机构洞察:高盛CPI预览

.jpeg)

GS:CPI 预览 FICC 和股票 | 2024 年 12 月 10 日 |

来自 GS Research:我们预计 11 月核心 CPI 将增长 0.28%(而共识为 0.3%),同比增速为 3.27%(而共识为 3.3%)。

• 我们预计 11 月总体 CPI 将增长 0.28%,反映出食品价格上涨 0.25%,能源价格上涨 0.3%。我们的预测与 11 月核心服务(不包括租金和业主等价租金)CPI 增长 0.20% 以及核心 PCE 增长 0.20% 一致。

• 我们重点介绍了本月报告中预计会出现的三个关键组成部分趋势:

1. 我们预计二手车价格将上涨 2.0%,反映出拍卖价格的反弹。

2. 我们预计机票价格将再次上涨 1.0%,反映出强劲的潜在定价趋势。

3. 我们预计,基于我们在线数据集中保费的持续增长(尽管增速有所放缓),汽车保险类别将出现反弹。• 展望未来,我们预计未来几个月每月 CPI 通胀率将在 0.20-0.25% 左右,但我们预计 1 月份的通胀率会略高一些,反映出年初价格上涨带来的适度推动。

Thoughts from around GS =>

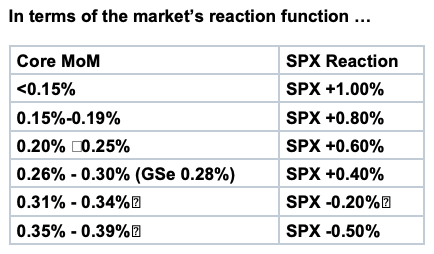

Dom Wilson (Senior Markets Advisor) The December FOMC may well end up determining how equities end up finishing the year. Tomorrow’s CPI is the last major data point ahead that flows into that. Our forecast of 0.28% for core CPI is around the consensus, but if we’re right that the composition of that and PPI maps to a 20bp core PCE release, that’s a little better than what we’ve seen and could be a mild relief. With the market pricing a high chance of a Dec cut, and having put a bit more easing back into 2025, the risks look more two-sided than they did. A properly high print – on the back of two firmer months already would likely see the market worry more about the scope for additional easing, though the bar is high for it to put December in jeopardy. Any meaningful relief probably also creates room for the market to price the prospect of continued easing into 2025. Our core views leave us wanting to have exposure to the resilience of the US growth story, while protecting against major tails and we continue to like having upside exposure to US equities and to the USD as part of that construct. Volatility in the SPX and key European indices continues to look very low both relative to its own history and relative to other asset classes. SPX vols are up from the literal lows last week, but with short-dated call vol firmly below 10, we like using calls or call spreads to carry some of that equity length, particularly over the next few weeks that cover CPI, FOMC and the turn of the year. Put protection is also relatively inexpensive, where those call strategies aren’t viable.

Mike Cahill (Senior FX Strategist) The 20bp move higher in the unemployment rate in the last two months raises the bar for this inflation print to directly influence the policy decision next week, but it should still matter for the overall policy package. Our economists’ inflation forecast is right in line with consensus, but would represent a fourth consecutive warmer print, and we have seen Fed officials respond to three or four prints in a row by adjusting future policy plans - in this case we think that just keeps them on a gradual, cautious path on net. A softer number, especially via a wider CPI-PCE wedge, should see a further relaxation in the 2025 pricing that we’ve already seen rally back a fair bit over the last 2-3 weeks, supporting wider risk sentiment if the market is confident the Fed can deal with tariff and labor market risks without significant inflation concerns. On the other hand, a firmer print coupled with the bounce in sentiment we’ve seen (with the market relatively relaxed about the net impact of possible policy changes) would pack even more Dollar upside if it’s coupled with an unfriendly inflation backdrop. This is especially true if Fed officials decide to wait and see how start of-year inflation readings look after surprises the last couple of years and continue to question whether policy is already not very restrictive.

Joe Clyne (Index Vol Trading) Heading into tomorrow's CPI, equities have settled into a very tight range and vol has collapsed, leaving seemingly little uncertainty about the path of stocks following the inflation print. The one day straddle looks to go out around 45 basis points entering CPI, which (though well off the lows we've seen on nonevent days) is quite low for an event. Vols beyond the one day space are quite low as well, with the 1 month 25 delta call holding a low 9 handle implied vol. The vol crush makes a degree of sense with dealers quite long gamma locally, but the desk likes holding short-dated upside as a hedge that should work in either direction if we can move even somewhat away from the gamma pin. For example, the year end 610 calls in SPY are below a 9 vol and cost less than 3 dollars.

免责声明:提供的材料仅供参考,不应视为投资建议。 本文中表达的观点,信息或观点仅属于作者,而不属于作者的雇主,组织,委员会或其他团体或个人或公司。

过去的业绩不代表未来的结果。

高风险警告:差价合约(CFD)是复杂的工具,由于杠杆作用,存在快速亏损的高风险。 当与Tickmill UK Ltd和Tickmill Europe Ltd进行差价合约交易时,分别有72%和73%的零售投资者账户亏损。 您应该考虑自己是否了解差价合约的工作原理,以及是否有具有承受损失资金的的高风险的能力。

期货和期权:保证金交易期货和期权具有高风险,可能导致损失超过您的初始投资。这些产品并不适合所有投资者。请确保您完全了解这些风险,并采取适当的措施来管理您的风险。