The FTSE Finish Line: June 20 - 2025

The FTSE Finish Line: June 20 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group.

London stocks saw a reversal Friday to post a slight decline after initially benefiting from broad gains as the United States postponed its decision regarding potential involvement in the Middle East conflict for the next two weeks, which boosted market sentiment. The FTSE 100 index, composed of blue-chip stocks, traded 0.3% on track to end a five-week winning streak. The Bank of England decided to maintain stable interest rates on Thursday, as anticipated, but cautioned about risks stemming from a weakened labour market and rising energy prices due to the ongoing Iran-Israel war. As the air conflict between the two countries continued into its second week, Europe attempted to encourage Iran to engage in negotiations. Meanwhile, the White House indicated that decisions regarding possible U.S. involvement would be made within two weeks. Although the immediate chances of U.S. intervention in Iran may have lessened, the news of this two-week pause indicates it will continue to be a pressing topic for the markets in the week ahead.

Retail sales showed weakness but were marked by volatility, alongside an overshoot in the government’s cash requirement, making for a busy start to UK data today. The GfK Consumer Confidence Index for June improved slightly, rising two points to -18. However, May’s retail sales saw a sharp decline of -2.8% m/m on the ex-fuel measure, which seems inconsistent in the context of improved confidence. This drop follows a strong April driven by weather-boosted food sales, suggesting a correction was inevitable. A more notable trend is the ex-fuel price deflator, which doubled from 0.6% y/y in April to 1.2% y/y in May, indicating that April’s rising cost pressures have now negatively impacted sales volumes. Stripping out weather-related volatility, the three-month smoothed average growth in retail sales volumes up to May is a less alarming 0.8% 3m/y.

On public finances, May’s data revealed a mixed picture. The headline borrowing figure (PSNBex) shows a cumulative deficit of £37.7bn for the first two months of 2025-26, which is £3bn lower than the Office for Budget Responsibility (OBR) forecast. However, on a cash basis (CGNCR), the government’s requirement reached £39.9bn over April and May, exceeding the OBR benchmark by £7.4bn. This early-stage overshoot raises concerns, particularly as the monthly profiles rely on stronger performance later in the year. Given that CGNCR figures tend to be less subject to revisions than PSNBex, this could signal challenges ahead for containing gilt supply.

Single Stock Stories & Broker Updates:

Shares of the luxury homebuilder Berkeley in the UK have dropped by 8.9% to 3,780p, making it one of the biggest losers on the FTSE 100 index and on track for its largest percentage decline since March 2020. The company announced Rob Perrins as the new executive chair, with Michael Dobson set to step down on September 5. During Dobson's nearly three-year leadership, the company's shares increased by 20.4%. Additionally, Richard Stearn has been appointed as the new CEO. Berkeley has reaffirmed its pre-tax profit guidance for FY26 at 450 million pounds ($606.2 million), compared to analysts' expectations of 477 million pounds, according to data from LSEG. The company plans to invest 5 billion pounds over the next decade, which is expected to yield 4,000 new homes. Year-to-date, the stock has risen by 6.41%.

Metro Bank Holdings shares have risen 3.7% to 130.4p, making them one of the top percentage gainers on the FTSE midcaps index. The largest shareholder of the British lender is reportedly considering selling his stake, according to sources cited by Reuters. Colombian billionaire Jaime Gilinski Bacal, who holds a 52.87% stake in MTRO, is exploring his options, including a potential sale. In recent weeks, private equity firms Pollen Street Capital and BC Partners have made offers for the bank, according to sources. With today's gains, the stock has increased by approximately 38% this year.

Barclays has raised its rating on the British insurer Hiscox to "overweight" from "equal weight," increasing the price target to 1,400p from 1,180p, indicating a potential upside of 10.93% based on the stock's last closing price. As of Friday, HSX rose approximately 1.03% to 1,275p. The brokerage highlighted the company's goal to boost growth and profitability in its retail segment as a key differentiator, especially as the "large-ticket" reinsurance and commercial markets are expected to soften. In May, the company announced plans to achieve $200 million (or 148.4 million pounds) in annual savings by 2028 through operational improvements aimed at reducing costs and scaling internationally. These savings are likely to position the Retail division at the higher end of the expected range, according to Barclays. The consensus rating among 14 analysts remains "buy," with a median price target of 1,400p, as per data from LSEG. HSX has seen a year-to-date increase of around 16.52%.

