The FTSE Finish Line: May 7 - 2025

The FTSE Finish Line: May 7 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group.

Britain's main indexes fell on Wednesday, weighed down by declines in healthcare and real estate stocks, despite positive trade negotiations. Investors remain attentive to the forthcoming interest rate decision by the U.S. Federal Reserve. The UK's healthcare companies index fell by 2% after the U.S. Food and Drug Administration appointed Vinay Prasad, an oncologist known for his past criticism of FDA leadership and COVID-19 policies, as the head of its Centre for Biologics Evaluation and Research. Meanwhile, the real estate index declined by 1.3% following an industry survey that indicated a continued contraction in Britain's construction sector for the fourth consecutive month in April. These sector declines occurred despite some advancements in global trade, as U.S. and Chinese officials are scheduled to meet in Switzerland this weekend in talks that could mark the initial steps towards addressing a trade war that is impacting the global economy.

Single Stock Stories & Broker Updates:

Shares of pharmaceutical companies GSK fell by 4.2% to 1,389p, while AstraZeneca declined by 2.2% to 10,464p. The U.S. Food and Drug Administration has appointed Vinay Prasad, an oncologist known for his critiques of FDA leadership and COVID-19 policies, as the new director of its Center for Biologics Evaluation and Research. Analyst Andrew Tsai from Jefferies suggests Prasad may increase the requirements for companies seeking new drug approvals. GSK, recognized as one of the largest vaccine producers globally, is experiencing the most significant loss on the FTSE 100, with the potential for its largest percentage decline in a month. Conversely, AstraZeneca, which has a smaller vaccine division, is also facing its most challenging day since April 9, when stocks of global pharmaceutical companies dropped after former U.S. President Donald Trump reiterated plans for substantial tariffs on drug imports. Additionally, Reuters reported that U.S. Health Secretary Robert F. Kennedy Jr. has requested further justification for the expansion of RSV vaccines produced by Pfizer and GSK. Notably, despite the current session's declines, GSK has risen 3.1% and AstraZeneca 0.04% year-to-date.

BT Group shares fell 3.96% to 162.95 p, becoming one of the top losers on FTSE 100 after Deutsche Bank downgraded its rating to 'Sell' from 'Hold' with a target price of 140 p. The brokerage claims BT's 17.6% YTD rise is "unsupported by fundamentals" and notes limited market recovery and high competition in the telecom industry. However, Bharti Global's stake purchase has mitigated concerns over BT's weaker performance and broker downgrades. Of 20 analysts, 12 have a "buy" or higher rating, 4 have "hold," and 4 rate it "sell" or lower, with a median target price of 172.50 p.

Shares of Rentokil Initial fell 2.1% to 354p, making it one of the top FTSE 100 losers, which is down 0.25%. CEO Andy Ransom plans to retire by 2026 after 12 years. RTO shares rose about 232% during his tenure, peaking at 663.8p in July 2023. Jefferies analysts view the succession planning as a positive move for Rentokil. The stock is down 9.8% this year.

FD Technologies shares rose 22.7% to 23.65 pounds, their highest since May 2022, making them among London's top gainers. The company is in advanced talks with TA Associates for a potential acquisition at a valuation of 541.6 million pounds. TA proposed buying shares at 24.50 pounds. The FDPF board is prepared to recommend the offer if formalized. Year-to-date, the stock is up approximately 22%.

Empresaria Group's shares rose 40% to 35 pence, the highest since August 2024, amid a potential takeover offer featuring £10 per share in cash and £50 in loan notes payable in 3 years. The company, valuing itself higher, has a market cap of £12.4 million but has seen a 5.7% decline in stock year-to-date.

Shares of Trainline fell 7.6% to 258.6p, making it the top loser on the FTSE mid-cap index. The company expects FY26 revenue growth to be between 0% to 3%, citing potential impacts from global macroeconomic uncertainty, Transport for London's expansion, and Google's search engine changes. FY25 revenue grew by 11% to 442 million pounds, with net ticket sales of 5.9 billion pounds. Net ticket sales growth for FY26 is projected at 6% to 9%, down from 12% for FY25. The stock is down 40.3% year-to-date.

