S&P Rallying As US GDP Dips

Stocks Rallying on USD Weakness

US Stocks are pushing higher today on the back of a further slide in the Dollar yesterday. The greenback came under fresh selling pressure on the back of a lower-than-forecast prelim Q2 GDP number. At 2.1%, the first look at Q2 GDP was below both the prior and expected 2.4% reading and has seen the market pairing back its near-term Fed rate hike expectations. Traders have been struggling over recent weeks to get a strong read on the chances of a September hike. However, with market pricing currently sitting around 90% in favour of an unchanged decision, stocks look to have room to move further north near-term.

US Jobs Data on Watch

Looking ahead to tomorrow’s jobs data, along with the headline NFP reading, traders will also be looking at the latest wage growth results. If wage growth is seen to have fallen further back last month, this should be strongly bullish for stocks, serving as further evidence that a deflationary trend is taking hold. Such a reading, alongside a lower NFP result, should see the S&P push higher into next week. On the other hand, any surprise upside in tomorrow’s data will no doubt muddy the waters, leading USD higher near-term and fuelling some pullback in stocks.

Technical Views

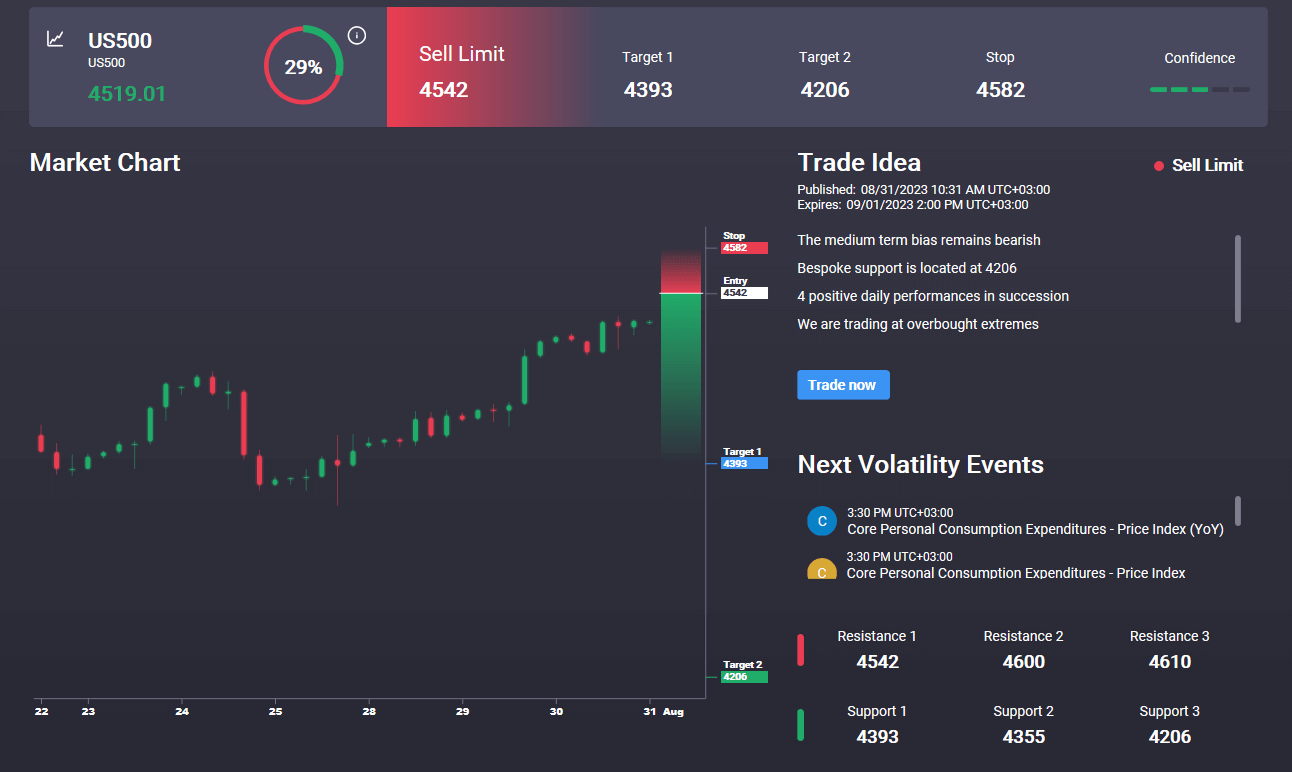

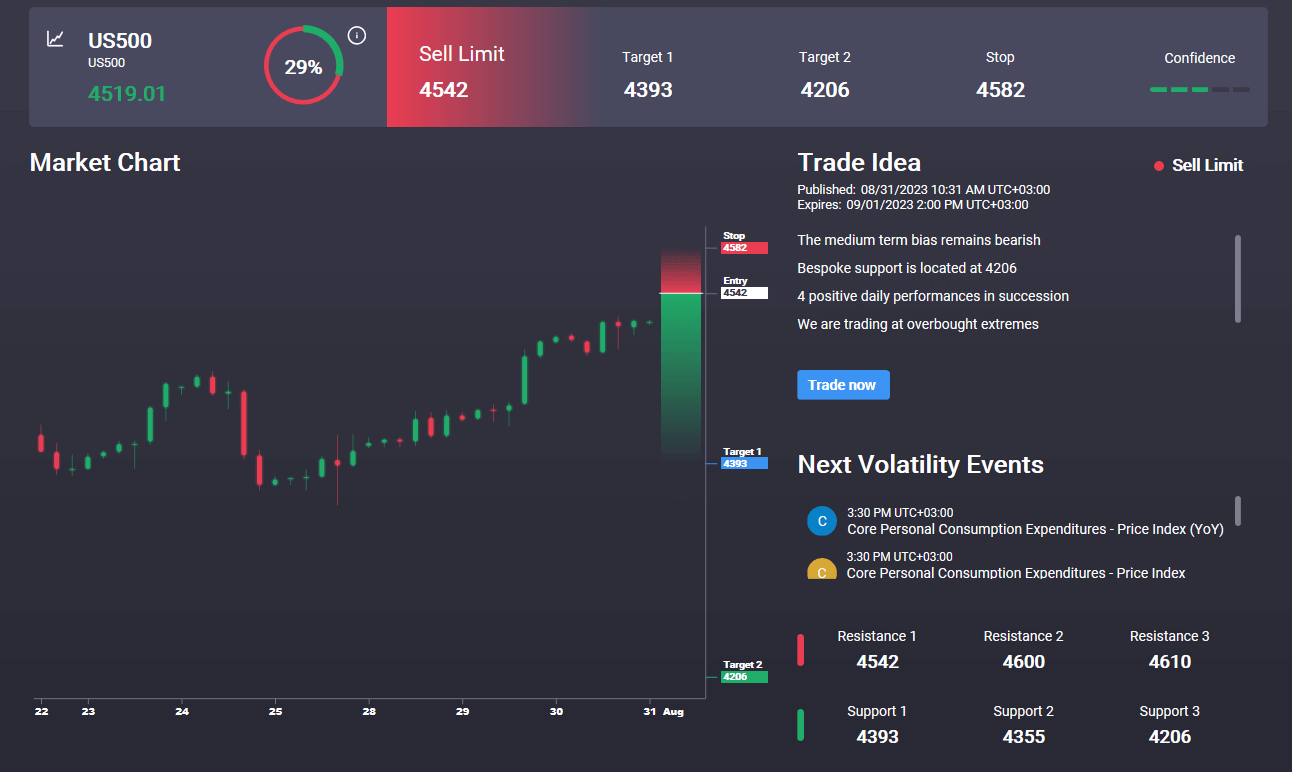

S&P 500

The correction lower from 4627.50 highs has found fresh demand into the 4396.25 level with price since bouncing sharply off the level. Given the overall bull channel, the focus is on a further push higher. However, with strong bearish divergence on momentum studies, the market is at risk of printing a lower high unless bulls can quickly get back above the 4627.50 level, keeping the focus on further upside. In the Signal Centre today we have a sell signal set at 4542 targeting 4393 next.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.