Shares of Downing Renewables & Infrastructure Trust PLC, a British investment firm, surged 22.3% to 101.8 pence, marking its highest level since June 2023. The stock is currently the leading gainer on the FTSE small-cap index and is on track for a record one-day percentage increase, assuming the gains are maintained. Bagnall Energy is set to purchase the company for £174.6 million ($235.2 million), with DORE shareholders receiving 102.6 pence per share. Bagnall Energy holds a 25.4% stake in DORE, as per LSEG data. Including the gains from this session, DORE has increased by approximately 33% for the year to date.

Technical & Trade View

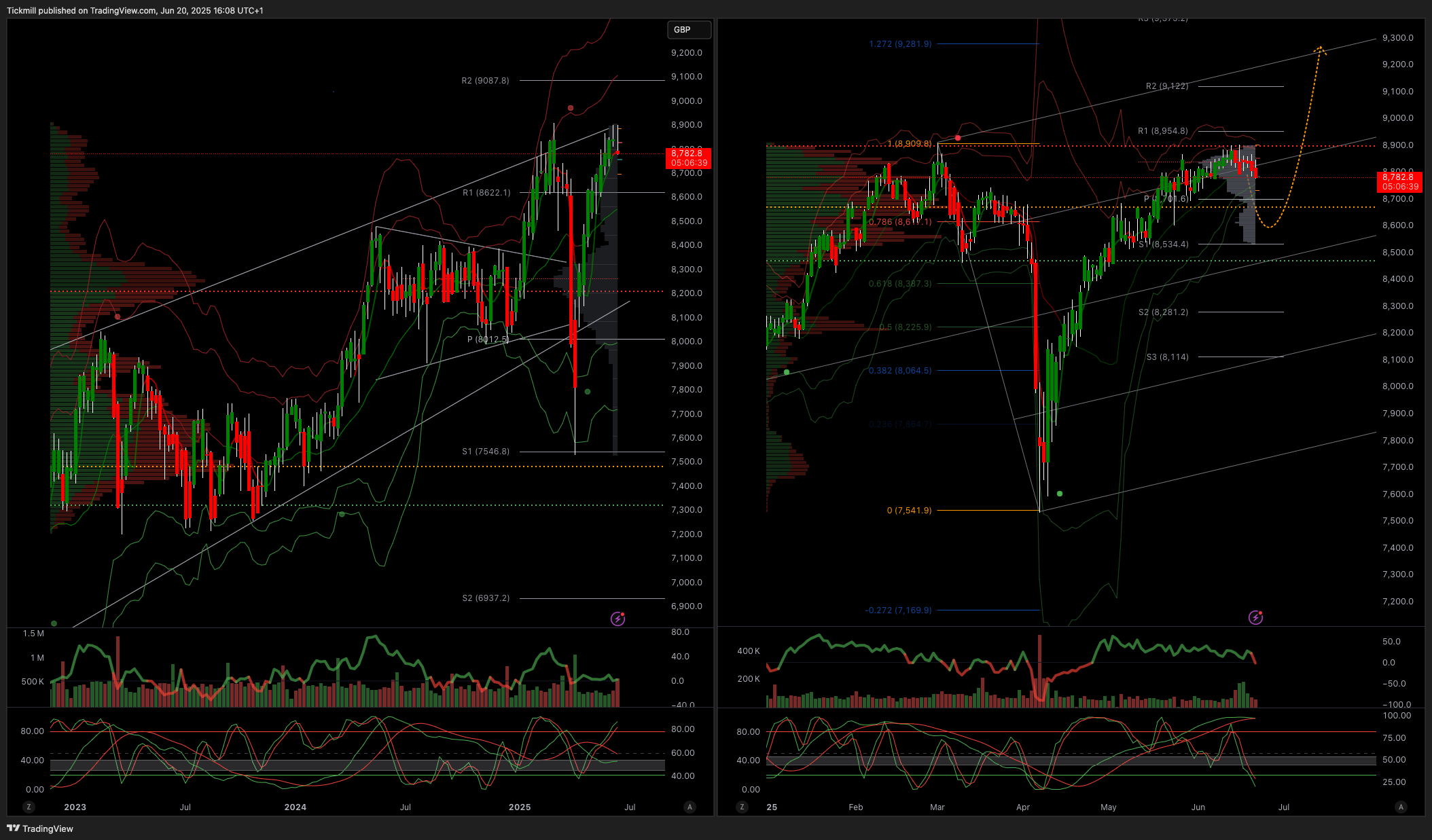

FTSE Bias: Bullish Above Bearish below 8700

Primary support 8600

Below 8500 opens 8400

Primary objective 9200

Daily VWAP Bearish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!