Technical & Trade View

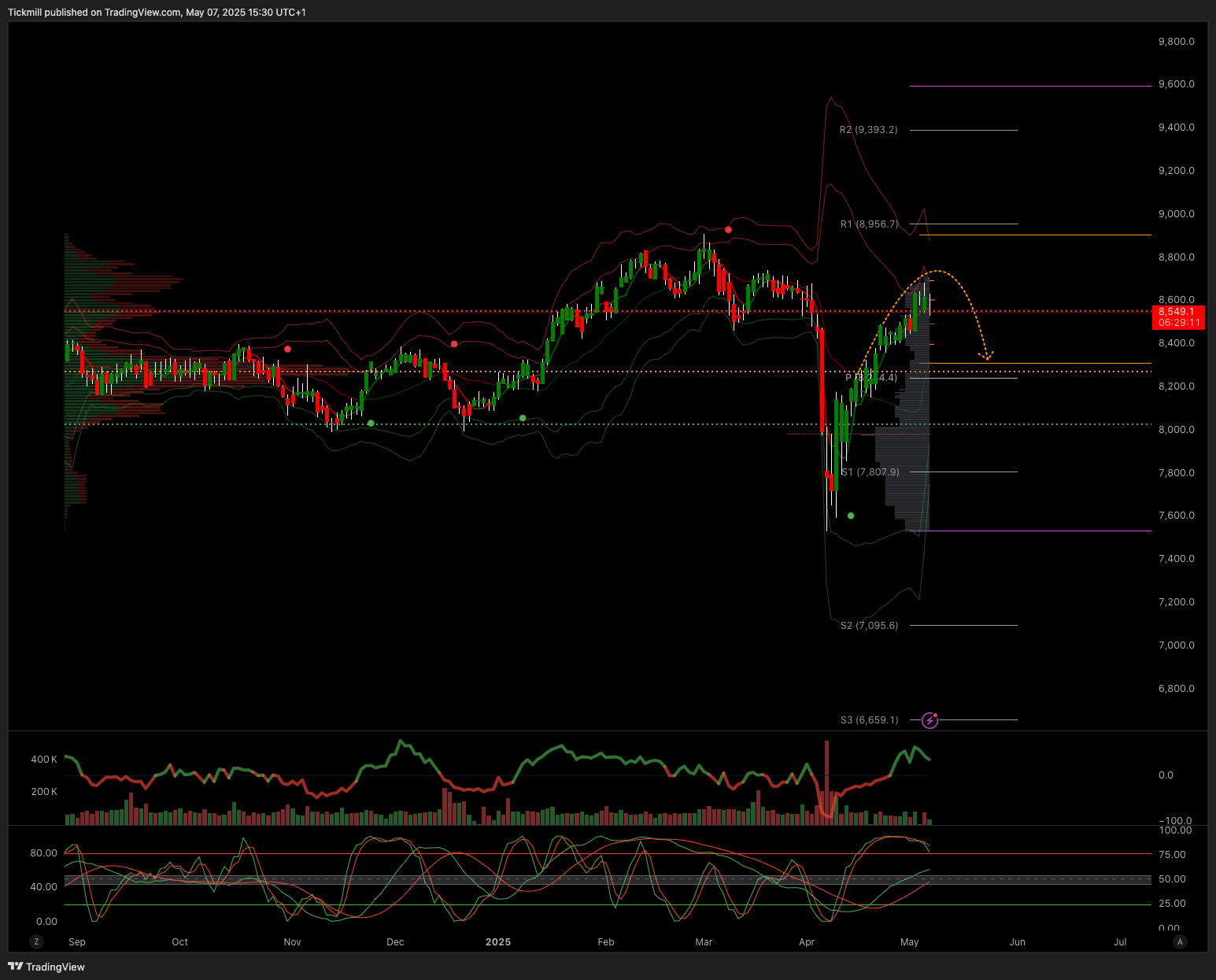

FTSE Bias: Bullish Above Bearish below 8700

Primary support 8500

Below 8500 opens 8250

Primary objective 8300

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!