The FTSE Finish Line - August 2 - 2023

The FTSE Finish Line - August 2 - 2023

FTSE US Credit Rating Adjustment Weighs Risk Appetite

UK's FTSE 100 index opened lower, before trading down by 1.35%, reaching a two-week low. The global risk sentiment was affected by ratings agency Fitch's decision to cut the United States' credit rating. Meanwhile, the FTSE 250 midcap index also declined.

Despite the overall negative market sentiment, BAE Systems, the UK's largest defence company, saw its shares surge by 4.7%. This came after the company raised its full-year guidance for 2023, forecasting a growth of 10-12% in annual earnings per share.

However, not all companies had positive developments. London-listed shares of Smurfit Kappa, Europe's largest paper packaging producer, fell by 3.0% after reporting a decline in first-half core profit to 1.1 billion euros ($1.21 billion).

On the other hand, ConvaTec Group, a technology firm, experienced a 4.0% jump in its shares after raising its full-year guidance, potentially indicating a positive outlook for the company's performance.

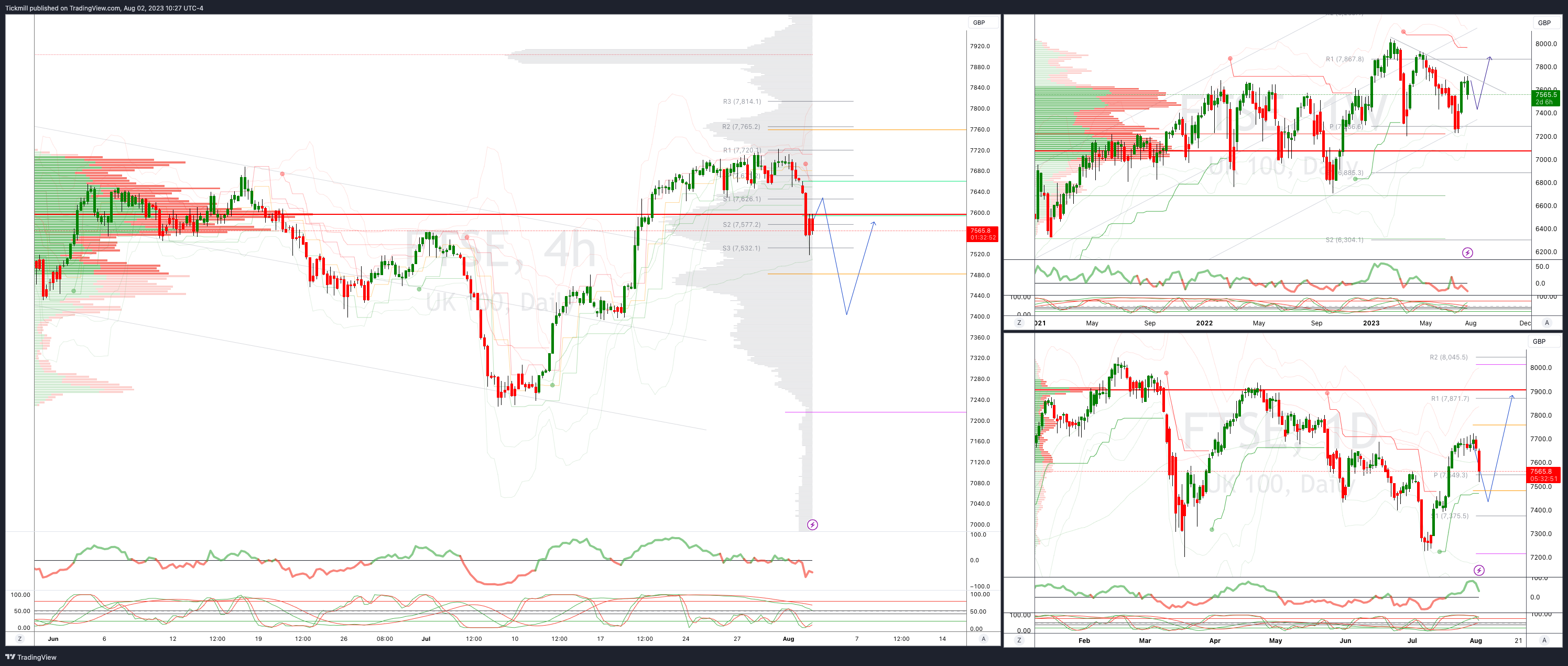

FTSE Intraday Bullish Above Bearish below 7650

Below 7550 opens 7400

Primary support is 7400

Primary objective 7750

20 Day VWAP bullish, 5 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!