US Dollar Under Pressure: Analyzing the Impact of the Fed Statements

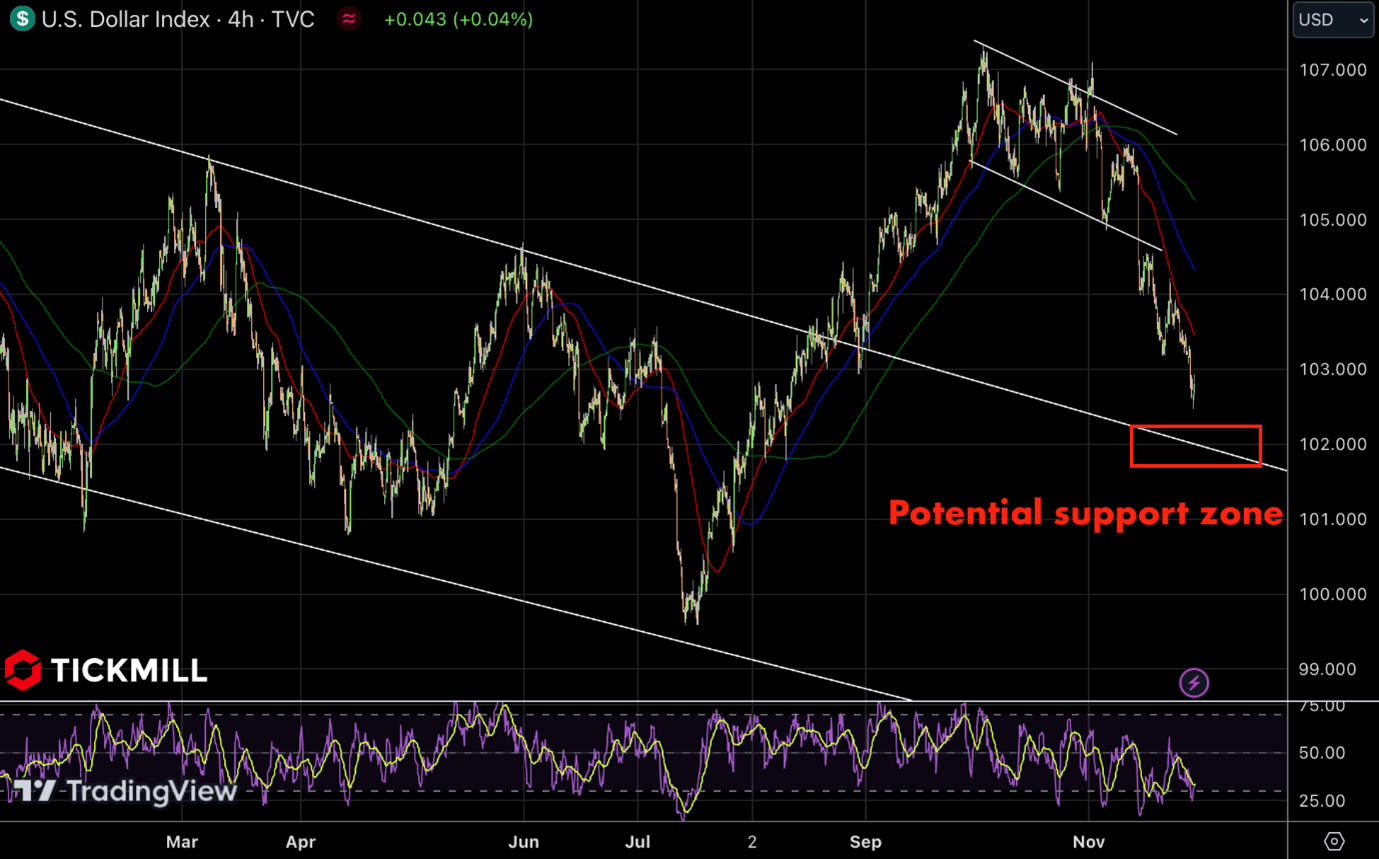

The statements made by the Fed officials on Tuesday prompted a mild sell-off of the dollar. At the beginning of Wednesday, the US Dollar Index (DXY) tested the 102.50 area, but during the day, it managed to recover from the decline, ending slightly positive. From a technical analysis standpoint, after breaking through the bearish channel, there could have been a speculative bearish momentum that is expected to dissipate near the 102 level:

Several Federal Reserve officials stated yesterday that there are signs of an economic slowdown, particularly in the deceleration of consumer spending growth. Indicators of activity in the US services and manufacturing sectors are also declining. Additionally, inflation is decreasing, but it's not enough to assert that the Fed has reached its peak of tightening. Clearly, past incidents of a resurgence in inflation after periods of slowdown compel officials to be more cautious in their statements and actions. However, these comments seem to have been sufficient to trigger another reassessment of inflation expectations and Fed rate expectations. From the second half of yesterday, the yield on the 2-year bond fell by about 20 basis points, and the 10-year bond by 15 basis points:

Powell's speech on Friday poses another bearish risk for the dollar and bond yields. Based on the tone of comments from other Fed representatives, it can be expected that Powell will also emphasize the need for a rate hike pause in December.

Against the backdrop of falling bond yields, gold gained further, aiming to test the next round level of $2050 per troy ounce. The S&P 500 futures also rose on Wednesday, approaching the 4600 level, the highest since August. Lower bond rates force investors to accept a lower expected return on stocks, leading to an increase in market capitalization.

The economic calendar on Thursday will be quite interesting: data on US inflation (Core PCE), Eurozone inflation for November, and Chinese PMI in the manufacturing sector will be released. The market will also pay attention to US unemployment claims data.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.