SP500 LDN TRADING UPDATE 13/05/25

SP500 LDN TRADING UPDATE 13/05/25

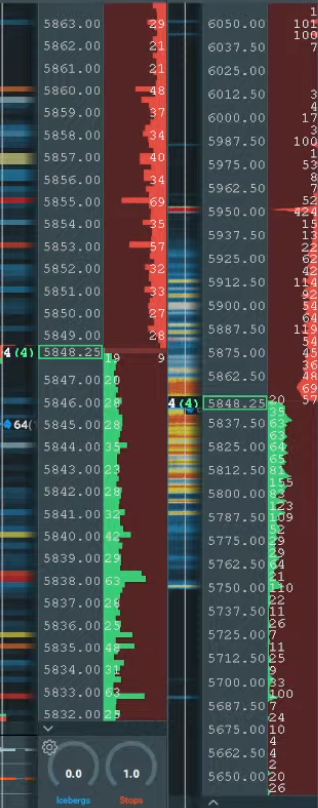

WEEKLY & DAILY LEVELS

WEEKLY BULL BEAR ZONE 5740/30

WEEKLY RANGE RES 5810 SUP 5550

DAILY BULL BEAR ZONE 5800/10

DAILY RANGE RES 5928 SUP 5808

2 SIGMA RES 6010 SUP 5726

5741/5710 GAP LEVELS

(QUOTING FRONT MONTH EMINI SP500 FUTURES CONTRACT PRICES, FOR EQUIVALENT US500 LEVELS SUBTRACT CIRCA 25 POINTS)

TRADES & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON TEST REJECT DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

LONG ON ACCEPTANCE ABOVE DAILY RANGE RES TARGET 2 SIG RES

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

Stocks are gaining momentum due to easing trade war tensions, but it's the lower-quality themes leading the charge today.

- As of today, Fundamental Long/Short nets are in just the 5th percentile. The cover bid is significant, with China Internet stocks up 5%, MoMo Losers up 5%, Energy Shorts up 4%, Regional Banks up 4%, and Non-Profitable Tech up 4%.

- Market volumes are strong as anticipated, currently on track for 23 billion shares, the highest since April 10th, the day after the first 90-day pause was announced. On the downside, top-of-book liquidity is averaging just $5 million, which is higher than expected given the volume spike.

- Healthcare remains a focal point due to the Trump Executive Order, with much to analyze regarding MFN pricing, PBMs, and the "cut out middlemen" comment, along with China tariffs and reconciliation. This could impact hospitals (HCA, THC, CYH), Medicaid (CNC, MOH), and exchanges (OSCR). The House Energy & Commerce Committee markup is scheduled for tomorrow.

- TMT desk flows are predictably skewed towards buying at the start. Most demand is concentrated in Mega-cap Tech (NVDA, TSM, GOOGL, META) and China ADRs. US Mega-cap flow is primarily driven by the Long-Only/Sovereign community. It will be interesting to see how sustainable this bid is.

Our Franchise:

Overall activity levels have surged by 71%, significantly outpacing market volumes, which are up by only 33% compared to the 10-day moving average.

Our floor shows a 6% improvement in buying, primarily driven by Limit Orders (LOs).

Limit Orders have improved by 18% on the buying side, with notable buying skews in Technology, Consumer Discretionary, Industrials, and Financials. Supply is heavily concentrated in Healthcare.

Hedge Funds show a 3% tilt towards buying. Demand is primarily in Consumer Discretionary, Healthcare, Financials, and Technology, while supply is moderate across Staples, Communication Services, and REITs.

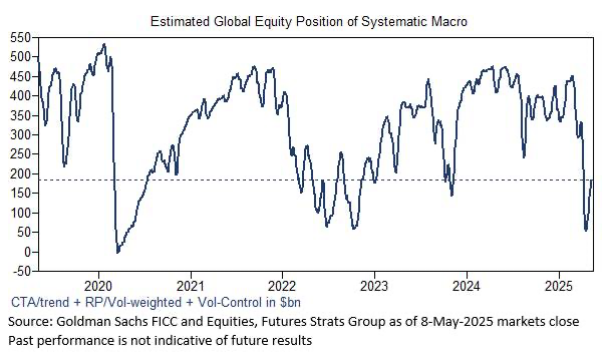

Chart of the Day:

Stock indices are breaking through momentum thresholds on the upside, and the VIX dropping below 20 creates an almost "perfect storm" for non-fundamental equity demand (credit to Brian Garrett).

Market length has increased slightly but remains below average, rising from 1 out of 10 three weeks ago to 3.5 out of 10 currently.

The "systematic macro" approach was long $450 billion of global stocks for much of 2023-2024, and they are currently long approximately $185 billion.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!