Pfizer Earnings Soar in Q1 Despite Covid Sales Drop

Pfizer Shares Rally on Q1 Earnings Beat

Despite a tough day for stock markets on Tuesday, shares in US pharma company Pfizer were seen rising over the session following the release of better-than-forecast Q1 figures. Pfizer posted Q1 EPS of $1.23, well above the $0.98 the market was looking for. Additionally, revenues were seen much higher than forecast too at $18.282 billion vs $16.607 billion expected. This marks the ninth consecutive quarter of earnings growth for the company which last saw a negative quarter in Q4 2020.

Interestingly, Pfizer recorded a sharp drop in demand for its covid products, including its vaccine and antiviral pill. Of the $18.2 billion recorded in sales over Q1, covid products brought in $7.1 billion. Looking ahead, Pfizer CEO Albert Bourla said he expects this year to be a “transition year” for the company as demand shifts away from the covid products which have dominated sales over recent years.

Looking ahead, Pfizer was optimistic on its prospects noting that Q1 revenues excluding covid products were up 5% on the year. Over the year as a whole, Pfizer forecasts sales revenues of between $67 billion and $71 billion with earnings of between $3.25 - $3.45 per share. Additionally, with the majority of new product launches scheduled for the second half of the year, Pfizer expects non-covid revenues to grow at a faster pace from summer onward.

Technical Views

Pfizer

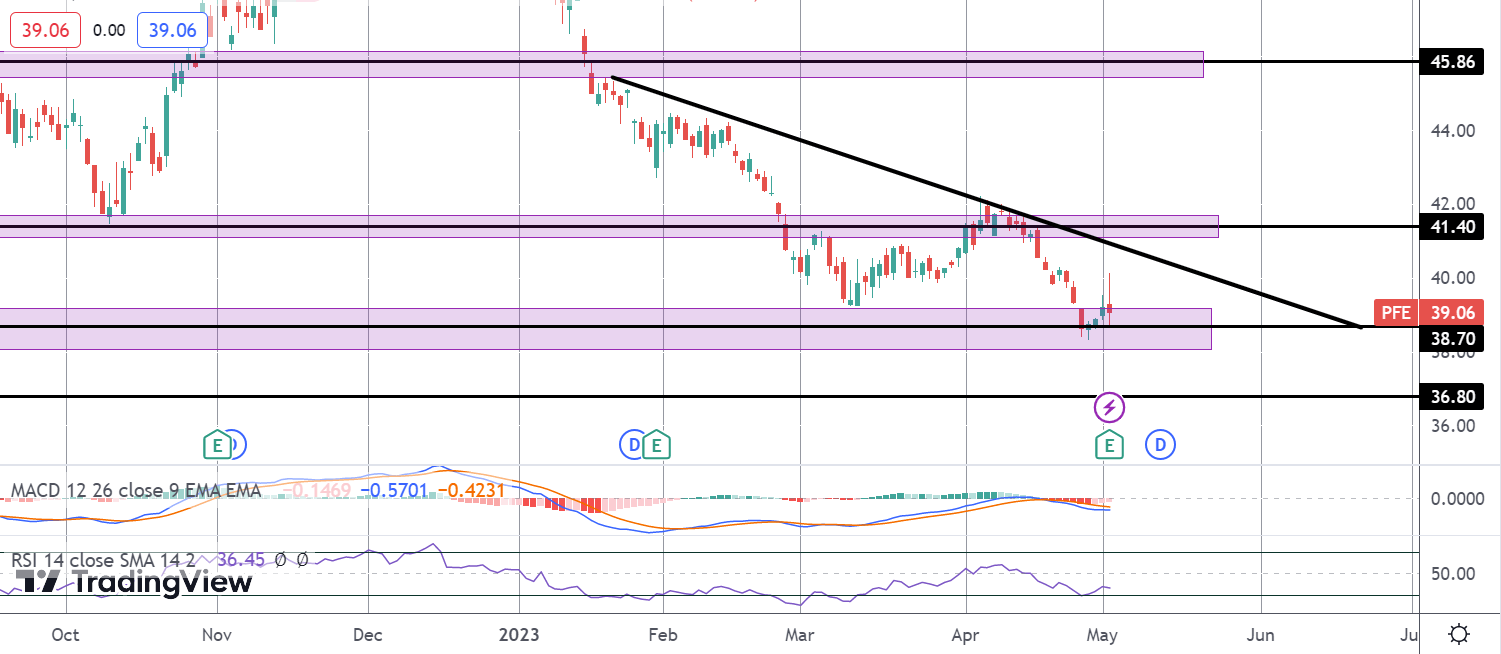

Shares have been moving lower over recent months, guided by the bearish trend line which continues to hold as resistance. For now, 38.70 is holding as support. However, with momentum studies still bearish and with the trend line overhead, the focus remains on a further push lower and an eventual breakdown towards the 36.80 level next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.