SP500 LDN TRADING UPDATE 24/04/25

SP500 LDN TRADING UPDATE 24/04/25

WEEKLY & DAILY LEVELS

WEEKLY BULL BEAR ZONE 5250/60

WEEKLY RANGE RES 5476 SUP 5146

DAILY ONE TF DOWN 5262

WEEKLY ONE TF DOWN 5496

MONTHLY ONE TF DOWN 5997

DAILY BULL BEAR ZONE 5370/60

DAILY RANGE RES 5473.75 SUP 5355.25

2 SIGMA RES 5741 SUP 5085

5314 - 5610 GAP LEVELS

(QUOTING FRONT MONTH EMINI SP500 FUTURES CONTRACT PRICES, FOR EQUIVALENT US500 LEVELS – 30 POINTS)

WEEKLY ACTION AREA VIDEO https://www.youtube.com/watch?v=P4oaIdrVRmI&t=114s

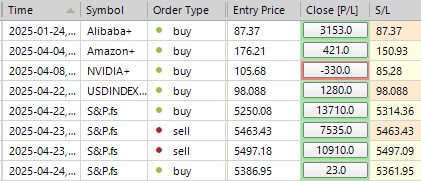

TRADES & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET WEEKLY RANGE RES

LONG ON TEST/REJECT 5314 TARGET DAILY BULL BEAR ZONE

LONG ON ACCEPTANCE ABOVE 5505 TARGET 5610 GAP FILL

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: TARIFF RELIEF

FICC and Equities | April 23, 2025 | 8:50 PM UTC

The S&P 500 closed up 167 basis points at 5,375, with a Market on Close (MOC) buy order of $4 billion. The Nasdaq 100 (NDX) rose 228 basis points to 18,693, the Russell 2000 (R2K) gained 153 basis points to 1,919, and the Dow Jones increased by 107 basis points to 39,606. A total of 17.5 billion shares were traded across all U.S. equity exchanges, surpassing the year-to-date daily average of 16.3 billion shares. The VIX dropped 693 basis points to 28.45, crude oil declined 206 basis points to $62.37, the U.S. 10-year Treasury yield fell 2 basis points to 4.38%, gold decreased 280 basis points to $3,285, the DXY rose 101 basis points to 99.92, and Bitcoin surged 296 basis points to $93,873.

President Trump's comments on China and Federal Reserve Chairman Powell appeared to be a strategic move to calm market concerns. The Wall Street Journal reported that the White House is considering reducing tariffs on China to ease the trade war. The market also responded positively to Elon Musk's announcement that he would significantly reduce his involvement with the U.S. government to focus on Tesla, as his work with Dogecoin is "mostly done." Tesla shares rose 5% despite an earnings miss. Our trading desk observed a burst of activity following the initial WSJ headlines, which subsided as the session progressed. The rally seemed driven by macro products, with ETFs accounting for about 38% of the trading volume. Flows indicated a risk-on stance, particularly in tech sectors from the asset management community, which showed a slightly more constructive outlook. Elsewhere, buy orders appeared predominantly cover-driven.

On the micro level, several companies reported positive earnings updates, including:

1) Tesla (TSLA) +7%: Despite weaker results, shares rose due to Musk's comments about focusing on the company.

2) Vertiv (VRT) +20%: Beat earnings expectations and raised full-year guidance.

3) SAP +9%: Reported solid quarterly earnings.

4) AT&T +4.5%: Exceeded expectations in phone additions and revenue/EBITDA.

5) ServiceNow (NOW) +7%: Delivered a strong first-quarter report, above expectations on current remaining performance obligations (cRPO); debates likely on macro and second-half outlook following the resignation of P. Smith, President of Global Customer and Field Operations.

6) Boeing (BA) +6%: Free cash flow burn of $2.29 billion was over $1 billion better than expected. Results reflect only tariffs enacted as of March 31. Call scheduled for 10:30 AM ET.

FLOWS: Our trading floor activity was rated a 6 on a 1-10 scale. We ended with a +466 basis point buy skew, approximately $3 billion in net demand. Long-only investors drove most of the supply, finishing as net buyers of over $1.5 billion across all sectors, led by macro products and pockets of tech and discretionary sectors. Hedge funds remained flat, with sell skews in macro products and financials. Short ratios on the ETF side were elevated at over 70%.

DERIVATIVES: The market initially surged higher until Treasury Secretary Bessent downplayed hopes of de-escalation between the U.S. and China. Volatility decreased throughout the day as the rally faded. Implied volatility continues to be impacted by systematic vol selling; we suggest investors consider taking the opposite side of that trade. Despite appearing high, our desk believes volatility is still underpriced. For the past three days, the daily straddle has realized its potential. Today's flows were skewed towards buyers of upside; we favor June 25-delta calls, now trading below a 20-volatility handle. As attention shifts to earnings, Google (GOOGL) reports tomorrow night, and the QQQ implied move for the rest of the week is estimated at 2.3%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!