Gold Lower on Trade Optimism

Gold prices continue to slide as we move through the back of the week. The futures market is now down around 9% from the month’s highs as safe-haven demand continues to weaken on the back of recent developments. The big story for gold traders at the moment is the improvement in global trade optimism following the US/China deal announced last week. Both sides have agreed to heavily reduce tariffs over the next 90 days to allow for further negotiations aimed at striking a proper trade deal. The reaction lower in gold suggests traders are optimistic that such a deal can be agreed, likely encouraged by the recent trade deal agreed with the UK. Trump has also signalled that talks are moving well with India, Japan, South Korea and others.

Peace Talks & Ceasefires

Alongside positive developments on the trade front, risk sentiment is also being bolstered by the ceasefire holding between India and Pakistan and news this week that Trump has lifted sanctions against Syria during his state visit. Focus is now on peace talks between Russia and Ukraine which are due to start today in Turkey though Putin has confirmed he won’t be attending the talks. If positive headlines are seen on the back of the talks, this should further support risk sentiment near-term, keeping gold prices anchored lower.

Technical Views

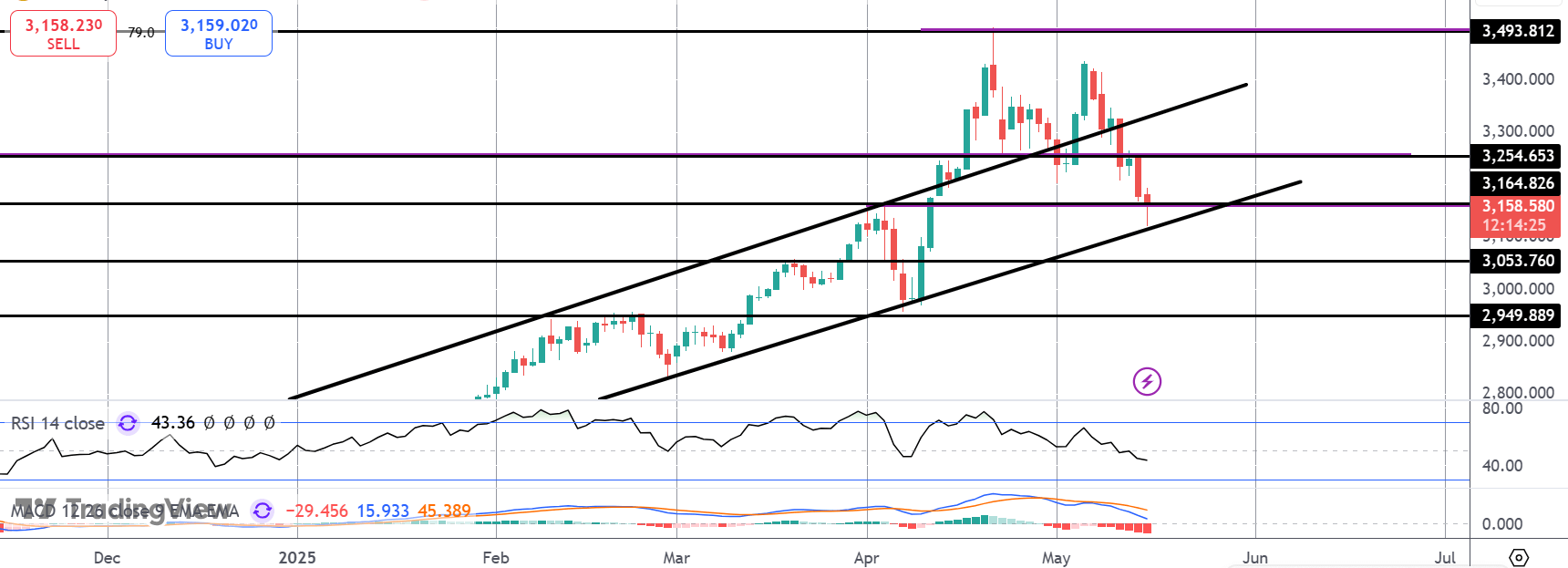

Gold

The sell off in gold has stalled for now into the bull channel lows and the 3,164.82 level. While price holds this support zone, focus is on a fresh push higher if bulls can get back above 3,254.65. Below there, however, 3,053.76 will be the next support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.