Market Spotlight: Netflix Shares Fall As New Subscribers Plunge

Mixed Results From Netflix

The latest set of earnings from Netflix yesterday did little to encourage investors that the company is headed for a new ‘golden era’. On the headline figures, the numbers were broadly in line with expectations. EPS came in a little over forecasts at $2.85 vs $2.85 forecast while revenues were a little soft at $8.162 billion vs $8.177 billion forecast. To put these figures in perspective, during the same period a year prior the company reported EPS of $3.53 on revenues of $7.868 billion. However, it was the details of the report which was of more interest for investors.

Subscriber Growth Drops Again

In terms of negatives, new subscriber growth was seen falling short of analyst projections at 1.75 million vs 2.2 million forecast. Given the dwindling subscriber growth trajectory seen on the back of the pandemic these figures were clearly concerning for investors. Netflix stock fell initially as traders digest this data. However, the stock was seen bouncing back after hours as traders reacted positively to news that the company’s new ad service has been successful in driving revenues.

Guidance Lowered

Looking ahead, Netflix issued weaker-than-forecast profit guidance for the coming quarter. Wall Street had been looking for an EPS of $3.07 on revenues of $8.18 billion whereas Netflix forecast EPS of $2.84 on revenues of $8.24 billion. Given the mixed figures, near-term performance in the stock is likely to be more tied to broader tech sector performance and USD movements around Fed expectations.

Technical Views

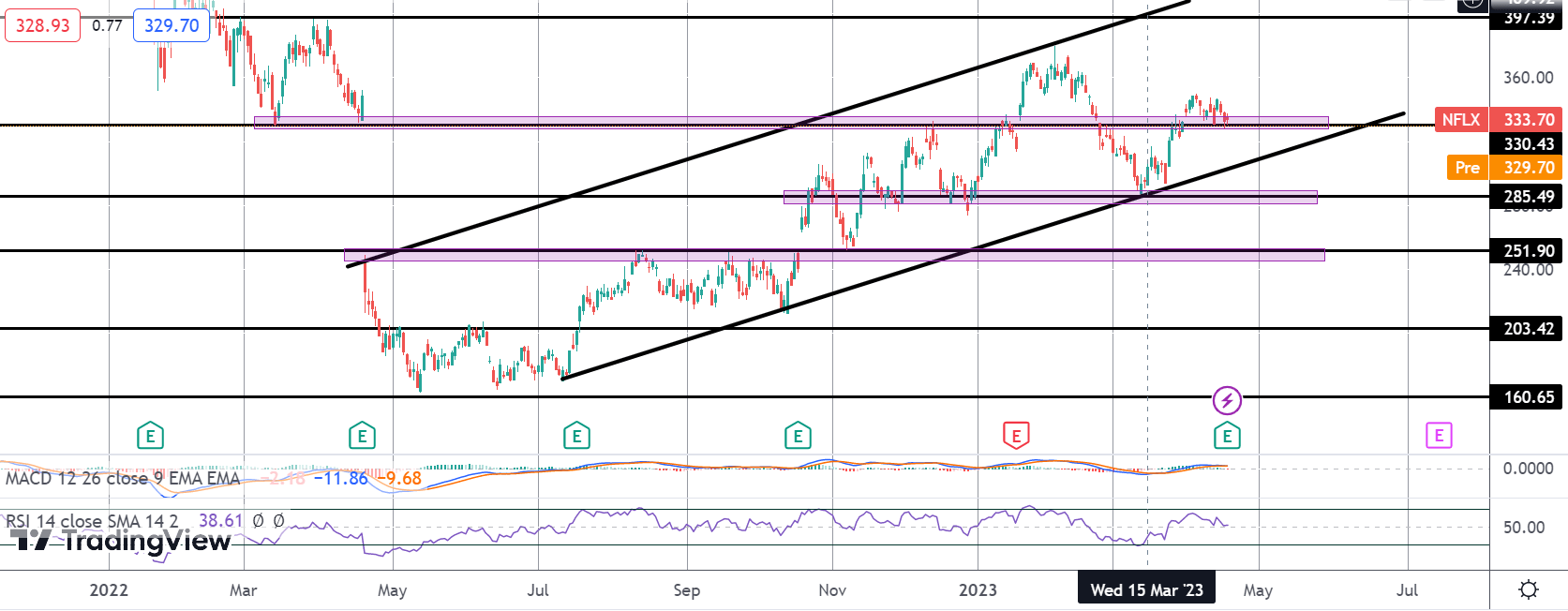

Netflix

For now, Netflix shares remain within the large bull channel which has framed the recovery off last year’s lows. The correction from highs around 380 found support into the channel lows and 285.49 level with price currently holding around the 330.43 level. While this area holds as support the focus is on a continuation higher towards the 397.39 level next. To the downside, a break of the channel low and 285.49 level opens the way for a test of 251.90 support.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.