Pound Plunges On Soft UK Jobs Data

Jobs Data Weakens

GBPUSD has come under fresh selling pressure today in response to weaker-than-forecast UK jobs data. The data showed that in the three months through September, the unemployment rate was seen rising to 5% from 4.8% prior, above the 4.9% the market was looking for. Additionally, the claimant count was seen rising to 29k from 25.8k prior, again coming above the 17.6k the market was looking for. Finally, average earnings were seen cooling to 4.8% from 5% both prior and expected. In all, it was a weak set of data across the board and is further strengthening traders’ expectations of a fresh BOE rate cut next month accordingly.

BOE & Autumn Budget Impact

Recent data shows that both jobs and inflation are starting to turn lower. While the BOE held rate steady at the last meeting, there was a strong dovish camp within the bank (5-4 to hold). As such, any negative data ahead of the December meeting will likely be seen as tipping the scales in favour of a fresh cut. Additionally, with the Autumn Budget ahead there is a growing view that GBP has lower to fall with the expected tax hikes seen as a hinderance to growth with weaker consumer and business spending anticipated as a result. As such, the post-budget December meeting looks increasingly likely to yield a fresh BOE rate cut, driving GBP lower.

Technical Views

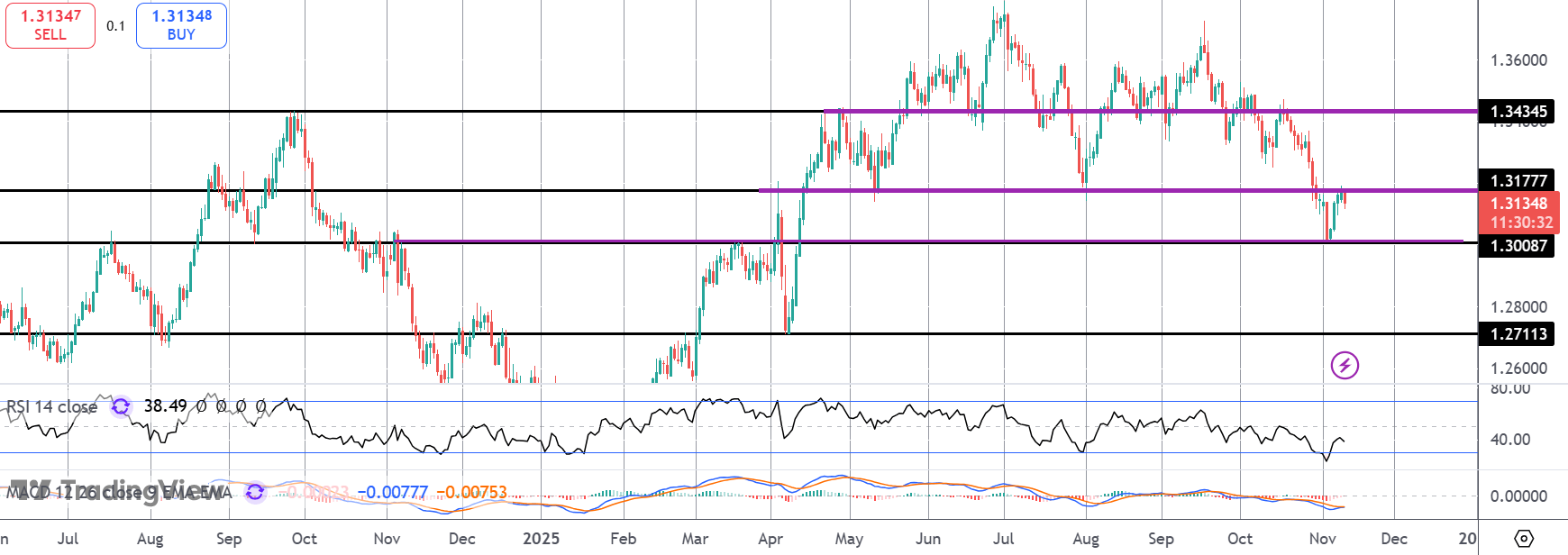

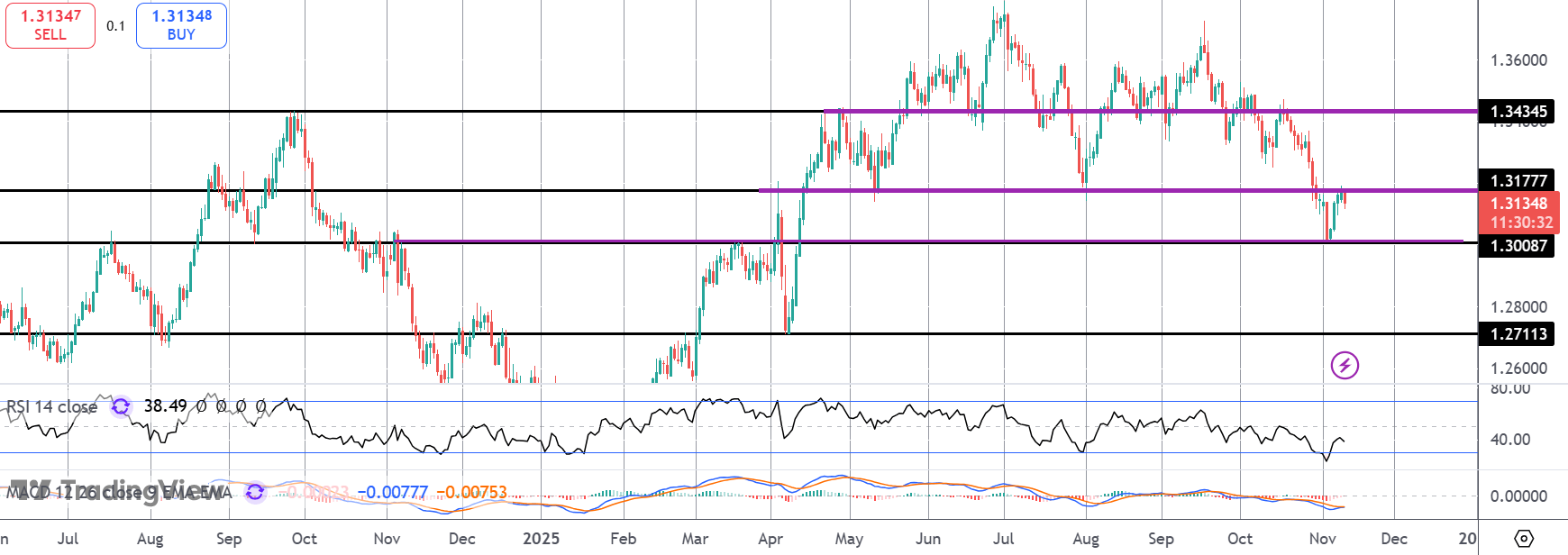

GBPUSD

The recovery off the 1.30 level has run into heavy resistance at a retest of the broken 1.3177 level. This can be seen as a pivotal level for the market with risks of a deeper move lower while we hold below this level. If we break below 1.30, 1.2711 will be the deeper target for bears. However, if bulls can get back above 1.3177, focus will turn to 1.3434 instead.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.