FTSE 100 FINISH LINE 2/2/26

FTSE 100 FINISH LINE 2/2/26

The UK's FTSE 100 posted modest gains on Monday as investors shifted their focus to defensive sectors like pharmaceuticals and consumer staples amid a global downturn in energy and metal stocks. The blue-chip index rose 0.8% despite broader market volatility. The precious metals mining sector experienced a sharp decline, dropping 4.9% to its lowest level in three weeks. Key players, including Endeavour Mining and Fresnillo, saw significant losses, each falling nearly 5%. Other major London-listed mining firms were also impacted, with Glencore down 2.4% and Rio Tinto slipping 1.1%, as the selloff extended to silver and industrial metals.

The selloff was triggered by U.S. President Donald Trump's announcement of Kevin Warsh as his nominee for the next Federal Reserve chair, prompting investors to reduce leveraged positions and adopt a more cautious stance. Defensive sectors, which typically perform well during periods of economic uncertainty, benefited from this shift. Healthcare stocks rose 1.3%, bolstered by a 1.4% gain in AstraZeneca shares, while the personal care sector gained momentum with Unilever climbing 2.2%, making these stocks key contributors to the FTSE 100's resilience.

In the energy sector, easing geopolitical tensions between the U.S. and Iran led to a decline in crude oil prices, pulling energy stocks down by 1.6%. Industry heavyweights Shell and BP were not immune, falling 1.5% and 1.7%, respectively. Looking ahead, investors are turning their attention to the Bank of England’s policy meeting on Thursday. The central bank is widely expected to hold interest rates steady at 3.75%, with limited clarity on the timing of future rate cuts as it continues to monitor inflation closely. Meanwhile, a recent survey indicated that most British businesses plan to implement pay raises this year, with increases likely ranging between 3% and 3.49%. These figures slightly exceed the comfort levels of some Bank of England policymakers as they aim to bring inflation back to target levels.

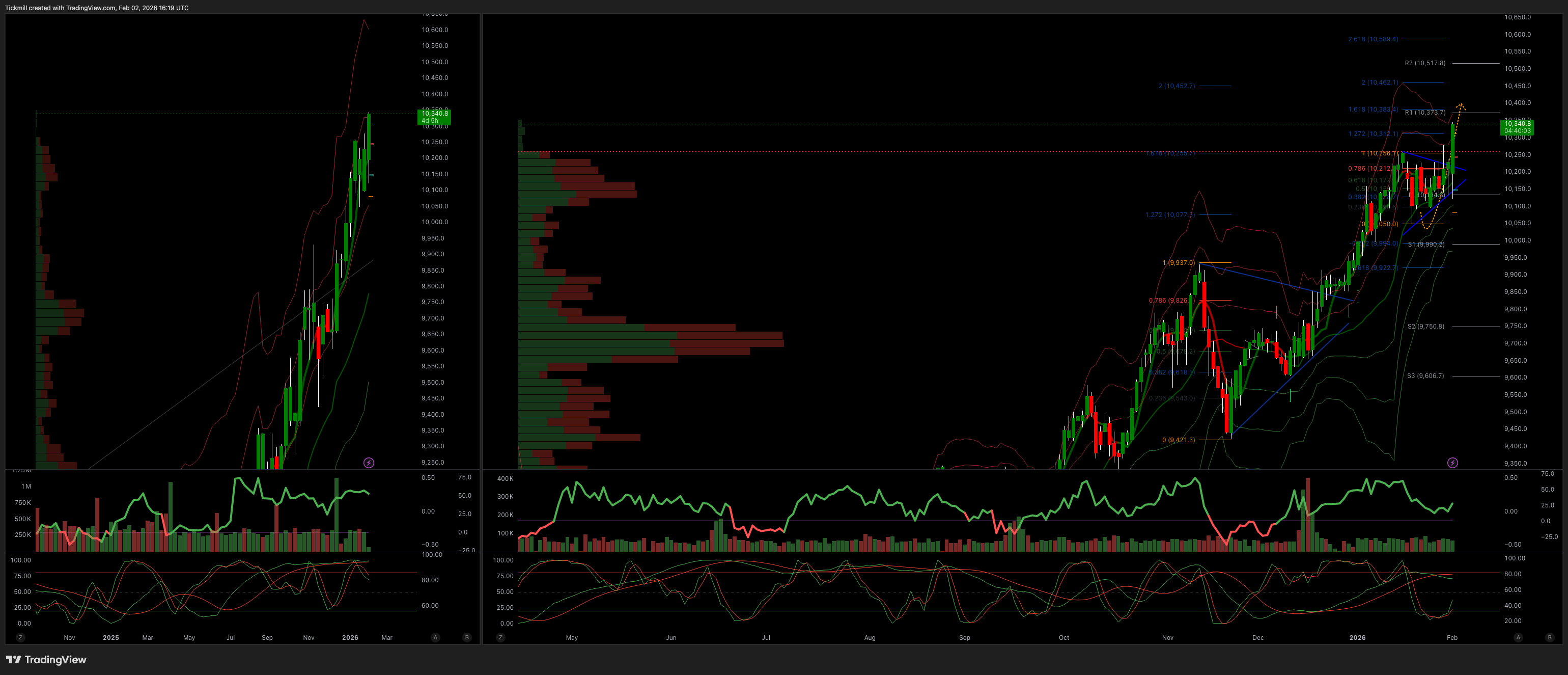

TECHNICAL & TRADE VIEW - FTSE100

Daily VWAP Bullish

Weekly VWAP Bullish

Above 10150 Target 10370

Below 10070 Target 9950

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!