Market Spotlight: Hidden Warnings in JPM Earnings

JPM Records Q4 Earnings & Revenues Beat

America’s biggest bank, JP Morgan, kicked off US earnings season on Friday along with several other big names. The bank saw earnings and revenues both topping forecasts in Q4 with EPS of $3.57 vs $3.05 expected on revenues of $34.54 billion vs $34.35 billion expected. While the headline figures were positive, sending the bank’s stock soaring by almost 6% on Fridays, there were some other details which have raised some uncertainty for the broader US economy.

Hidden Warning Signs

JP Morgan’s projections for net interest income (money the bank receives on deposits) was below market forecasts at $74 billion. The group’s CEO Jamie Dimon added some colour on this explaining that higher rates were driving greater competition among savers. In light of this, the bank warned that it will need to change its rates to become more attractive to prospective savers.

Additionally, Dimon warned that while conditions were generally favourable, there are plenty of downside risks for the US economy. Dimon cited uncertainty linked to the ongoing Russia – Ukraine conflict alongside energy and food supply issues and persistent inflation as the key threats to monitor.

Near-Term Outlook

In all, the guidance on net interest income, along with concerns over downside risks, was broadly in line with current forecasts for a US recession this year. However, given strong headline performance, should one or more of these risk factors suddenly improve in the coming quarter, this would represent clear upside risks for the bank’s stock.

Technical Views

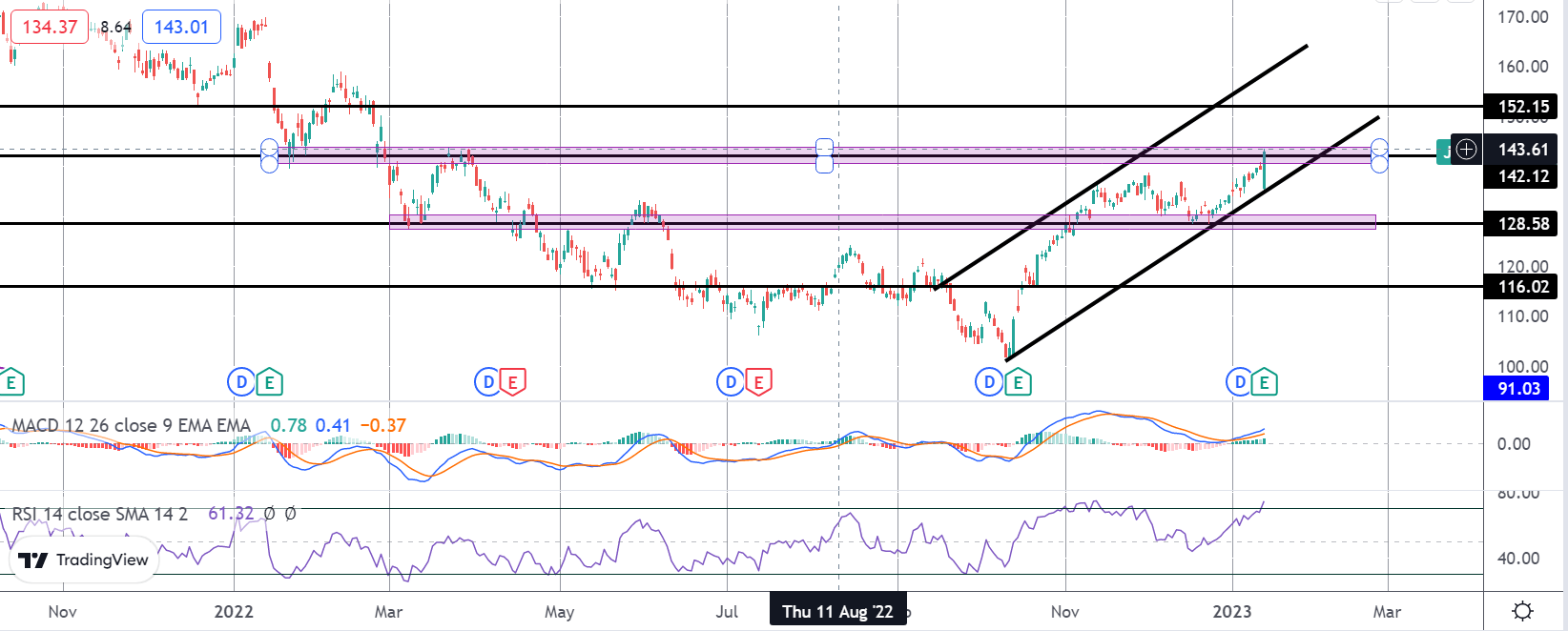

JP Morgan

The rally in JPM stock off the 2022 lows has seen the market moving higher within a bull channel. Price is currently testing the 142.12 resistance level and, with momentum studies firmly bullish, the focus is on a continuation higher and a test of the 152.15 level next. To the downside, should price slip back below the bull channel, 128.58 is the next support to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.