspeakers post print providing little clarity on 25bps vs 50bps in September. Our chief economist Jan Hatzius is sticking with25bps (still think the baseline path will be-25bps with clear guidance of more cuts to come).§With S&P breaking the 50dma (5506) early in the session, technical setup very tricky as mkt tried to digest > $5b of ECMsupply hitting the tape this week. AVGO eps post close yesterday added fuel to the fire, with weaker semiconductor revs bleeding into the rest of the space (GSTMTSEM closed-385bps). Into next week, we’ll be watching for incremental tech updates from our Communacopia Conference (9/9-9/12), the theTrump-Harris Debate (Tues), CPI (wed), ECB decision (Thurs),and treasury issuance ($58bn 3YR auction Tuesday, $39bn10YR auction Wed).§Our floor was a 6 on a 1-10 scale in terms of overall activity levels. Overall executed flow on our desk finished with a-6.75% sell skew vs 30day avg of +80bps.Into the end of the week, flows were mixed with investors trading around:(1)ongoing conference season (GS hosted their annual Retail conference Wed-Thurs), (2) flight into defensives on ongoing growth concerns, and (3) block/ECM-related supply with over $5bn in issuance being traded in the US on the week. Today,LOs finished with $2b net sell skew, with supply heavily concentrated within tech and macro products. HFs finished $600m net for sale with short sales outpacing long sales.

Chart(s) of the Day

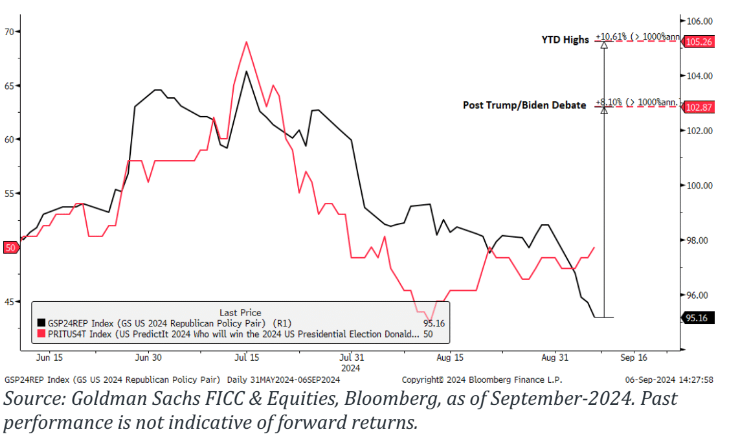

The first debate between former President Trump and Vice President Harris iscoming up this Tuesday (September 10th) and could be an inflection point ineither direction for the US election.Since Biden exited the race, the election odds have gotten closer to 50%-50% chance of either party winning the presidency according to betting markets. The market neutral Republican pair (GSP24REP)has underperformed 9% locally (w/ or without commodities), underperforming its beta to polling, predictit markets, macro drivers and the like. Our attribution analysis of this underperformance would suggest the market has been positioning away from Republican policy and towards Democratic policy, rather than it being a function of a cyclical bias or some factor skew (although it does have a cyclical bias). We think there is positive symmetry going long the Republican policy pair tactically into the debate, and like buying short dated call options on the Republican policy outperform basket.Republican Policy Pair (GSP24REP)is composed of long outperformers(GS24REPL, ex-commodity exposed basket is GS24RLXC) and short underperformers (GS24REPS).1 month GS24REPL 103% calls cost 1.65%1 month GS24RLXC 103% calls cost 1.89%

NVDA … green line = NVDA normalized stock performance in 2023, blue line = NVDA normalized performance in 2024 (YTD) .. tactical debate right now is if NVDA follows a similar ‘holding pattern’ as last year in ~Q4 until visibility on the out year (2026+) comes into view (e.g. this will shape the ‘multiple’ you pay on 2025 earnings) OR if the market can instead focus on the upcoming Blackwell product cycle as a near-term bull case anchor

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!