The FTSE Finish Line: May 1 - 2025

The FTSE Finish Line: May 1 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group

Britain's main stock index remained relatively steady on Thursday as investors weighed various corporate earnings, a U.S.-Ukraine minerals agreement, and the potential for a trade deal with China. On Wednesday, Ukraine and the United States finalised an agreement granting the U.S. preferential access to new mineral deals in Ukraine and providing funding for investment in the country's reconstruction. Separately, a social media account linked to Chinese state media reported on Tuesday that the U.S. has reached out to China to discuss President Trump's 145% tariffs. Meanwhile, British factory exports have experienced their steepest decline in nearly five years, with cost pressures rising in April. This decline is attributed to the effects of Trump's trade war and a recent tax increase for British employers, according to a survey.

Single Stock Stories & Broker Updates:

Lloyds Banking Group shares dropped 2.5% to 71.38p following a reported 7% decline in Q1 profits due to increased costs and charges. The bank recorded a £309 million impairment charge, including £35 million for economic outlook changes. Non-UK tariffs were higher than anticipated, prompting a £100 million provision for tariff impacts. Despite this, Lloyds maintains its financial forecast. Shares have risen approximately 33.8% year-to-date.

Informa rises 5.85% to 773 pence; Q1 underlying revenue grows 7.6% y/y. Co reaffirms FY25 outlook of 5% Group revenue growth and double-digit earnings growth. INF is down 8.84% YTD.

Whitbread rises 7.98% to 2,800p, top gainer on FTSE 100, marking the highest one-day gain since October 2024. The hotel operator initiates a £250 mln share buyback. It reports FY25 revenue of £2.92 bln, in line with expectations, and is optimistic about generating at least £300 mln incremental adjusted PBT by FY30. Jefferies anticipates a positive share price reaction. Year-to-date, WTB is down 10%.

Rolls-Royce up 2.3% to 771.6p; maintains 2025 operating profit outlook of £2.7-2.9 bln. Expects to mitigate U.S. tariff impact. Strong start to the year with all divisions performing well. Jefferies notes potential for guidance upgrade if macro conditions remain stable. RR's stock rises ~33% YTD.

Shares of National Grid fell 1.2% to 1,070 pence as Zoë Yujnovich is named the new CEO, succeeding John Pettigrew, who retires after nearly 10 years. Yujnovich previously served at Shell. Stock rose 19% during Pettigrew's time but is down 12.8% overall including session losses.

Technical & Trade View

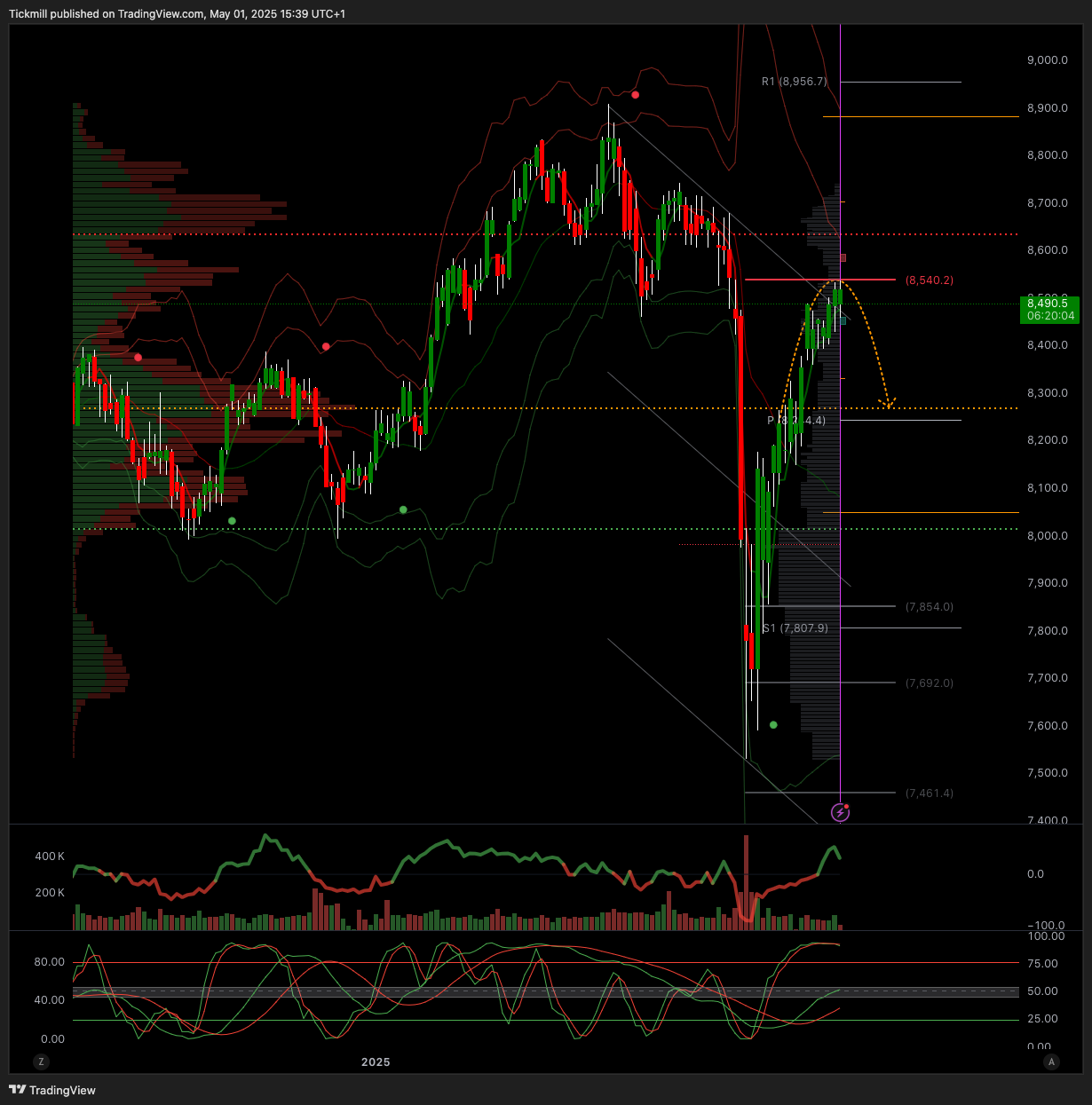

FTSE Bias: Bullish Above Bearish below 8600

Primary support 7500

Below 7800 opens 7648

Primary objective 8300

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!