USDCAD Higher Ahead of Key Data Releases

Loonie on Watch

USDCAD is pushing higher today, with the pair testing above the bear trendline and prior 2024 highs, despite the weakness in USD. Concerns over the sustainability of the current risk rally are seeing some unwinding of CAD longs. Traders are also bracing for two sets of key US and Canadian data later today which hold the potential to drive plenty of volatility in the pair.

Canadian GDP

First up, we get the latest Canadian GDP figures which are expected flat at 0.2% month-on-month. The BOC is widely expected to ease rates this year with traders looking for signals as to when expected cuts will likely come. With this in mind, any weakness in today’s data will likely be sharply bearish for CAD as traders bring their BOC rate-cut expectations forward.

US Core PCE Due

Following that data, we then get a look at the US core PCE price index. Given that this is a key inflation gauge for the Fed, there will be plenty of focus on this release, which is expected to rise to 0.4% from 0.2% prior. With CPI having come in above forecasts this month, any strength in today’s reading might well fuel a fresh bid in USD, reversing the recent losses. If this doe slay out, then we can expect the current rally in USDCAD to continue near-term.

Technical Views

USDCAD

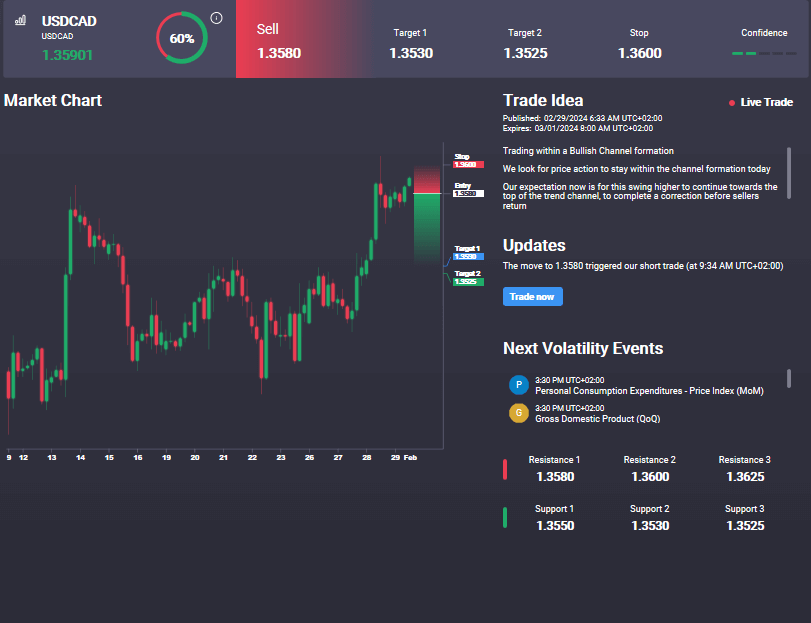

The rally has seen the pair testing above the bear trend line and prior 2024 highs. While above the 1.3501 level and with momentum studies bullish, the focus is on a further push higher with 1.3683 the next target for bulls. Interestingly, the Signal Centre has an active sell signal from 1.3580 targeting a move back down to low 1.35s.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.