The FTSE Finish Line - July 17 - 2023

The FTSE Finish Line - July 17 - 2023

FTSE Modestly Lower To Start The Week

FTSE 100 index experienced a slip to start the week, primarily led by declines in mining stocks. The lower metal prices were a result of weak growth in China, the world's second-largest economy. The FTSE 100, which has a significant concentration of commodity-related companies, has fallen by over 7% from its record high levels reached in February. The decline was influenced by fluctuating oil and metal prices due to concerns about demand in China's economy. The second-quarter growth of China's economy was feeble, with the post-COVID momentum deteriorating rapidly. This has increased pressure on policymakers to implement further stimulus measures to support economic activity. Industrial metal miners were particularly affected, experiencing a 1.8% dip as prices of most base metals faced downward pressure. Global mining giants Rio Tinto and Glencore also suffered losses, declining by 2.2% and 2.7%, respectively, however, the bottom spot on the index today is Coca Cola HBC as the bottler shed 4% on the session. Investor confidence in online grocery retailer Ocado -1.55% has waned this year due to the company's ongoing losses, putting pressure on the company to achieve profitability. Despite a projected 9.8% increase in income to £1.385 billion compared to last year, including a 3.3% boost from their partnership with Marks & Spencer (MKS), shareholders are growing impatient. However, if the forecasted adjusted EBITDA loss of £25.1 million is accurate, a significant rise from last year's £13.6 million loss, it is likely to further dampen shareholders' spirits. Ocado's continued investment in automation technology and increased marketing budgets will continue to deplete its cash reserves, leading to an expected increase in net debt.

It is important to monitor any changes in Ocado's forecasts, as the company aims for moderate annual revenue growth in the mid-single digits and a "slightly positive EBITDA." Ocado plans to recover these losses in the second half of the year. Ocado remains a potential target for takeover, which has caused its shares to surge since the lows of June. On the positive side of today’s ledger is Natwest sitting on gains of 1.5% as investors cheer the announcement of Apple’s partnership with the UK high street bank as the iPhone maker rolls out tap to pay technology for UK businesses.

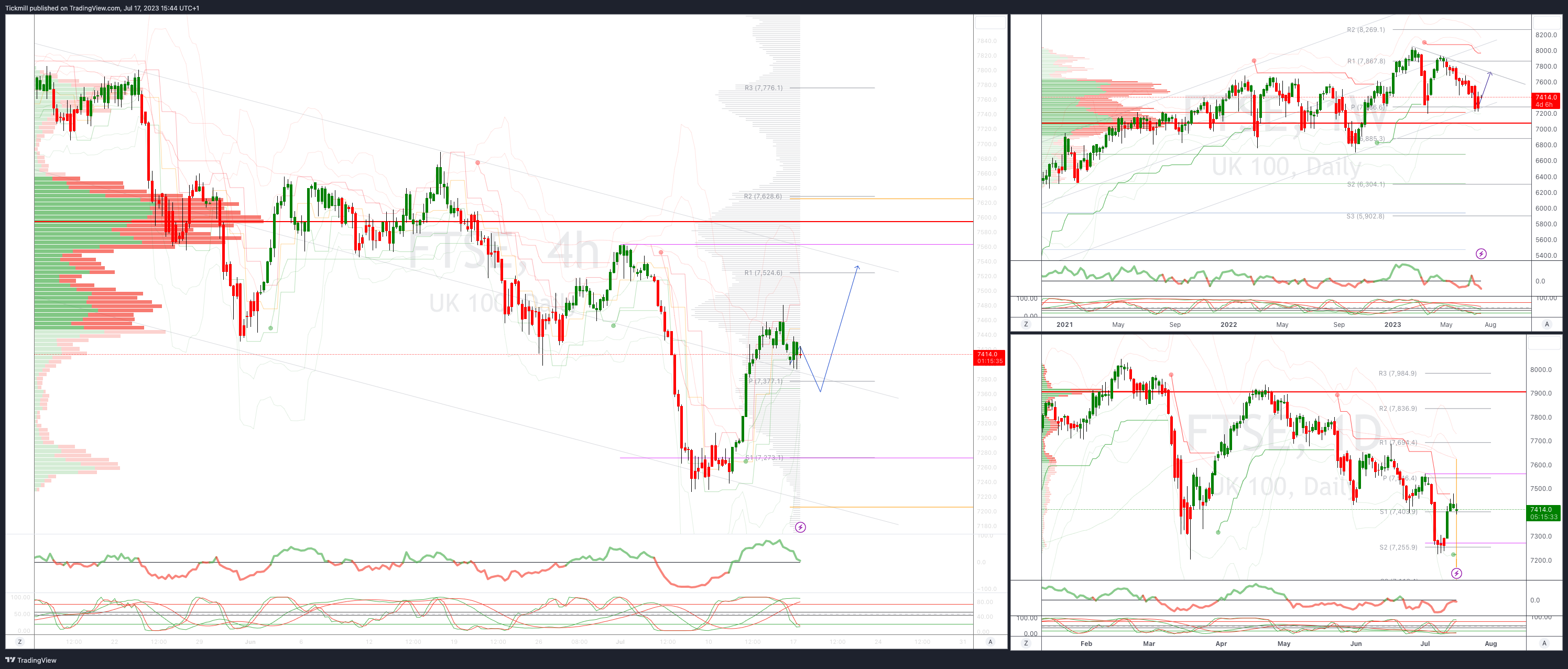

FTSE Intraday Bullish Above Bearish below 7400

Above 7550 opens 7660

Primary resistance is 7600

Primary objective 7538

20 Day VWAP bearish, 5 Day VWAP bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!